In a move that has fundamentally reshaped the global semiconductor landscape, NVIDIA (NASDAQ: NVDA) has finalized a landmark $5 billion strategic investment in Intel (NASDAQ: INTC). Announced in late December 2025 and finalized as the industry enters 2026, the deal marks a "pragmatic armistice" between two historically fierce rivals. The investment, structured as a private placement of common stock, grants NVIDIA an approximate 5% ownership stake in Intel, but its true value lies in securing priority access to Intel’s advanced packaging facilities in the United States.

This strategic pivot is a direct response to the persistent "CoWoS bottleneck" at TSMC (NYSE: TSM), which has constrained the AI industry's growth for over two years. By tethering its future to Intel’s packaging prowess, NVIDIA is not only diversifying its supply chain but also spearheading a massive "reshoring" effort that aligns with U.S. national security interests. The partnership ensures that the world’s most powerful AI chips—the engines of the current technological revolution—will increasingly be "Packaged in America."

The Technical Pivot: Foveros and EMIB vs. CoWoS Scaling

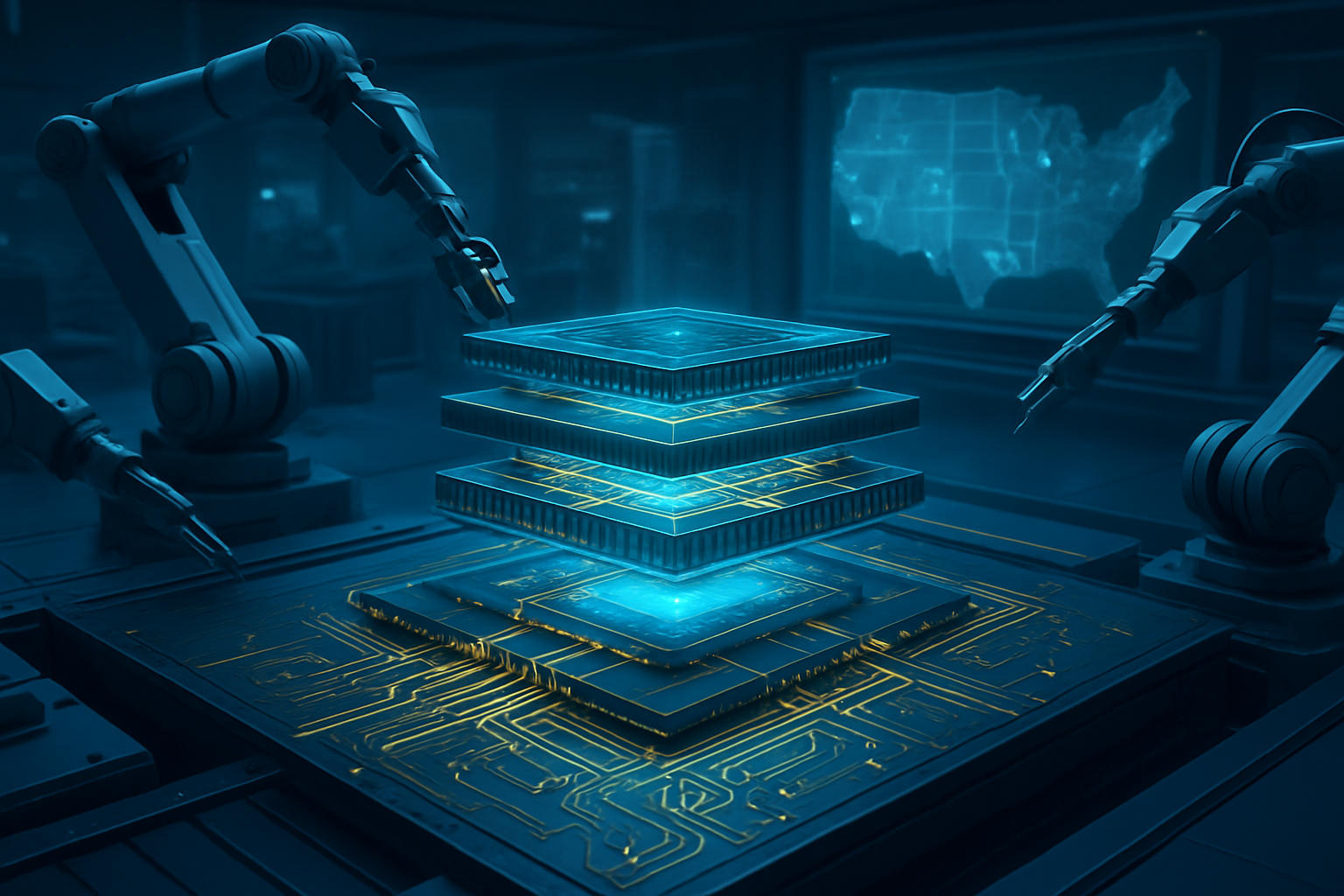

The heart of this partnership is a shift in how high-performance silicon is assembled. For years, NVIDIA relied almost exclusively on TSMC’s Chip-on-Wafer-on-Substrate (CoWoS) technology to bind its GPU dies with High Bandwidth Memory (HBM). However, as AI architectures like the Blackwell successor push the limits of thermal density and physical size, CoWoS has faced significant scaling challenges. Intel’s proprietary packaging technologies, Foveros and EMIB (Embedded Multi-die Interconnect Bridge), offer a compelling alternative that solves several of these "physical wall" problems.

Unlike CoWoS, which uses a large silicon interposer that can be expensive and difficult to manufacture at scale, Intel’s EMIB uses small silicon bridges embedded directly in the package substrate. This approach significantly improves thermal dissipation—a critical requirement for NVIDIA’s latest data center racks, which have struggled with the massive heat signatures of ultra-dense AI clusters. Furthermore, Intel’s Foveros technology allows for true 3D stacking, enabling NVIDIA to stack compute tiles vertically. This reduces the physical footprint of the chips and improves power efficiency, allowing for more "compute per square inch" than previously possible with traditional 2.5D methods.

Initial reactions from the semiconductor research community have been overwhelmingly positive. Analysts note that while TSMC remains the undisputed leader in wafer fabrication (the "printing" of the chips), Intel has spent a decade perfecting advanced packaging (the "assembly"). By splitting its production—using TSMC for 2nm wafers and Intel for the final assembly—NVIDIA is effectively "cherry-picking" the best technologies from both giants to maintain its lead in the AI hardware race.

Competitive Implications: A Lifeline for Intel Foundry

For Intel, this $5 billion infusion is more than just capital; it is a definitive validation of its IDM 2.0 (Intel Foundry) strategy. Under the leadership of CEO Pat Gelsinger and the recent operational "simplification" efforts, Intel has been desperate to prove that it can serve as a world-class foundry for external customers. Securing NVIDIA—the most valuable chipmaker in the world—as a flagship packaging customer is a massive blow to critics who doubted Intel’s ability to compete with Asian foundries.

The competitive landscape for AI labs and hyperscalers is also shifting. Companies like Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Meta (NASDAQ: META) are the primary beneficiaries of this deal, as it promises a more stable and scalable supply of AI hardware. By de-risking the supply chain, NVIDIA can provide more predictable delivery schedules for its upcoming "X-class" GPUs. Furthermore, the partnership has birthed a new category of hardware: the "Intel x86 RTX SOC." These hybrid chips, which fuse Intel’s high-performance CPU cores with NVIDIA’s GPU chiplets in a single package, are expected to dominate the workstation and high-end consumer markets by late 2026, potentially disrupting the traditional modular PC market.

Geopolitics and the Global Reshoring Boom

The NVIDIA-Intel alliance is perhaps the most significant milestone in the "Global Reshoring Boom." For decades, the semiconductor supply chain has been heavily concentrated in East Asia, creating a "single point of failure" that became a major geopolitical anxiety. This deal represents a decisive move toward "Silicon Sovereignty" for the United States. By utilizing Intel’s Fab 9 in Rio Rancho, New Mexico, and its massive Ocotillo complex in Arizona, NVIDIA is effectively insulating its most critical products from potential instability in the Taiwan Strait.

This move aligns perfectly with the objectives of the U.S. CHIPS and Science Act, which has funneled billions into domestic manufacturing. Industry experts are calling this the creation of a "Silicon Shield" that is geographical rather than just political. While NVIDIA continues to rely on TSMC for its most advanced 2nm nodes—where Intel’s 18A process still trails in yield consistency—the move to domestic packaging ensures that the most complex part of the manufacturing process happens on U.S. soil. This hybrid approach—"Global Wafers, Domestic Packaging"—is likely to become the blueprint for other tech giants looking to balance performance with geopolitical security.

The Horizon: 2026 and Beyond

Looking ahead, the roadmap for the NVIDIA-Intel partnership is ambitious. At CES 2026, the companies showcased prototypes of custom x86 server CPUs designed specifically to work in tandem with NVIDIA’s NVLink interconnects. These chips are expected to enter mass production in the second half of 2026. The integration of these two architectures at the packaging level will allow for CPU-to-GPU bandwidth that was previously unthinkable, potentially unlocking new capabilities in real-time large language model (LLM) training and complex scientific simulations.

However, challenges remain. Integrating two different design philosophies and proprietary interconnects is a monumental engineering task. There are also concerns about how this partnership will affect Intel’s own GPU ambitions and NVIDIA’s relationship with other ARM-based partners. Experts predict that the next two years will see a "packaging war," where the ability to stack and connect chips becomes just as important as the ability to shrink transistors. The success of this partnership will likely hinge on Intel’s ability to maintain high yields at its New Mexico and Arizona facilities as they scale to meet NVIDIA’s massive volume requirements.

Summary of a New Computing Era

The $5 billion partnership between NVIDIA and Intel marks the end of the "pure foundry" era and the beginning of a more complex, collaborative, and geographically distributed manufacturing model. Key takeaways from this development include:

- Supply Chain Security: NVIDIA has successfully hedged against TSMC capacity limits and geopolitical risks.

- Technical Superiority: The adoption of Foveros and EMIB solves critical thermal and scaling issues for next-gen AI hardware.

- Intel’s Resurgence: Intel Foundry has gained the ultimate "seal of approval," positioning itself as a vital pillar of the global AI economy.

As we move through 2026, the industry will be watching the production ramps in New Mexico and Arizona closely. If Intel can deliver on NVIDIA’s quality standards at scale, this "Silicon Superpower" alliance will likely define the hardware landscape for the remainder of the decade. The era of the "Mega-Package" has arrived, and for the first time in years, its heart is beating in the United States.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.