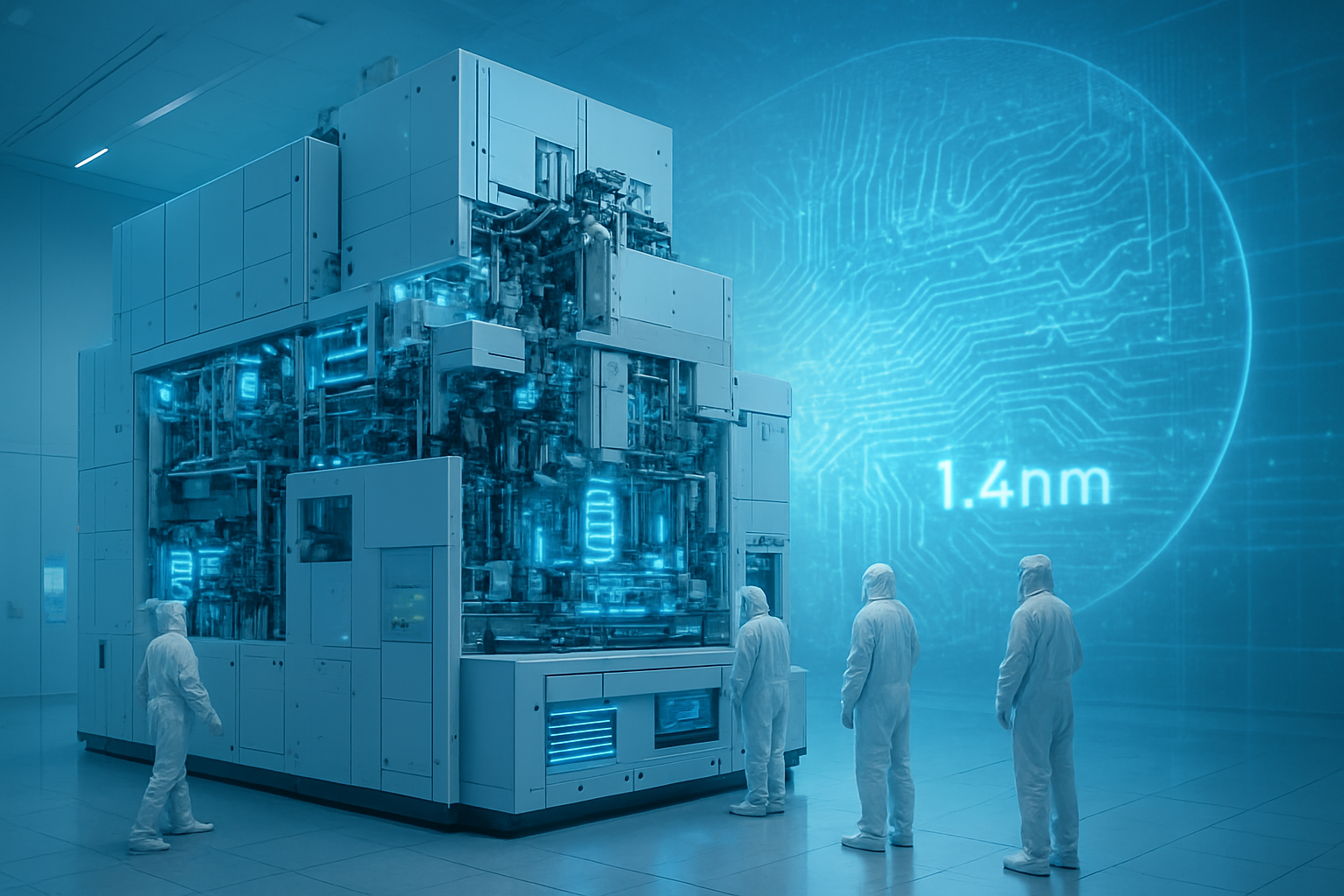

As of late December 2025, the semiconductor industry has reached a pivotal turning point with Intel Corporation (NASDAQ: INTC) officially operationalizing the world’s first commercial-grade High-Numerical Aperture (High-NA) Extreme Ultraviolet (EUV) lithography systems. At the heart of this technological leap is Intel’s Fab 52 in Chandler, Arizona, where the deployment of ASML (NASDAQ: ASML) Twinscan EXE:5200B machines marks a high-stakes bet on reclaiming the crown of process leadership. This move signals the beginning of the "Angstrom Era," as Intel prepares to transition its 1.4nm (14A) node into risk production, a feat that could redefine the competitive hierarchy of the global chip market.

The immediate significance of this deployment cannot be overstated. By successfully integrating these $380 million machines into its high-volume manufacturing (HVM) workflow, Intel is attempting to leapfrog its primary rival, Taiwan Semiconductor Manufacturing Company (NYSE: TSM), which has opted for a more conservative roadmap. This strategic divergence comes at a critical time when the demand for ultra-efficient AI accelerators and high-performance computing (HPC) silicon is at an all-time high, making the precision and density offered by High-NA EUV the new "gold standard" for the next generation of artificial intelligence.

The ASML Twinscan EXE:5200B represents a massive technical evolution over the standard "Low-NA" EUV tools that have powered the industry for the last decade. While standard EUV systems utilize a numerical aperture of 0.33, the High-NA variant increases this to 0.55. This improvement allows for a resolution jump from 13.5nm down to 8nm, enabling the printing of features that are nearly twice as small. For Intel, the primary advantage is the reduction of "multi-patterning." In previous nodes, complex layers required multiple passes through a scanner to achieve the necessary density, a process that is both time-consuming and prone to defects. The EXE:5200B allows for "single-patterning" on critical layers, potentially reducing the number of process steps from 40 down to fewer than 10 for certain segments of the chip.

Technical specifications for the EXE:5200B are staggering. The machine stands two stories tall and weighs as much as two Airbus A320s. In terms of productivity, the 5200B model has achieved a throughput of 175 to 200 wafers per hour, a significant increase over the 125 wafers per hour managed by the earlier EXE:5000 research modules. This productivity gain is essential for making the $380 million-per-unit investment economically viable in a high-volume environment like Fab 52. Furthermore, the system boasts a 0.7nm overlay accuracy, ensuring that the billions of transistors on a 1.4nm chip are aligned with atomic-level precision.

The reaction from the research community has been a mix of awe and cautious optimism. Experts note that while the hardware is revolutionary, the ecosystem—including photoresists, masks, and metrology tools—must catch up to the 0.55 NA standard. Intel’s early adoption is seen as a "trial by fire" that will mature the entire supply chain. Industry analysts have praised Intel’s engineering teams at the D1X facility in Oregon for the rapid validation of the 5200B, which allowed the Arizona deployment to happen months ahead of the original 2026 schedule.

Intel’s "de-risking" strategy is a bold departure from the industry’s typical "wait-and-see" approach. By acting as the lead customer for High-NA EUV, Intel is absorbing the early technical hurdles and high costs associated with the new technology. The strategic advantage here is twofold: first, Intel gains a 2-3 year head start in mastering the High-NA ecosystem; second, it has designed its 14A node to be "design-rule compatible" with standard EUV. This means if the High-NA yields are initially lower than expected, Intel can fall back on traditional multi-patterning without requiring its customers to redesign their chips. This safety net is a key component of CEO Pat Gelsinger’s plan to restore investor confidence.

For TSMC, the decision to delay High-NA adoption until its A14 or even A10 nodes (likely 2028 or later) is rooted in economic pragmatism. TSMC argues that standard EUV, combined with advanced multi-patterning and "Hyper-NA" techniques, remains more cost-effective for its current customer base, which includes Apple (NASDAQ: AAPL) and Nvidia (NASDAQ: NVDA). However, this creates a window of opportunity for Intel Foundry. If Intel can prove that High-NA leads to superior power-performance-area (PPA) metrics for AI chips, it may lure high-profile "anchor" customers away from TSMC’s more mature, yet technically older, processes.

The ripple effects will also be felt by AI startups and fabless giants. Companies designing the next generation of Large Language Model (LLM) trainers require maximum transistor density to fit more HBM (High Bandwidth Memory) and compute cores on a single die. Intel’s 14A node, powered by High-NA, promises a 2.9x increase in transistor density over current 3nm processes. This could make Intel the preferred foundry for specialized AI silicon, disrupting the current near-monopoly held by TSMC in the high-end accelerator market.

The deployment at Fab 52 takes place against a backdrop of intensifying geopolitical competition. Just as Intel reached its High-NA milestone, reports surfaced from Shenzhen, China, regarding a domestic EUV prototype breakthrough. A Chinese research consortium has reportedly validated a working EUV light source using Laser-Induced Discharge Plasma (LDP) technology. While this prototype is currently less efficient than ASML’s systems and years away from high-volume manufacturing, it signals that China is successfully navigating around Western export controls to build a "parallel supply chain."

This development underscores the fragility of the "Silicon Shield" and the urgency of Intel’s mission. The global AI landscape is increasingly tied to the ability to manufacture at the leading edge. If China can eventually bridge the EUV gap, the technological advantage currently held by the U.S. and its allies could erode. Intel’s aggressive push into High-NA is not just a corporate strategy; it is a critical component of the U.S. government’s goal to secure domestic semiconductor manufacturing through the CHIPS Act.

Comparatively, this milestone is being likened to the transition from 193nm immersion lithography to EUV in the late 2010s. That transition saw several players, including GlobalFoundries, drop out of the leading-edge race due to the immense costs. The High-NA transition appears to be having a similar effect, narrowing the field of "Angstrom-era" manufacturers to a tiny elite. The stakes are higher than ever, as the winner of this race will essentially dictate the hardware limits of artificial intelligence for the next decade.

Looking ahead, the next 12 to 24 months will be focused on yield optimization. While the machines are now in place at Fab 52, the challenge lies in reaching "golden" yield levels that make 1.4nm chips commercially profitable. Intel expects its 14A-E (an enhanced version of the 14A node) to begin development shortly after the initial 14A rollout, further refining the use of High-NA for even more complex architectures. Potential applications on the horizon include "monolithic 3D" transistors and advanced backside power delivery, which will be integrated with High-NA patterning.

Experts predict that the industry will eventually see a "convergence" where TSMC and Samsung (OTC: SSNLF) are forced to adopt High-NA by 2027 to remain competitive. The primary challenge that remains is the "reticle limit"—High-NA machines have a smaller field size, meaning chip designers must use "stitching" to create large AI chips. Mastering this stitching process will be the next major hurdle for Intel’s engineers. If successful, we could see the first 1.4nm AI accelerators hitting the market by late 2027, offering performance leaps that were previously thought to be a decade away.

Intel’s successful deployment of the ASML Twinscan EXE:5200B at Fab 52 is a landmark achievement in the history of semiconductor manufacturing. It represents a $380 million-per-unit gamble that Intel can out-innovate its rivals by embracing complexity rather than avoiding it. The key takeaways from this development are Intel’s early lead in the 1.4nm race, the stark strategic divide between Intel and TSMC, and the emerging domestic threat from China’s lithography breakthroughs.

As we move into 2026, the industry will be watching Intel’s yield reports with bated breath. The long-term impact of this deployment could be the restoration of the "Tick-Tock" model of innovation that once made Intel the undisputed leader of the tech world. For now, the "Angstrom Era" has officially arrived in Arizona, and the race to define the future of AI hardware is more intense than ever.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.