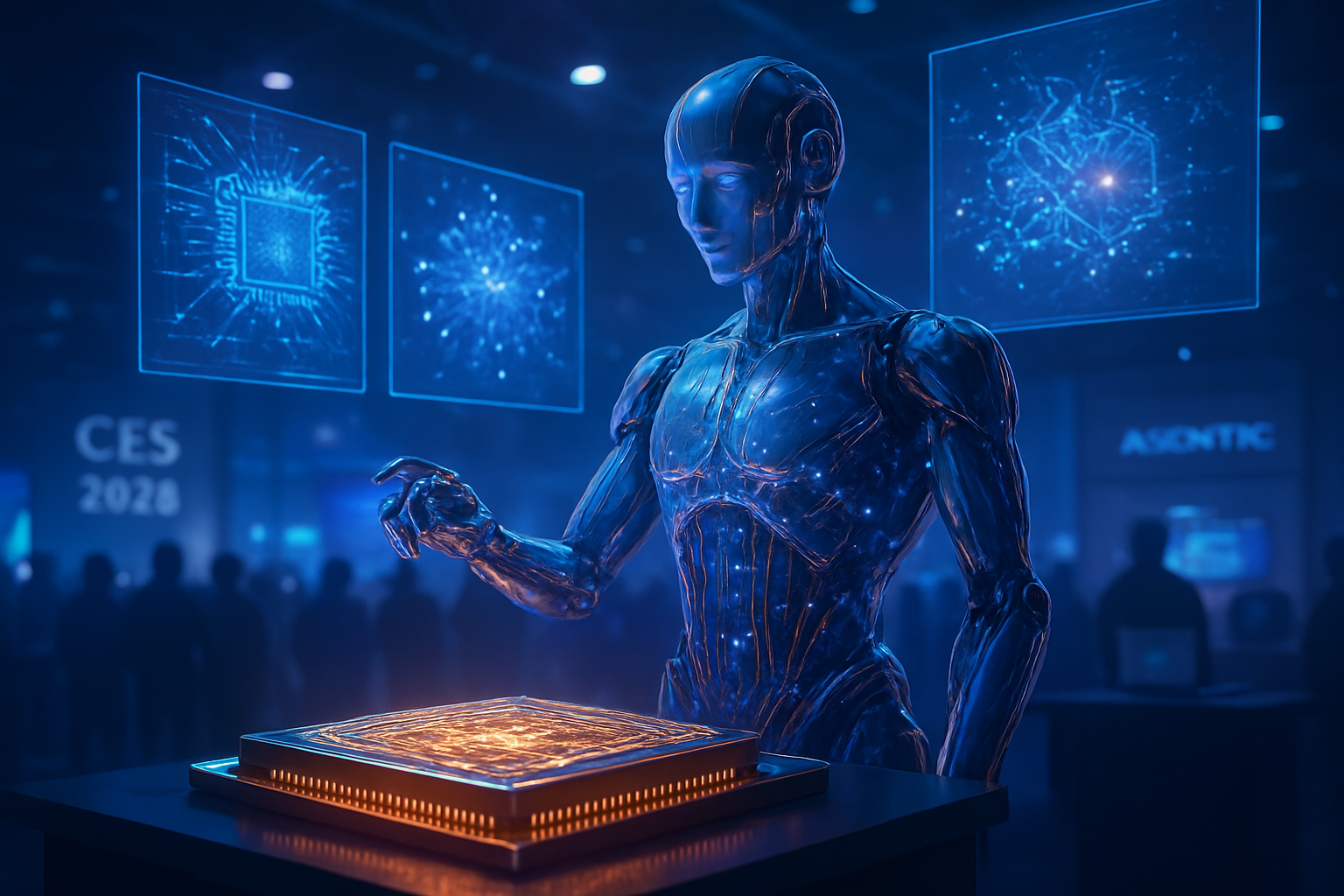

The landscape of personal computing underwent a seismic shift this month at CES 2026 as Qualcomm (NASDAQ: QCOM) officially completed the rollout of its second-generation PC platform: the Snapdragon X2 Elite and Snapdragon X2 Plus. Built on a cutting-edge 3nm process, these processors represent more than just a generational speed bump; they signal the definitive end of the "Generative AI" era in favor of "Agentic AI." By packing a record-shattering 85 TOPS (Trillion Operations Per Second) into a dedicated Neural Processing Unit (NPU), Qualcomm is enabling a new class of autonomous AI assistants that operate entirely on-device, fundamentally altering how humans interact with their computers.

The significance of the Snapdragon X2 series lies in its move away from the cloud. For the past two years, AI has largely been a "request-and-response" service, where user data is sent to massive server farms for processing. Qualcomm’s new silicon flips this script, bringing the power of large language models (LLMs) and multi-step reasoning agents directly into the local hardware. This "on-device first" philosophy promises to solve the triple-threat of modern AI challenges: latency, privacy, and cost. With the Snapdragon X2, your PC is no longer just a window to an AI in the cloud—it is the AI.

Technical Prowess: The 85 TOPS NPU and the Rise of Agentic Silicon

At the heart of the Snapdragon X2 series is the third-generation Hexagon NPU, which has seen its performance nearly double from the 45 TOPS of the first-generation X Elite to a staggering 80–85 TOPS. This leap is critical for what Qualcomm calls "Agentic AI"—assistants that don't just write text, but perform multi-step, cross-application tasks autonomously. For instance, the X2 Elite can locally process a command like, "Review my last three client meetings, extract the action items, and cross-reference them with my calendar to find a time for a follow-up session," all without an internet connection. This is made possible by a new 64-bit virtual addressing architecture that allows the NPU to access more than 4GB of system memory directly, enabling it to run larger, more complex models that were previously restricted to data centers.

Architecturally, Qualcomm has moved to a hybrid design for its 3rd Generation Oryon CPU cores. While the original X Elite utilized 12 identical cores, the X2 Elite features a "Prime + Performance" cluster consisting of up to 18 cores (12 performance and 6 efficiency). This shift, manufactured on TSMC (NYSE: TSM) 3nm technology, delivers a 35% increase in single-core performance while reducing power consumption by 43% compared to its predecessor. The graphics side has also seen a massive overhaul with the Adreno X2 GPU, which now supports DirectX 12.2 Ultimate and can drive three 5K displays simultaneously—addressing a key pain point for professional users who felt limited by the first-generation hardware.

Initial reactions from the industry have been overwhelmingly positive. Early benchmarks shared by partners like HP Inc. (NYSE: HPQ) and Lenovo (HKG: 0992) suggest that the X2 Elite outperforms Apple’s (NASDAQ: AAPL) latest M-series chips in sustained AI workloads. "The move to 85 TOPS is the 'gigahertz race' of the 2020s," noted one senior analyst at the show. "Qualcomm isn't just winning on paper; they are providing the thermal and memory headroom that software developers have been begging for to make local AI agents actually usable in daily workflows."

Market Disruption: Shaking the Foundations of the Silicon Giants

The launch of the Snapdragon X2 series places immediate pressure on traditional x86 heavyweights Intel (NASDAQ: INTC) and AMD (NASDAQ: AMD). While both companies have made strides with their own AI-focused chips (Lunar Lake and Strix Point, respectively), Qualcomm's 85 TOPS NPU sets a new benchmark that may take the rest of the industry another year to match. This lead gives Qualcomm a strategic advantage in the premium "AI PC" segment, especially as Microsoft (NASDAQ: MSFT) deepens its integration of Windows 11 with the Snapdragon architecture. The new "Snapdragon Guardian" hardware-level security suite further enhances this position, offering enterprise IT departments the ability to manage or wipe devices even when the OS is unresponsive—a feature traditionally dominated by Intel’s vPro.

The shift toward on-device intelligence also poses a subtle but significant threat to the business models of cloud AI providers. If a laptop can handle 90% of a user's AI needs locally, the demand for expensive subscription-based cloud tokens for services like ChatGPT or Claude could diminish. Startups are already pivoting to this "edge-first" reality; at CES, companies like Paage.AI and Anything.AI demonstrated agents that search local encrypted files to provide answers privately, bypassing the need for cloud-based indexing. By providing the hardware foundation for this ecosystem, Qualcomm is positioning itself as the tollkeeper for the next generation of autonomous software.

The Broader Landscape: A Pivot Toward Ubiquitous Privacy

The Snapdragon X2 launch is a milestone in the broader AI landscape because it marks the transition from "AI as a feature" to "AI as the operating system." We are seeing a move away from the chatbot interface toward "Always-On" sensing. The X2 chips include enhanced micro-NPUs (eNPUs) that process voice, vision, and environmental context at extremely low power levels. This allows the PC to be "aware"—knowing when a user walks away to lock the screen, or sensing when a user is frustrated and offering a proactive suggestion. This transition to Agentic AI represents a more natural, human-centric way of computing, but it also raises new concerns regarding data sovereignty.

By keeping the data on-device, Qualcomm is leaning into the privacy-first movement. As users become more wary of how their data is used to train massive foundation models, the ability to run an 85 TOPS model locally becomes a major selling point. It echoes previous industry shifts, such as the move from mainframe computing to personal computing in the 1980s. Just as the PC liberated users from the constraints of time-sharing systems, the Snapdragon X2 aims to liberate AI from the constraints of the cloud, providing a level of "intellectual privacy" that has been missing since the rise of the modern internet.

Looking Ahead: The Software Ecosystem Challenges

While the hardware has arrived, the near-term success of the Snapdragon X2 will depend heavily on software optimization. The jump to 85 TOPS provides the "runway," but developers must now build the "planes." We expect to see a surge in "Agentic Apps" throughout 2026—software designed to talk to other software via the NPU. Microsoft’s deep integration of local Copilot features in the upcoming Windows 11 26H1 update will be the first major test of this ecosystem. If these local agents can truly match the utility of cloud-based counterparts, the "AI PC" will transition from a marketing buzzword to a functional necessity.

However, challenges remain. The hybrid core architecture and the specific 64-bit NPU addressing require developers to recompile and optimize their software to see the full benefits. While Qualcomm’s emulation layers have improved significantly, "native-first" development is still the goal. Experts predict that the next twelve months will see a fierce battle for developer mindshare, with Qualcomm, Apple, and Intel all vying to be the primary platform for the local AI revolution. We also anticipate the launch of even more specialized "X2 Extreme" variants later this year, potentially pushing NPU performance past the 100 TOPS mark for professional workstations.

Conclusion: The New Standard for Personal Computing

The debut of the Snapdragon X2 Elite and X2 Plus at CES 2026 marks the beginning of a new chapter in technology history. By delivering 85 TOPS of local NPU performance, Qualcomm has effectively brought the power of a mid-range 2024 server farm into a thin-and-light laptop. The focus on Agentic AI—autonomous, action-oriented, and private—shifts the narrative of artificial intelligence from a novelty to a fundamental utility. Key takeaways from this launch include the dominance of the 3nm process, the move toward hybrid CPU architectures, and the clear prioritization of local silicon over cloud reliance.

In the coming weeks and months, the tech world will be watching the first wave of consumer devices from HP, Lenovo, and ASUS (TPE: 2357) as they hit retail shelves. Their real-world performance will determine if the promise of Agentic AI can live up to the CES hype. Regardless of the immediate outcome, the direction of the industry is now clear: the future of AI isn't in a distant data center—it’s in the palm of your hand, or on your lap, running at 85 TOPS.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.