As of January 2026, the artificial intelligence industry has reached a fever pitch, not just in the complexity of its models, but in the physical reality of the hardware required to run them. The "compute crunch" of 2024 and 2025 has evolved into a structural "capacity wall" centered on two critical components: High Bandwidth Memory (HBM) and Chip-on-Wafer-on-Substrate (CoWoS) advanced packaging. For industry titans like Google (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT), the strategy has shifted from optimizing the Total Cost of Ownership (TCO) to an aggressive, almost desperate, pursuit of Time-to-Market (TTM). In the race for Artificial General Intelligence (AGI), these giants have signaled that they are willing to pay any price to cut the manufacturing queue, effectively prioritizing speed over cost in a high-stakes scramble for silicon.

The immediate significance of this shift cannot be overstated. By January 2026, the demand for CoWoS packaging has surged to nearly one million wafers per year, far outstripping the aggressive expansion efforts of TSMC (NYSE:TSM). This bottleneck has created a "vampire effect," where the production of AI accelerators is siphoning resources away from the broader electronics market, leading to rising costs for everything from smartphones to automotive chips. For Google and Microsoft, securing these components is no longer just a procurement task—it is a matter of corporate survival and geopolitical leverage.

The Technical Frontier: HBM4 and the 16-Hi Arms Race

At the heart of the current bottleneck is the transition from HBM3e to the next-generation HBM4 standard. While HBM3e was sufficient for the initial waves of Large Language Models (LLMs), the massive parameter counts of 2026-era models require the 2048-bit memory interface width offered by HBM4—a doubling of the 1024-bit interface used in previous generations. This technical leap is essential for feeding the voracious data appetites of chips like NVIDIA’s (NASDAQ:NVDA) new Rubin architecture and Google’s TPU v7, codenamed "Ironwood."

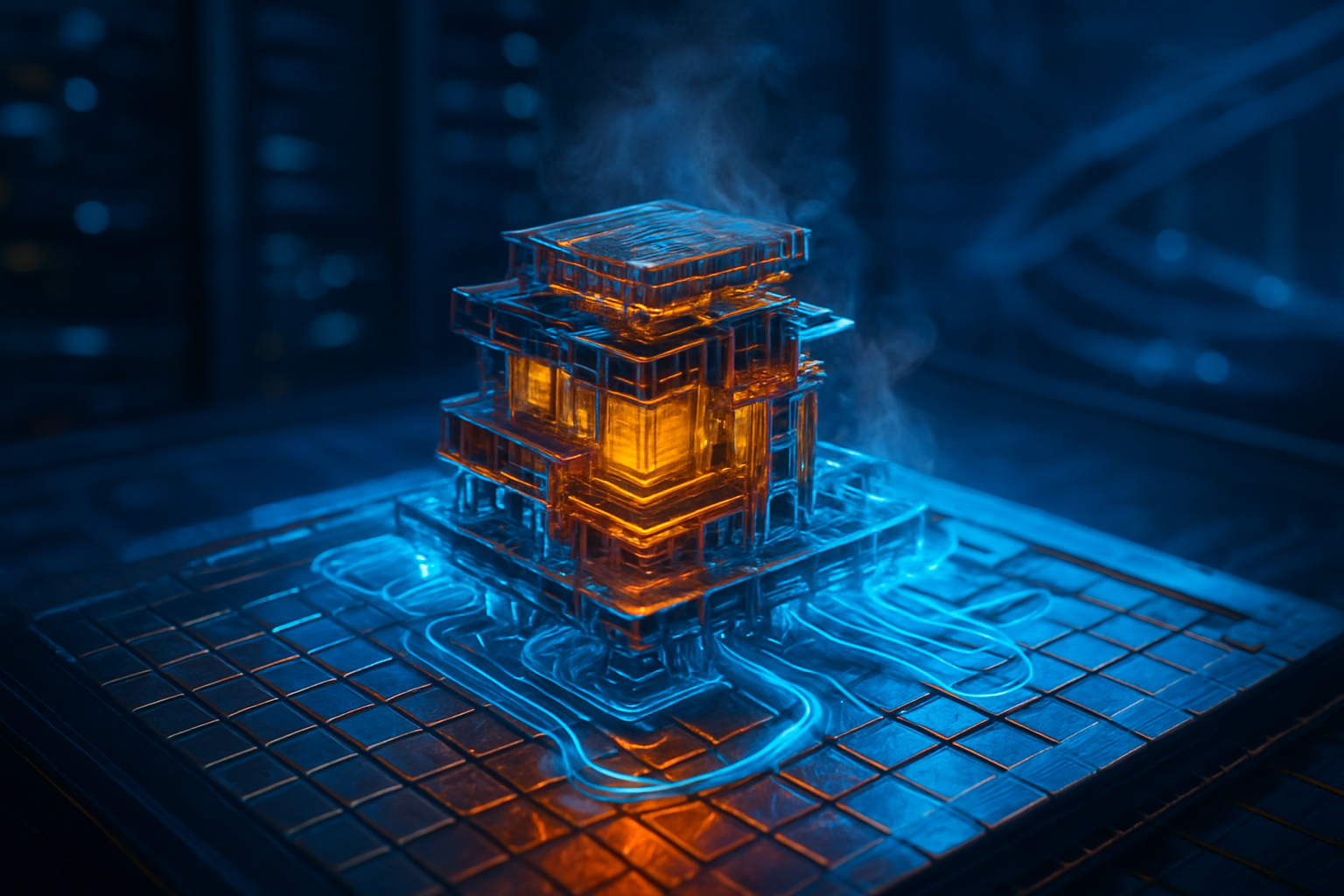

The engineering challenge of HBM4 lies in the physical stacking of memory. The industry is currently locked in a "16-Hi arms race," where 16 layers of DRAM are stacked into a single package. To keep these stacks within the JEDEC-defined thickness of 775 micrometers, manufacturers like SK Hynix (KRX:000660) and Samsung (KRX:005930) have had to reduce wafer thickness to a staggering 30 micrometers. This thinning process has cratered yields and necessitated a shift toward "Hybrid Bonding"—a copper-to-copper connection method that replaces traditional micro-bumps. This complexity is exactly why CoWoS (Chip-on-Wafer-on-Substrate) has become the primary point of failure in the supply chain; it is the specialized "glue" that connects these ultra-thin memory stacks to the logic processors.

Initial reactions from the research community suggest that while HBM4 provides the necessary bandwidth to avoid "memory wall" stalls, the thermal dissipation issues are becoming a nightmare for data center architects. Industry experts note that the move to 16-Hi stacks has forced a redesign of cooling systems, with liquid-to-chip cooling now becoming a mandatory requirement for any Tier-1 AI cluster. This technical hurdle has only increased the reliance on TSMC’s advanced CoWoS-L (Local Silicon Interconnect) packaging, which remains the only viable solution for the high-density interconnects required by the latest Blackwell Ultra and Rubin platforms.

Strategic Maneuvers: Custom Silicon vs. The NVIDIA Tax

The strategic landscape of 2026 is defined by a "dual-track" approach from the hyperscalers. Microsoft and Google are simultaneously NVIDIA’s largest customers and its most formidable competitors. Microsoft (NASDAQ:MSFT) has accelerated the mass production of its Maia 200 (Braga) accelerator, while Google has moved aggressively with its TPU v7 fleet. The goal is simple: reduce the "NVIDIA tax," which currently sees NVIDIA command gross margins north of 75% on its high-end H100 and B200 systems.

However, building custom silicon does not exempt these companies from the HBM and CoWoS bottleneck. Even a custom-designed TPU requires the same HBM4 stacks and the same TSMC packaging slots as an NVIDIA Rubin chip. To secure these, Google has leveraged its long-standing partnership with Broadcom (NASDAQ:AVGO) to lock in nearly 50% of Samsung’s 2026 HBM4 production. Meanwhile, Microsoft has turned to Marvell (NASDAQ:MRVL) to help reserve dedicated CoWoS-L capacity at TSMC’s new AP8 facility in Taiwan. By paying massive prepayments—estimated in the billions of dollars—these companies are effectively "buying the queue," ensuring that their internal projects aren't sidelined by NVIDIA’s overwhelming demand.

The competitive implications are stark. Startups and second-tier cloud providers are increasingly being squeezed out of the market. While a company like CoreWeave or Lambda can still source NVIDIA GPUs, they lack the vertical integration and the capital to secure the raw components (HBM and CoWoS) at the source. This has allowed Google and Microsoft to maintain a strategic advantage: even if they can't build a better chip than NVIDIA, they can ensure they have more chips, and have them sooner, by controlling the underlying supply chain.

The Global AI Landscape: The "Vampire Effect" and Sovereign AI

The scramble for HBM and CoWoS is having a profound impact on the wider technology landscape. Economists have noted a "Vampire Effect," where the high margins of AI memory are causing manufacturers like Micron (NASDAQ:MU) and SK Hynix to convert standard DDR4 and DDR5 production lines into HBM lines. This has led to an unexpected 20% price hike in "boring" memory for PCs and servers, as the supply of commodity DRAM shrinks to feed the AI beast. The AI bottleneck is no longer a localized issue; it is a macroeconomic force driving inflation across the semiconductor sector.

Furthermore, the emergence of "Sovereign AI" has added a new layer of complexity. Nations like the UAE, France, and Japan have begun treating AI compute as a national utility, similar to energy or water. These governments are reportedly paying "sovereign premiums" to secure turnkey NVIDIA Rubin NVL144 racks, further inflating the price of the limited CoWoS capacity. This geopolitical dimension means that Google and Microsoft are not just competing against each other, but against national treasuries that view AI leadership as a matter of national security.

This era of "Speed over Cost" marks a significant departure from previous tech cycles. In the mobile or cloud eras, companies prioritized efficiency and cost-per-user. In the AGI race of 2026, the consensus is that being six months late with a frontier model is a multi-billion dollar failure that no amount of cost-saving can offset. This has led to a "Capex Cliff," where investors are beginning to demand proof of ROI, yet companies feel they cannot afford to stop spending lest they fall behind permanently.

Future Outlook: Glass Substrates and the Post-CoWoS Era

Looking toward the end of 2026 and into 2027, the industry is already searching for a way out of the CoWoS trap. One of the most anticipated developments is the shift toward glass substrates. Unlike the organic materials currently used in packaging, glass offers superior flatness and thermal stability, which could allow for even denser interconnects and larger "system-on-package" designs. Intel (NASDAQ:INTC) and several South Korean firms are racing to commercialize this technology, which could finally break TSMC’s "secondary monopoly" on advanced packaging.

Additionally, the transition to HBM4 will likely see the integration of the "logic die" directly into the memory stack, a move that will require even closer collaboration between memory makers and foundries. Experts predict that by 2027, the distinction between a "memory company" and a "foundry" will continue to blur, as SK Hynix and Samsung begin to incorporate TSMC-manufactured logic into their HBM stacks. The challenge will remain one of yield; as the complexity of these 3D-stacked systems increases, the risk of a single defect ruining a $50,000 chip becomes a major financial liability.

Summary of the Silicon Scramble

The HBM and CoWoS bottleneck of 2026 represents a pivotal moment in the history of computing. It is the point where the abstract ambitions of AI software have finally collided with the hard physical limits of material science and manufacturing capacity. Google and Microsoft's decision to prioritize speed over cost is a rational response to a market where "time-to-intelligence" is the only metric that matters. By locking down the supply of HBM4 and CoWoS, they are not just building data centers; they are fortifying their positions in the most expensive arms race in human history.

In the coming months, the industry will be watching for the first production yields of 16-Hi HBM4 and the operational status of TSMC’s Arizona packaging plants. If these facilities can hit their targets, the bottleneck may begin to ease by late 2027. However, if yields remain low, the "Speed over Cost" era may become the permanent state of the AI industry, favoring only those with the deepest pockets and the most aggressive supply chain strategies. For now, the silicon squeeze continues, and the price of entry into the AI elite has never been higher.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.