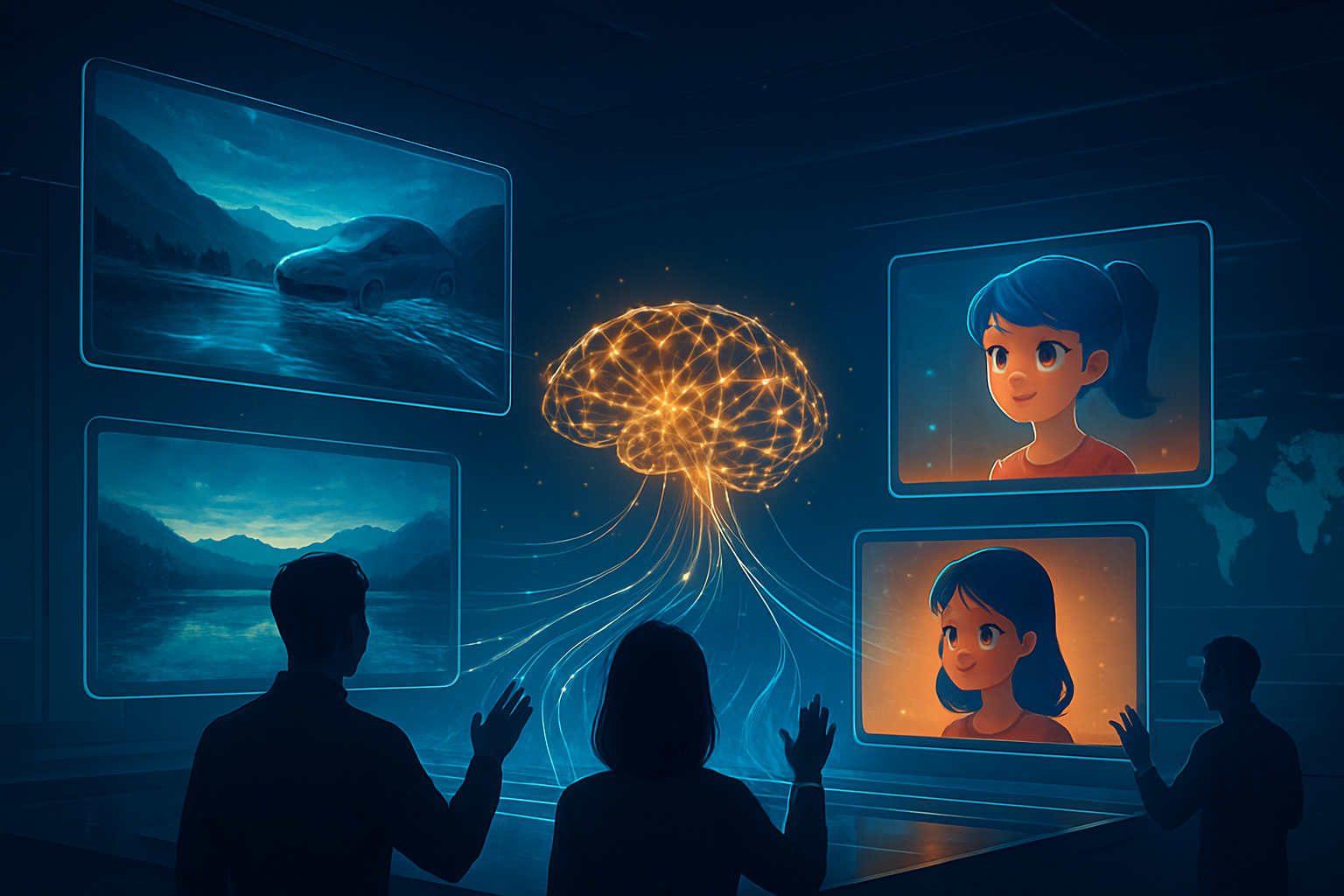

In a decisive move against the rising tide of sophisticated digital deception, researchers from the University of California, Riverside, and Alphabet Inc. (NASDAQ: GOOGL) have unveiled UNITE, a revolutionary deepfake detection system designed to identify AI-generated content where traditional tools fail. Unlike previous generations of detectors that relied almost exclusively on spotting anomalies in human faces, UNITE—short for Universal Network for Identifying Tampered and synthEtic videos—shifts the focus to the entire video frame. This advancement allows it to flag synthetic media even when the subjects are partially obscured, rendered in low resolution, or completely absent from the scene.

The announcement comes at a critical juncture for the technology industry, as the proliferation of text-to-video (T2V) generators has made it increasingly difficult to distinguish between authentic footage and AI-manufactured "hallucinations." By moving beyond a "face-centric" approach, UNITE provides a robust defense against a new class of misinformation that targets backgrounds, lighting patterns, and environmental textures to deceive viewers. Its immediate significance lies in its "universal" applicability, offering a standardized immune system for digital platforms struggling to police the next generation of generative AI outputs.

A Technical Paradigm Shift: The Architecture of UNITE

The technical foundation of UNITE represents a departure from the Convolutional Neural Networks (CNNs) that have dominated the field for years. Traditional CNN-based detectors were often "overfitted" to specific facial cues, such as unnatural blinking or lip-sync errors. UNITE, however, utilizes a transformer-based architecture powered by the SigLIP-So400M (Sigmoid Loss for Language Image Pre-Training) foundation model. Because SigLIP was trained on nearly three billion image-text pairs, it possesses an inherent understanding of "domain-agnostic" features, allowing the system to recognize the subtle "texture of syntheticness" that permeates an entire AI-generated frame, rather than just the pixels of a human face.

A key innovation introduced by the UC Riverside and Google team is a novel training methodology known as Attention-Diversity (AD) Loss. In most AI models, "attention heads" tend to converge on the most prominent feature—usually a face. AD Loss forces these attention heads to focus on diverse regions of the frame simultaneously. This ensures that even if a face is heavily pixelated or hidden behind an object, the system can still identify a deepfake by analyzing the background lighting, the consistency of shadows, or the temporal motion of the environment. The system processes segments of 64 consecutive frames, allowing it to detect "temporal flickers" that are invisible to the human eye but characteristic of AI video generators.

Initial reactions from the AI research community have been overwhelmingly positive, particularly regarding UNITE’s "cross-dataset generalization." In peer-reviewed tests presented at the 2025 Conference on Computer Vision and Pattern Recognition (CVPR), the system maintained an unprecedented accuracy rate of 95-99% on datasets it had never encountered during training. This is a significant leap over previous models, which often saw their performance plummet when tested against new, "unseen" AI generators. Experts have hailed the system as a milestone in creating a truly universal detection standard that can keep pace with rapidly evolving generative models like OpenAI’s Sora or Google’s own Veo.

Strategic Moats and the Industry Arms Race

The development of UNITE has profound implications for the competitive landscape of Big Tech. For Alphabet Inc., the system serves as a powerful "defensive moat." By late 2025, Google began integrating UNITE-derived algorithms into its YouTube Likeness Detection suite. This allows the platform to offer creators a proactive shield, automatically flagging unauthorized AI versions of themselves or their proprietary environments. By owning both the generation tools (Veo) and the detection tools (UNITE), Google is positioning itself as the "responsible leader" in the AI space, a strategic move aimed at winning the trust of advertisers and enterprise clients.

The pressure is now on other tech giants, most notably Meta Platforms, Inc. (NASDAQ: META), to evolve their detection strategies. Historically, Meta’s efforts have focused on real-time API mitigation and facial artifacts. However, UNITE’s success in full-scene analysis suggests that facial-only detection is becoming obsolete. As generative AI moves toward "world-building"—where entire landscapes and events are manufactured without human subjects—platforms that cannot analyze the "DNA" of a whole frame will find themselves vulnerable to sophisticated disinformation campaigns.

For startups and private labs like OpenAI, UNITE represents both a challenge and a benchmark. While OpenAI has integrated watermarking and metadata (such as C2PA) into its products, these protections can often be stripped away by malicious actors. UNITE provides a third-party, "zero-trust" verification layer that does not rely on metadata. This creates a new industry standard where the quality of a lab’s detector is considered just as important as the visual fidelity of its generator. Labs that fail to provide UNITE-level transparency for their models may face increased regulatory hurdles under emerging frameworks like the EU AI Act.

Safeguarding the Information Ecosystem

The wider significance of UNITE extends far beyond corporate competition; it is a vital tool in the defense of digital reality. As we move into the 2026 midterm election cycle, the threat of "identity-driven attacks" has reached an all-time high. Unlike the crude face-swaps of the past, modern misinformation often involves creating entirely manufactured personas—synthetic whistleblowers or "average voters"—who do not exist in the real world. UNITE’s ability to flag fully synthetic videos without requiring a known human face makes it the frontline defense against these manufactured identities.

Furthermore, UNITE addresses the growing concern of "scene-swap" misinformation, where a real person is digitally placed into a controversial or compromising location. By scrutinizing the relationship between the subject and the background, UNITE can identify when the lighting on a person does not match the environmental light source of the setting. This level of forensic detail is essential for newsrooms and fact-checking organizations that must verify the authenticity of "leaked" footage in real-time.

However, the emergence of UNITE also signals an escalation in the "AI arms race." Critics and some researchers warn of a "cat-and-mouse" game where generative AI developers might use UNITE-style detectors as "discriminators" in their training loops. By training a generator specifically to fool a universal detector like UNITE, bad actors could eventually produce fakes that are even more difficult to catch. This highlights a potential concern: while UNITE is a massive leap forward, it is not a final solution, but rather a sophisticated new weapon in an ongoing technological conflict.

The Horizon: Real-Time Detection and Hardware Integration

Looking ahead, the next frontier for the UNITE system is the transition from cloud-based analysis to real-time, "on-device" detection. Researchers are currently working on optimizing the UNITE architecture for hardware acceleration. Future Neural Processing Units (NPUs) in mobile chipsets—such as Google’s Tensor or Apple’s A-series—could potentially run "lite" versions of UNITE locally. This would allow for real-time flagging of deepfakes during live video calls or while browsing social media feeds, providing users with a "truth score" directly on their devices.

Another expected development is the integration of UNITE into browser extensions and third-party verification services. This would effectively create a "nutrition label" for digital content, informing viewers of the likelihood that a video has been synthetically altered before they even press play. The challenge remains the "2% problem"—the risk of false positives. On platforms like YouTube, where billions of minutes of video are uploaded daily, even a 98% accuracy rate could lead to millions of legitimate creative videos being incorrectly flagged. Refining the system to minimize these "algorithmic shadowbans" will be a primary focus for engineers in the coming months.

A New Standard for Digital Integrity

The UNITE system marks a pivotal moment in AI history, shifting the focus of deepfake detection from specific human features to a holistic understanding of digital "syntheticness." By successfully identifying AI-generated content in low-resolution and obscured environments, UC Riverside and Google have provided the industry with its most versatile shield to date. It is a testament to the power of academic-industry collaboration in addressing the most pressing societal challenges of the AI era.

As we move deeper into 2026, the success of UNITE will be measured by its integration into the daily workflows of social media platforms and its ability to withstand the next generation of generative models. While the arms race between those who create fakes and those who detect them is far from over, UNITE has significantly raised the bar, making it harder than ever for digital deception to go unnoticed. For now, the "invisible" is becoming visible, and the war for digital truth has a powerful new ally.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.