As the calendar turns to early 2026, the global semiconductor landscape has reached a pivotal inflection point with the official arrival of the 2nm era. Samsung Electronics (KRX:005930) has formally announced the mass production of its SF2 (2nm) process, a technological milestone aimed squarely at reclaiming the manufacturing crown from its primary rival, Taiwan Semiconductor Manufacturing Company (NYSE:TSM). The centerpiece of this rollout is the Exynos 2600, a next-generation mobile processor codenamed "Ulysses," which is set to power the upcoming Galaxy S26 series.

This development is more than a routine hardware refresh; it represents Samsung’s strategic "all-in" bet on Gate-All-Around (GAA) transistor architecture. By integrating the SF2 node into its flagship consumer devices, Samsung is attempting to prove that its third-generation Multi-Bridge Channel FET (MBCFET) technology can finally match or exceed the stability and performance of TSMC’s 2nm offerings. The immediate significance lies in the Exynos 2600’s ability to handle the massive compute demands of on-device generative AI, which has become the primary battleground for smartphone manufacturers in 2026.

The Technical Edge: BSPDN and the 25% Efficiency Leap

The transition to the SF2 node brings a suite of architectural advancements that represent a significant departure from the previous 3nm (SF3) generation. Most notably, Samsung has targeted a 25% improvement in power efficiency at equivalent clock speeds. This gain is achieved through the refinement of the MBCFET architecture, which allows for better electrostatic control and reduced leakage current. While initial production yields are estimated to be between 50% and 60%—a marked improvement over the company's early 3nm struggles—the SF2 node is already delivering a 12% performance boost and a 5% reduction in total chip area.

A critical component of this efficiency story is the introduction of preliminary Backside Power Delivery Network (BSPDN) optimizations. While the full, "pure" implementation of BSPDN is slated for the SF2Z node in 2027, the Exynos 2600 utilizes a precursor routing technology that moves several power rails to the rear of the wafer. This reduces the "IR drop" (voltage drop) and mitigates the congestion between power and signal lines that has plagued traditional front-side delivery systems. Industry experts note that this "backside-first" approach is a calculated risk to outpace TSMC, which is not expected to introduce its own version of backside power delivery until the N2P node later this year.

The Exynos 2600 itself is a technical powerhouse, featuring a 10-core CPU configuration based on the latest ARM v9.3 platform. It debuts the AMD Juno GPU (Xclipse 960), which Samsung claims provides a 50% improvement in ray-tracing performance over the Galaxy S25. More importantly, the chip's Neural Processing Unit (NPU) has seen a 113% throughput increase, specifically optimized for running large language models (LLMs) locally on the device. This allows the Galaxy S26 to perform complex AI tasks, such as real-time video translation and generative image editing, without relying on cloud-based servers.

The Battle for Big Tech: Taylor, Texas as a Strategic Magnet

Samsung’s 2nm ambitions extend far beyond its own Galaxy handsets. The company is aggressively positioning its $44 billion mega-fab in Taylor, Texas, as the premier "sovereign" foundry for North American tech giants. By pivoting the Taylor facility to 2nm production ahead of schedule, Samsung is courting "Big Tech" customers like NVIDIA (NASDAQ:NVDA), Apple (NASDAQ:AAPL), and Qualcomm (NASDAQ:QCOM) who are eager to diversify their supply chains away from a Taiwan-centric model.

The strategy appears to be yielding results. Samsung has already secured a landmark $16.5 billion agreement with Tesla (NASDAQ:TSLA) to manufacture next-generation AI5 and AI6 chips for autonomous driving and the Optimus robotics program. Furthermore, AI silicon startups such as Groq and Tenstorrent have signed on as early 2nm customers, drawn by Samsung’s competitive pricing. Reports suggest that Samsung is offering 2nm wafers for approximately $20,000, significantly undercutting TSMC’s reported $30,000 price tag. This aggressive pricing, combined with the logistical advantages of a U.S.-based fab, has forced TSMC to accelerate its own Arizona-based production timelines.

However, the competitive landscape remains fierce. While Samsung has the advantage of being the only firm with three generations of GAA experience, TSMC’s N2 node has already entered volume production with Apple as its lead customer. Apple has reportedly secured over 50% of TSMC’s initial 2nm capacity for its upcoming A20 and M6 chips. The market positioning is clear: TSMC remains the "premium" choice for established giants with massive budgets, while Samsung is positioning itself as the high-performance, cost-effective alternative for the next wave of AI hardware.

Wider Significance: Sovereign AI and the End of Moore’s Law

The 2nm race is a microcosm of the broader shift toward "Sovereign AI"—the desire for nations and corporations to control the physical infrastructure that powers their intelligence systems. Samsung’s success in Texas is a litmus test for the U.S. CHIPS Act and the feasibility of domestic high-end manufacturing. If Samsung can successfully scale the SF2 process in the United States, it will validate the multi-billion dollar subsidies provided by the federal government and provide a blueprint for other international firms like Intel (NASDAQ:INTC) to follow.

This milestone also highlights the increasing difficulty of maintaining Moore’s Law. As transistors shrink to the 2nm level, the physics of electron tunneling and heat dissipation become exponentially harder to manage. The shift to GAA and BSPDN are not just incremental updates; they are fundamental re-architecturings of the transistor itself. This transition mirrors the industry's move from planar to FinFET transistors a decade ago, but with much higher stakes. Any yield issues at this level can result in billions of dollars in lost revenue, making Samsung's relatively stable 2nm pilot production a major psychological victory for the company's foundry division.

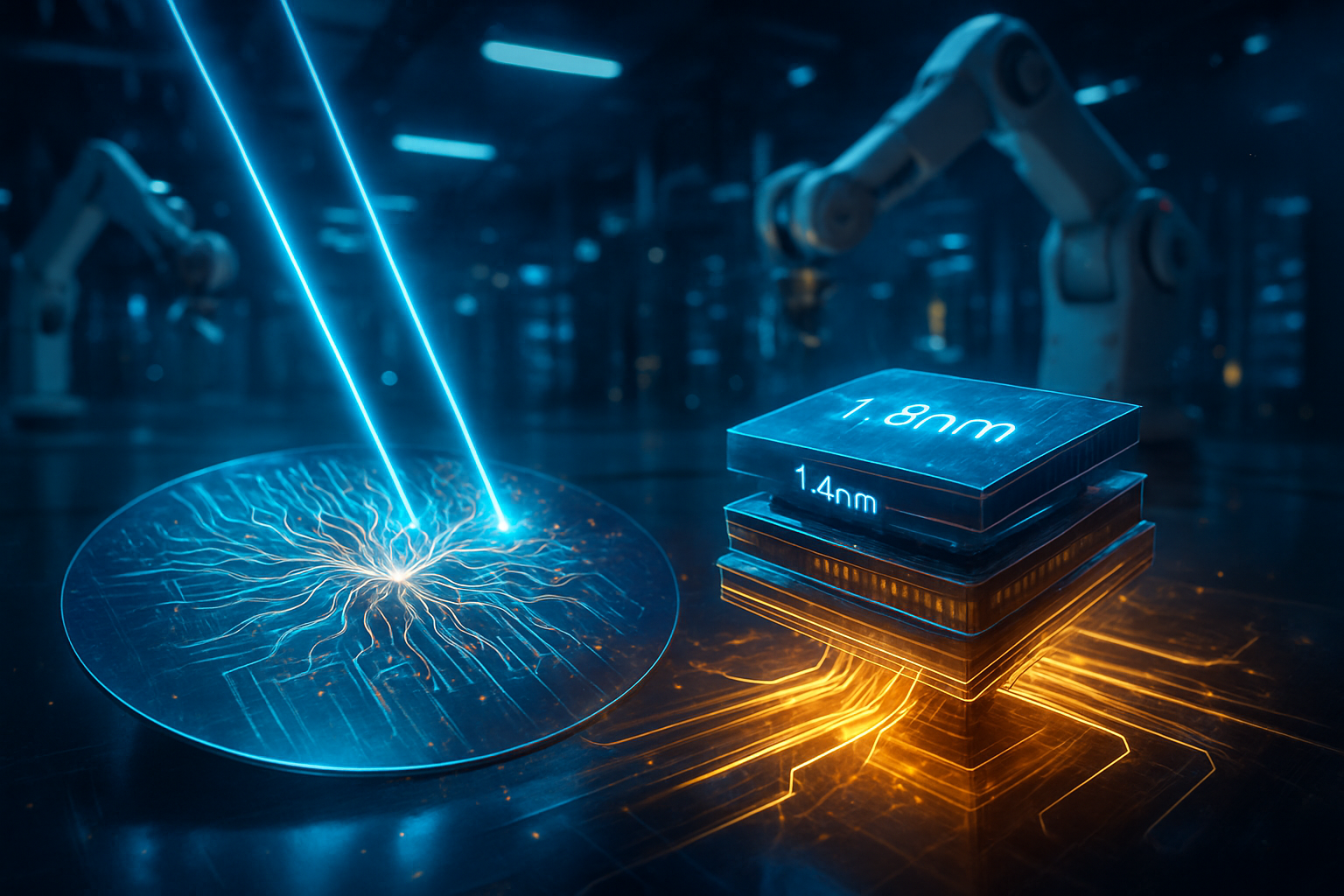

The Road to 1.4nm and Beyond

Looking ahead, the SF2 node is merely the first step in a long-term roadmap. Samsung has already begun detailing its SF2Z process for 2027, which will feature a fully optimized Backside Power Delivery Network to further boost density. Beyond that, the company is targeting 2028 for the mass production of its SF1.4 (1.4nm) node, which is expected to introduce "Vertical-GAA" structures to keep the scaling momentum alive.

In the near term, the focus will shift to the real-world performance of the Galaxy S26. If the Exynos 2600 can finally close the efficiency gap with Qualcomm’s Snapdragon series, it will restore consumer faith in Samsung’s in-house silicon. Furthermore, the industry is watching for the first "made in Texas" 2nm chips to roll off the line in late 2026. Challenges remain, particularly in scaling the Taylor fab’s capacity to 100,000 wafers per month while maintaining the high yields required for profitability.

Summary and Outlook

Samsung’s SF2 announcement marks a bold attempt to leapfrog the competition by leveraging its early lead in GAA technology and its strategic investment in U.S. manufacturing. With a 25% efficiency target and the power of the Exynos 2600, the company is making a compelling case for its 2nm ecosystem. The inclusion of early-stage backside power delivery and the securing of high-profile clients like Tesla suggest that Samsung is no longer content to play second fiddle to TSMC.

As we move through 2026, the success of this development will be measured by the market reception of the Galaxy S26 and the operational efficiency of the Taylor, Texas foundry. For the AI industry, this competition is a net positive, driving down costs and accelerating the hardware breakthroughs necessary for the next generation of intelligent machines. The coming weeks will be critical as early benchmarks for the Exynos 2600 begin to surface, providing the first definitive proof of whether Samsung has truly closed the gap.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.