Dallas, TX – November 18, 2025 – Southwest Airlines (NYSE: LUV) today announced a significant expansion of its pioneering efforts in implementing touchless biometric and digital check-in systems, marking a pivotal moment in transforming the air travel experience. Building on a successful inaugural pilot launch in October 2025 at Denver International Airport (DEN), the airline is now extending the Transportation Security Administration's (TSA) PreCheck Touchless ID program to key U.S. hubs including Hartsfield-Jackson Atlanta (ATL), New York LaGuardia (LGA), Portland (PDX), Salt Lake City (SLC), and Seattle (SEA). This strategic move underscores Southwest's commitment to leveraging advanced artificial intelligence (AI) and biometric technology to enhance security, dramatically reduce wait times, and create a more efficient, hygienic, and seamless journey for its passengers.

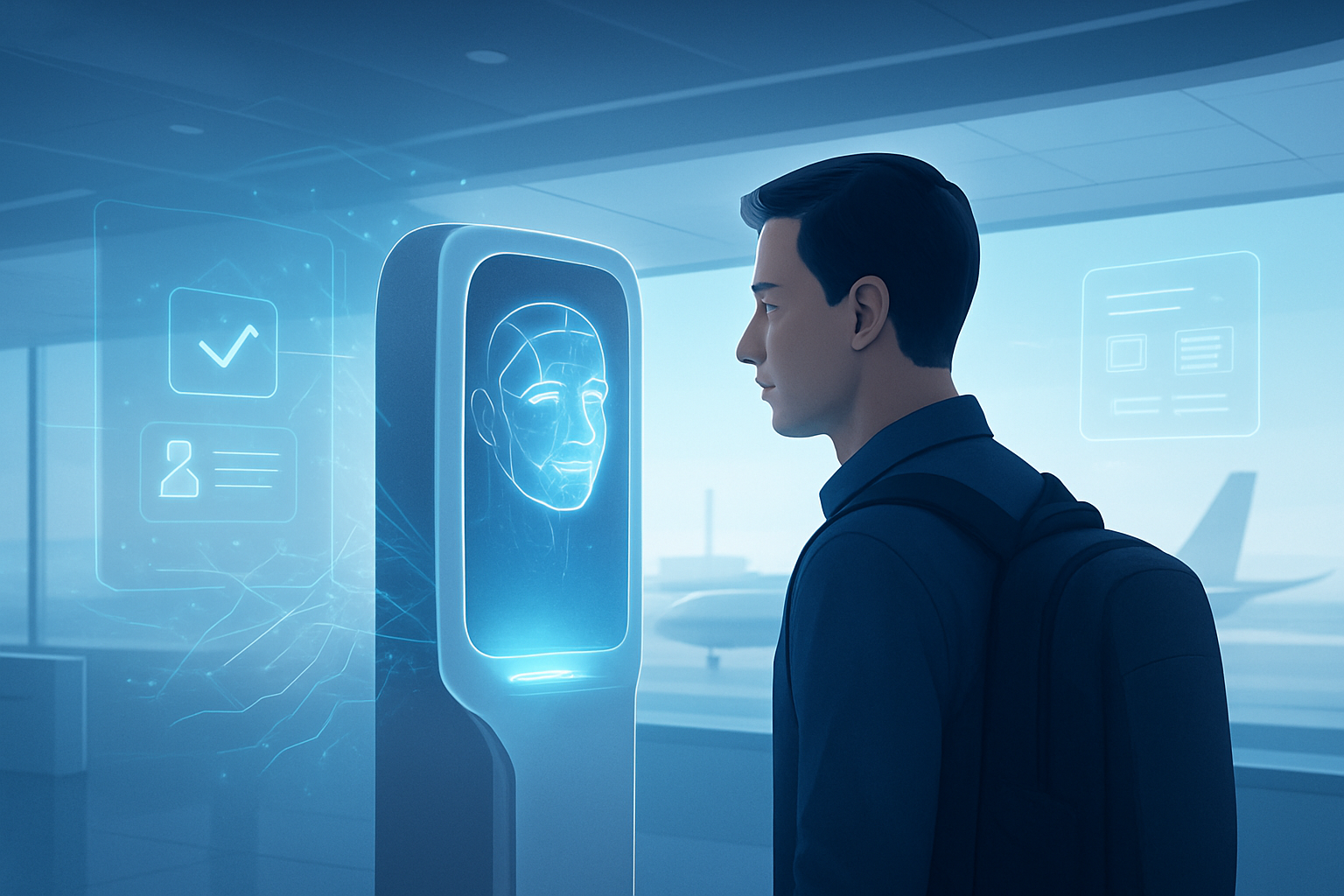

This initiative is set to redefine pre-flight procedures by allowing eligible travelers to verify their identity using facial comparison technology, eliminating the need to physically present identification documents or boarding passes. As air travel continues its resurgence and passenger volumes grow, Southwest Airlines (NYSE: LUV) is positioning itself at the forefront of digital innovation, aiming to deliver a high-quality, more convenient customer experience from booking to arrival, all while bolstering national security protocols.

The AI Behind the Smile: Unpacking Touchless Biometrics

The core of Southwest Airlines' (NYSE: LUV) and the TSA's biometric initiative is the TSA PreCheck Touchless ID program, which utilizes sophisticated facial comparison technology. This system replaces the traditional, manual process of identity verification by converting unique facial features into a digital, mathematical representation—a biometric template. When a traveler opts into the program and approaches a designated checkpoint, a high-resolution camera captures a live image of their face. This image is then encrypted and securely transmitted for instantaneous comparison against pre-registered photographs, such as those from passports or visas, stored in an official government database managed by U.S. Customs and Border Protection (CBP)'s Traveler Verification Service (TVS).

Technically, the process involves several layers of AI and computer vision. First, facial detection algorithms identify a human face. Then, feature extraction algorithms analyze specific facial landmarks, creating a unique digital template. Finally, matching and verification algorithms perform a one-to-one comparison between the live template and the stored template to confirm identity. This entire sequence typically takes less than 10 seconds. Unlike previous approaches that relied solely on human agents visually matching a face to a physical ID, this automated system significantly reduces human error, enhances accuracy, and provides a consistent, reliable layer of security. The technology also incorporates "liveness detection" to prevent spoofing attempts using photos or masks.

For Southwest (NYSE: LUV) passengers to participate, they must be a Rapid Rewards member, enrolled in TSA PreCheck, at least 18 years old, possess a valid Known Traveler Number (KTN), and have a valid U.S. passport uploaded to their Southwest mobile app profile. The enrollment process itself is digital, integrating seamlessly into the airline's existing mobile platform. This differs markedly from older, often cumbersome biometric trials that were limited to specific international boarding gates. The current implementation aims for a "curb-to-gate" integration, streamlining multiple touchpoints from bag drop to security and boarding, offering a truly touchless experience. Companies like FaceTec, providing 3D Face Verification, and Optiview, supplying high-resolution cameras, are among the foundational technology providers enabling such advanced systems.

The benefits for airport security and traveler efficiency are profound. For security, the technology offers enhanced accuracy, making identity fraud virtually impossible and allowing for real-time screening against watchlists. It also aids in verifying the authenticity of the ID credential itself through devices like Credential Authentication Technology (CAT-2) units used by the TSA. For travelers, the system promises drastically faster processing times, alleviating airport congestion, and a more seamless, less stressful journey without the constant need to present documents. This increased efficiency also translates to improved operational capacity for airports and quicker aircraft turnaround times for airlines.

Shaking Up the Tech Landscape: Impact on AI Companies and Tech Giants

Southwest Airlines' (NYSE: LUV) aggressive push into touchless biometrics creates a dynamic ripple effect across the AI and tech industries, presenting both immense opportunities and competitive shifts for companies of all sizes. The demand for sophisticated biometric solutions, robust cloud infrastructure, and advanced AI algorithms is skyrocketing.

Companies specializing in biometrics, such as SITA, Vision-Box, Idemia, Cognitec Systems, DERMALOG Identification Systems GmbH, NEC Corporation (TYO: 6701), and Thales Group (EPA: HO), stand to benefit significantly. These firms, which provide end-to-end automated passenger authentication solutions, are seeing increased demand for their facial recognition, fingerprint, and iris scanning technologies. Their expertise in developing highly accurate and secure biometric systems is crucial for scaling these initiatives across more airports and airlines. Additionally, BigBear.ai (NYSE: BBAI), through its Pangiam division, is deploying biometric software for Enhanced Passenger Processing (EPP) at international airports, showcasing the growing market for specialized AI-driven security solutions.

Tech giants are also playing a critical role. The immense computational power and secure data storage required for real-time biometric processing demand scalable cloud infrastructure, benefiting providers like Google (NASDAQ: GOOGL) and Microsoft (NASDAQ: MSFT), which offer robust cloud platforms and AI services. Companies like L3Harris Technologies (NYSE: LHX) and Collins Aerospace (part of Raytheon Technologies (NYSE: RTX)) are essential in providing the underlying hardware, software, and systems integration capabilities for TSA and airport infrastructure. Their established presence and ability to deliver large-scale, complex solutions give them a strategic advantage in this evolving market.

For AI labs and startups, the competitive landscape is intensifying. There's a surge in demand for expertise in computer vision, deep learning, and ethical AI development. Startups focusing on niche areas like advanced liveness detection, privacy-enhancing technologies (e.g., decentralized identity management), or specialized AI for data analytics and predictive maintenance within airport operations can find fertile ground. However, they must contend with the significant resources and established relationships of larger players. The shift towards biometrics also disrupts existing products and services that relied on manual verification, pushing companies to innovate or risk obsolescence. Market positioning now hinges on offering secure, accurate, scalable, and interoperable solutions that prioritize both efficiency and passenger experience.

A New Era of Travel: Wider Significance and Societal Implications

Southwest Airlines' (NYSE: LUV) adoption of touchless biometrics is more than just an airline upgrade; it's a microcosm of a broader paradigm shift in how AI is integrated into critical infrastructure and daily life. This initiative fits squarely within the larger AI landscape's trend towards automation, real-time data processing, and enhanced security through computer vision. It mirrors advancements seen in other sectors, such as AI's role in self-driving cars for environmental perception, or in healthcare for diagnostics and personalized medicine, by applying sophisticated pattern recognition to complex logistical and security challenges.

The impacts on the travel industry are transformative. Beyond the immediate benefits of reduced wait times and increased efficiency, biometrics pave the way for a truly frictionless "curb-to-gate" experience, potentially saving billions in operational costs and boosting global GDP growth from travel. The International Air Transport Association (IATA) reports high traveler satisfaction with biometric systems, indicating strong consumer acceptance. This development also aligns with government initiatives like the REAL ID Act, which, by May 7, 2025, will require REAL ID-compliant identification for domestic air travel, underscoring the need for robust identity verification methods. The TSA's broader biometric strategy aims for nationwide expansion of facial recognition technology across all 400+ airports, suggesting a future where biometric identity verification becomes the norm.

However, this technological leap is not without significant concerns. Privacy is paramount; civil liberties organizations voice apprehension about the extensive collection and storage of sensitive biometric data, even with assurances of data deletion. The potential for "function creep"—where data collected for one purpose is used for another—and mass surveillance remains a worry, driving calls for robust legislation like the Traveler Privacy Protection Act. Data security is another critical challenge; centralized biometric databases present attractive targets for cyberattacks, and a breach of immutable biometric data could have devastating consequences for individuals. Finally, algorithmic bias is a persistent concern. Studies have shown that facial recognition systems can exhibit disparities in accuracy across different demographic groups, potentially leading to misidentification or discriminatory interactions. Addressing these biases requires rigorous testing, diverse training data, and transparent algorithmic development to ensure equitable application.

The Horizon of Hyper-Efficient Travel: Future Developments

The journey towards fully integrated, touchless travel is far from over, and Southwest Airlines' (NYSE: LUV) current initiatives are merely a stepping stone. Experts predict a rapid evolution in the near-term (1-5 years) and a truly revolutionary long-term vision (5+ years).

In the near term, we can expect the TSA PreCheck Touchless ID program to expand to even more airports and integrate with a wider array of airlines. Digital check-in systems will become more sophisticated, incorporating AI-guided workflows and advanced "liveness tests" to further secure identity verification. A key development will be the proliferation of "wallet-ready credentials," such as the International Civil Aviation Organization's (ICAO) Digital Travel Credential (DTC), which will reside in secure digital wallets like Apple Wallet (NASDAQ: AAPL) or Google Wallet (NASDAQ: GOOGL). These credentials will allow travelers to selectively share necessary information, enhancing both convenience and privacy. The European Union's Entry/Exit System (EES), commencing in October 2025, will also mandate facial imaging and fingerprints for non-EU travelers, signaling a global trend towards biometric border control.

Looking further ahead, the long-term vision is a virtually entirely touchless airport experience, where a traveler's face serves as their universal token from curb to gate. This means automated bag drops, seamless lounge access, and efficient customs and immigration clearance, all powered by biometrics and AI. AI will actively monitor passenger flow, predict bottlenecks, and optimize airport operations in real-time. Potential applications extend beyond the airport, with biometrics potentially authorizing payments for retail, dining, hotel check-ins, and even access to destination venues.

However, significant challenges remain. Technologically, ensuring high accuracy across all demographics and developing robust exception processing for those unable to use biometrics are crucial. The cost of comprehensive infrastructure and achieving interoperability between disparate systems globally are also major hurdles. Ethically, concerns about privacy, function creep, and potential surveillance will necessitate strong regulatory frameworks and transparent practices. Experts predict the increasing adoption of multi-modal biometrics, combining facial recognition with fingerprint or iris scans, to enhance accuracy and security against spoofing. Companies like Aware Inc. (NASDAQ: AWRE), BIO-key International (NASDAQ: BKYI), and IDEX Biometrics (NASDAQ: IDBA) are at the forefront of developing these multi-modal solutions. The ultimate goal, as envisioned by airport designers and technology providers like SITA, is to create airports where the passenger experience is so seamless that they barely notice the security checks, transforming travel into an effortless flow.

The Future is Now: A Comprehensive Wrap-Up

Southwest Airlines' (NYSE: LUV) expansion of touchless biometrics and digital check-in systems marks a definitive stride into the future of air travel. This development is not just about convenience; it represents a significant advancement in leveraging AI and biometric technology to create a more secure, efficient, and hygienic travel ecosystem. The immediate impact is clear: faster processing times, reduced physical contact, and an improved passenger experience for eligible travelers at key U.S. airports.

In the grand tapestry of AI history, this moment signifies the maturation and widespread practical application of computer vision and deep learning in a critical public service sector. While not a singular breakthrough in fundamental AI research, it exemplifies the successful deployment of existing AI capabilities to solve complex real-world logistical and security challenges on a large scale. The involvement of tech giants like Google (NASDAQ: GOOGL) and Microsoft (NASDAQ: MSFT), alongside specialized biometric firms and government agencies, highlights a collaborative effort to integrate cutting-edge technology into the fabric of daily life.

Looking ahead, the long-term impact promises a fundamentally transformed travel experience, moving towards a truly "curb-to-gate" seamless journey. However, the success of this transformation hinges on addressing critical concerns around privacy, data security, and algorithmic bias. Robust legislative frameworks, transparent data handling practices, and continuous refinement of AI algorithms to ensure fairness and accuracy across all demographics will be paramount.

In the coming weeks and months, watch for further announcements from Southwest (NYSE: LUV) and other major airlines regarding additional airport expansions and enhanced digital features. Keep an eye on legislative developments concerning biometric data privacy and the ongoing efforts by the TSA and CBP to standardize and secure these evolving identity verification systems. The future of travel is here, and it’s increasingly touchless, digital, and powered by AI.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.