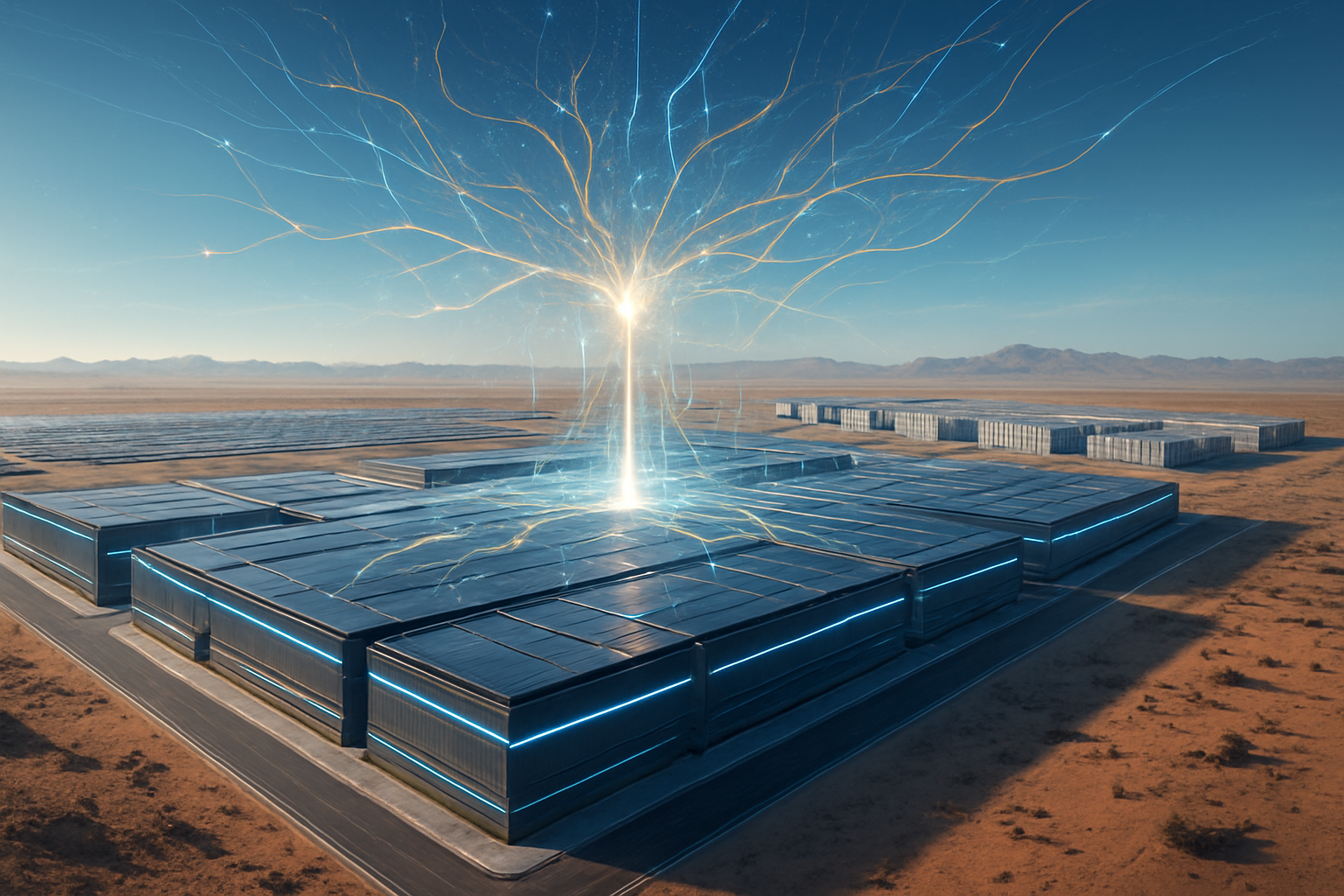

The era of the "AI Factory" has arrived, and it is hungry for power. As of January 12, 2026, the global technology landscape is witnessing an unprecedented convergence between the cutting edge of artificial intelligence and the decades-old reliability of nuclear fission. What began as a series of experimental power purchase agreements has transformed into a full-scale "Nuclear Renaissance," driven by the insatiable energy demands of next-generation AI data centers.

Led by industry titans like Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN), the tech sector is effectively underwriting the revival of the nuclear industry. This shift marks a strategic pivot away from a pure reliance on intermittent renewables like wind and solar, which—while carbon-neutral—cannot provide the 24/7 "baseload" power required to keep massive GPU clusters humming at 100% capacity. With the recent unveiling of even more power-intensive silicon, the marriage of the atom and the chip is no longer a luxury; it is a necessity for survival in the AI arms race.

The Technical Imperative: From Blackwell to Rubin

The primary catalyst for this nuclear surge is the staggering increase in power density within AI hardware. While the NVIDIA (NASDAQ: NVDA) Blackwell architecture of 2024-2025 already pushed data center cooling to its limits with chips consuming up to 1,500W, the newly released NVIDIA Rubin architecture has rewritten the rulebook. A single Rubin GPU is now estimated to have a Thermal Design Power (TDP) of between 1,800W and 2,300W. When these chips are integrated into the high-end "Rubin Ultra" Kyber rack architectures, power density reaches a staggering 600kW per rack.

This level of energy consumption has rendered traditional air-cooling obsolete, mandating the universal adoption of liquid-to-chip and immersion cooling systems. More importantly, it has created a "power gap" that renewables alone cannot bridge. To run a "Stargate-class" supercomputer—the kind Microsoft and Oracle (NYSE: ORCL) are currently building—requires upwards of five gigawatts of constant, reliable power. Because AI training runs can last for months, any fluctuation in power supply or "grid throttling" due to weather-dependent renewables can result in millions of dollars in lost compute time. Nuclear energy provides the only carbon-free solution that offers 90%+ capacity factors, ensuring that multi-billion dollar clusters never sit idle.

Industry experts note that this differs fundamentally from the "green energy" strategies of the 2010s. Previously, tech companies could offset their carbon footprint by buying Renewable Energy Credits (RECs) from distant wind farms. Today, the physical constraints of the grid mean that AI giants need the power to be generated as close to the data center as possible. This has led to "behind-the-meter" and "co-location" strategies, where data centers are built literally in the shadow of nuclear cooling towers.

The Strategic Power Play: Competitive Advantages in the Energy War

The race to secure nuclear capacity has created a new hierarchy among tech giants. Microsoft (NASDAQ: MSFT) remains a front-runner through its landmark deal with Constellation Energy (NASDAQ: CEG) to restart the Crane Clean Energy Center (formerly Three Mile Island Unit 1). As of early 2026, the project is ahead of schedule, with commercial operations expected by mid-2027. By securing 100% of the plant's 835 MW output, Microsoft has effectively guaranteed a dedicated, carbon-free "fuel" source for its Mid-Atlantic AI operations, a move that competitors are now scrambling to replicate.

Amazon (NASDAQ: AMZN) has faced more regulatory friction but remains equally committed. After the Federal Energy Regulatory Commission (FERC) challenged its "behind-the-meter" deal with Talen Energy (NASDAQ: TLN) at the Susquehanna site, AWS successfully pivoted to a "front-of-the-meter" arrangement. This allows them to scale toward a 960 MW goal while satisfying grid stability requirements. Meanwhile, Google—under Alphabet (NASDAQ: GOOGL)—is playing the long game by partnering with Kairos Power to deploy a fleet of Small Modular Reactors (SMRs). Their "Hermes 2" reactor in Tennessee is slated to be the first Gen IV reactor to provide commercial power to a U.S. utility specifically to offset data center loads.

The competitive advantage here is clear: companies that own or control their power supply are insulated from the rising costs and volatility of the public energy market. Oracle (NYSE: ORCL) has even taken the radical step of designing a 1-gigawatt campus powered by three dedicated SMRs. For these companies, energy is no longer an operational expense—it is a strategic moat. Startups and smaller AI labs that rely on public cloud providers may find themselves at the mercy of "energy surcharges" as the grid struggles to keep up with the collective demand of the tech industry.

The Global Significance: A Paradox of Sustainability

This trend represents a significant shift in the broader AI landscape, highlighting the "AI-Energy Paradox." While AI is touted as a tool to solve climate change through optimized logistics and material science, its own physical footprint is expanding at an alarming rate. The return to nuclear energy is a pragmatic admission that the transition to a fully renewable grid is not happening fast enough to meet the timelines of the AI revolution.

However, the move is not without controversy. Environmental groups remain divided; some applaud the tech industry for providing the capital needed to modernize the nuclear fleet, while others express concern over radioactive waste and the potential for "grid hijacking," where tech giants monopolize clean energy at the expense of residential consumers. The FERC's recent interventions in the Amazon-Talen deal underscore this tension. Regulators are increasingly wary of "cost-shifting," where the infrastructure upgrades needed to support AI data centers are passed on to everyday ratepayers.

Comparatively, this milestone is being viewed as the "Industrial Revolution" moment for AI. Just as the first factories required proximity to water power or coal mines, the AI "factories" of the 2020s are tethering themselves to the most concentrated form of energy known to man. It is a transition that has revitalized a nuclear industry that was, only a decade ago, facing a slow decline in the United States and Europe.

The Horizon: Fusion, SMRs, and Regulatory Shifts

Looking toward the late 2020s and early 2030s, the focus is expected to shift from restarting old reactors to the mass deployment of Small Modular Reactors (SMRs). These factory-built units promise to be safer, cheaper, and faster to deploy than the massive "cathedral-style" reactors of the 20th century. Experts predict that by 2030, we will see the first "plug-and-play" nuclear data centers, where SMR units are added to a campus in 50 MW or 100 MW increments as the AI cluster grows.

Beyond fission, the tech industry is also the largest private investor in nuclear fusion. Companies like Helion Energy (backed by Microsoft's Sam Altman) and Commonwealth Fusion Systems are racing to achieve commercial viability. While fusion remains a "long-term" play, the sheer amount of capital being injected by the AI sector has accelerated development timelines by years. The ultimate goal is a "closed-loop" AI ecosystem: AI helps design more efficient fusion reactors, which in turn provide the limitless energy needed to train even more powerful AI.

The primary challenge remains regulatory. The U.S. Nuclear Regulatory Commission (NRC) is currently under immense pressure to streamline the licensing process for SMRs. If the U.S. fails to modernize its regulatory framework, industry analysts warn that AI giants may begin moving their most advanced data centers to regions with more permissive nuclear policies, potentially leading to a "compute flight" to countries like the UAE or France.

Conclusion: The Silicon-Atom Alliance

The trend of tech giants investing in nuclear energy is more than just a corporate sustainability play; it is the fundamental restructuring of the world's digital infrastructure. By 2026, the alliance between the silicon chip and the atom has become the bedrock of the AI economy. Microsoft, Amazon, Google, and Oracle are no longer just software and cloud companies—they are becoming the world's most influential energy brokers.

The significance of this development in AI history cannot be overstated. It marks the moment when the "virtual" world of software finally hit the hard physical limits of the "real" world, and responded by reviving one of the most powerful technologies of the 20th century. As we move into the second half of the decade, the success of the next great AI breakthrough will depend as much on the stability of a reactor core as it does on the elegance of a neural network.

In the coming months, watch for the results of the first "Rubin-class" cluster deployments and the subsequent energy audits. The ability of the grid to handle these localized "gigawatt-shocks" will determine whether the nuclear renaissance can stay on track or if the AI boom will face a literal power outage.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.