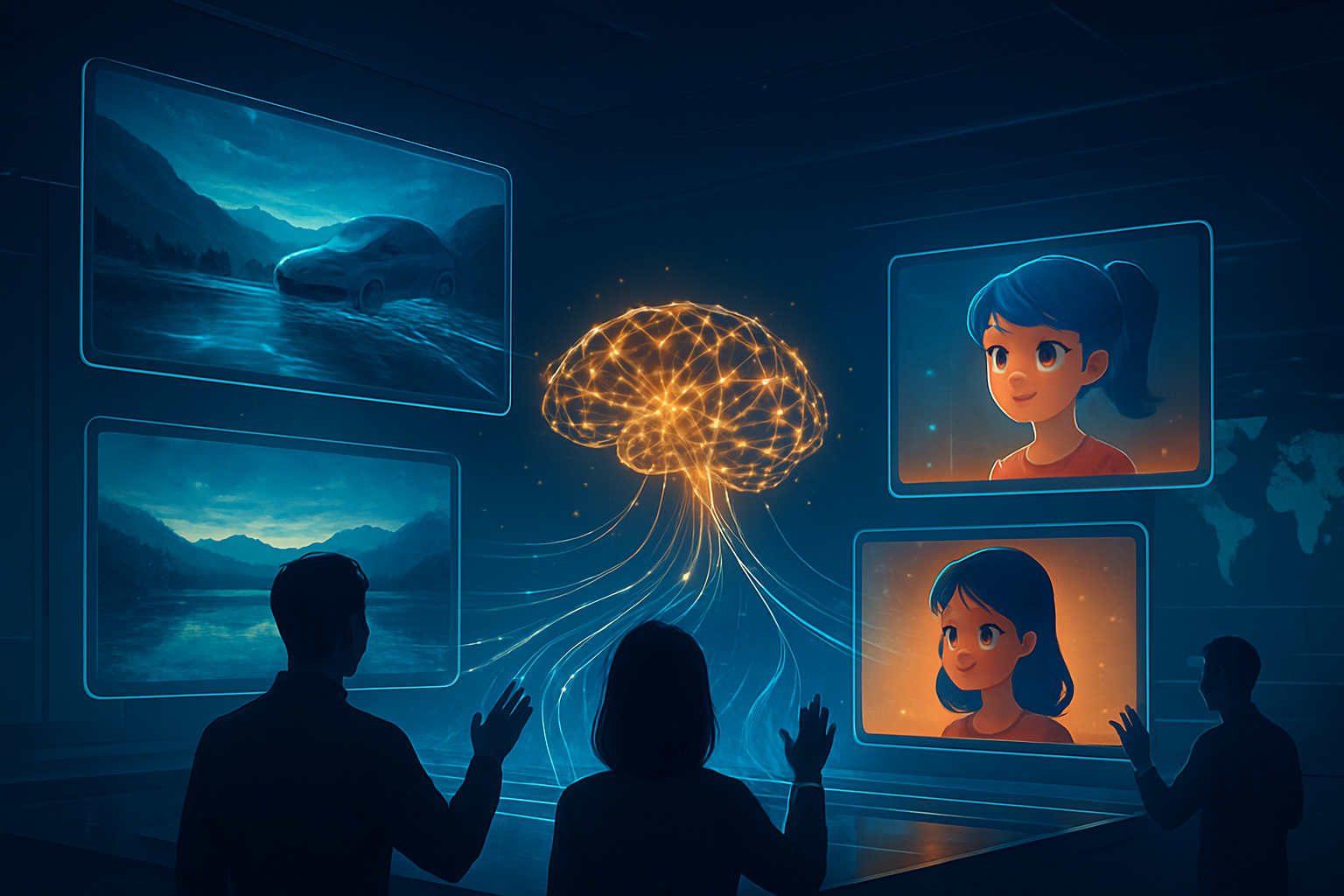

In a development that feels like it was plucked directly from the bridge of the Starship Enterprise, researchers at the MIT Center for Bits and Atoms (CBA) have unveiled a "Speech-to-Reality" system that allows users to verbally describe an object and watch as a robot builds it in real-time. Unveiled in late 2025 and gaining massive industry traction as we enter 2026, the system represents a fundamental shift in how humans interact with the physical world, moving the "generative AI" revolution from the screen into the physical workshop.

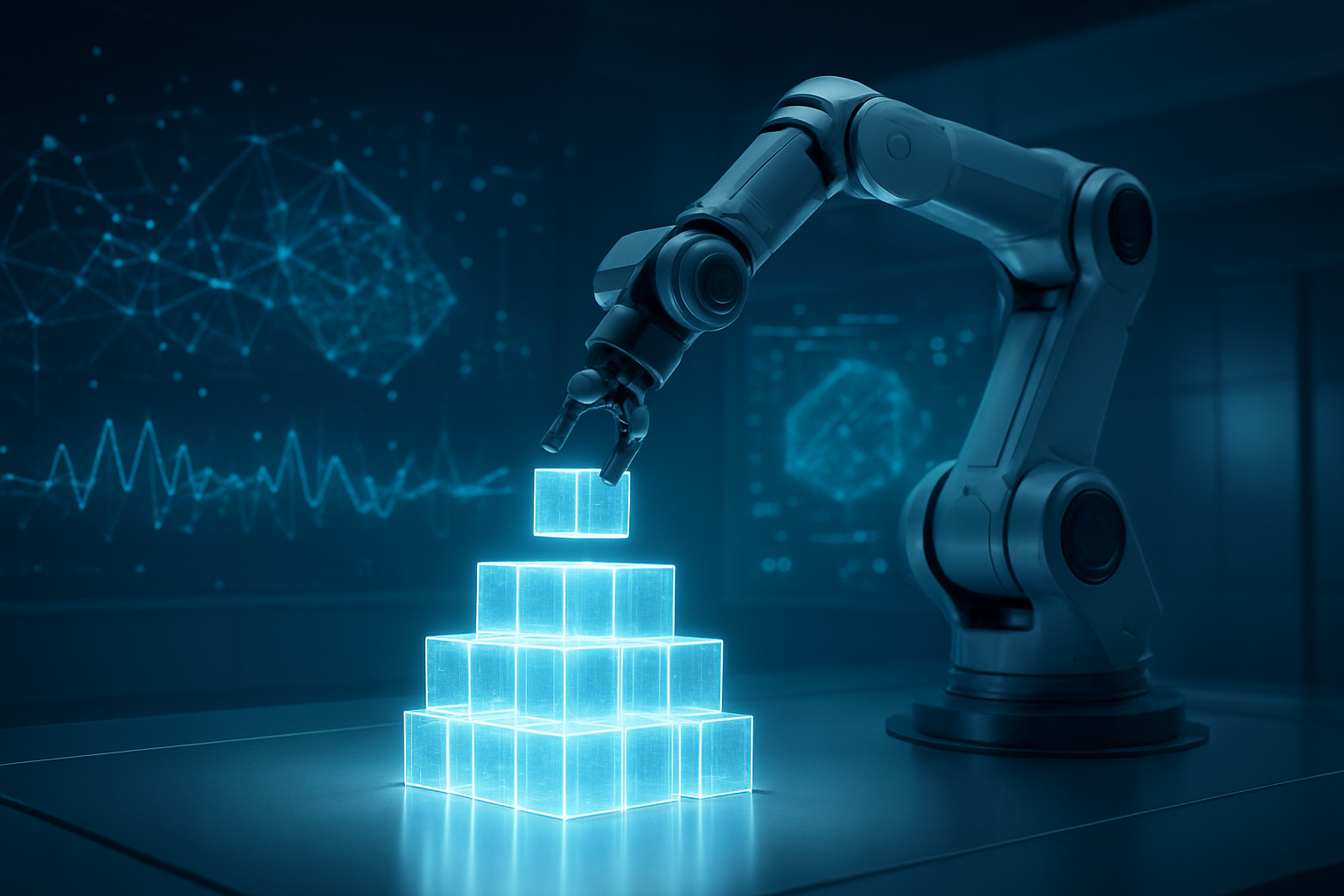

The breakthrough, led by graduate student Alexander Htet Kyaw and Professor Neil Gershenfeld, combines the reasoning capabilities of Large Language Models (LLMs) with 3D generative AI and discrete robotic assembly. By simply stating, "I need a three-legged stool with a circular seat," the system interprets the request, generates a structurally sound 3D model, and directs a robotic arm to assemble the piece from modular components—all in under five minutes. This "bits-to-atoms" pipeline effectively eliminates the need for complex Computer-Aided Design (CAD) software, democratizing manufacturing for anyone with a voice.

The Technical Architecture of Conversational Fabrication

The technical brilliance of the Speech-to-Reality system lies in its multi-stage computational pipeline, which translates abstract human intent into precise physical coordinates. The process begins with a natural language interface—powered by a custom implementation of OpenAI’s GPT-4 architecture—that parses the user's speech to extract design parameters and constraints. Unlike standard chatbots, this model acts as a "physics-aware" gatekeeper, validating whether a requested object is buildable or structurally stable before proceeding.

Once the intent is verified, the system utilizes a 3D generative model, such as Point-E or Shap-E, to create a digital mesh of the object. However, because raw 3D AI models often produce "hallucinated" geometries that are impossible to fabricate, the MIT team developed a proprietary voxelization algorithm. This software breaks the digital mesh into discrete, modular building blocks (voxels). Crucially, the system accounts for real-world constraints, such as the robot's available inventory of magnetic or interlocking cubes, and the physics of cantilevers to ensure the structure doesn't collapse during the build.

This approach differs significantly from traditional additive manufacturing, such as that championed by companies like Stratasys (NASDAQ: SSYS). While 3D printing creates monolithic objects over hours of slow deposition, MIT’s discrete assembly is nearly instantaneous. Initial reactions from the AI research community have been overwhelmingly positive, with experts at the ACM Symposium on Computational Fabrication (SCF '25) noting that the system’s ability to "think in blocks" allows for a level of speed and structural predictability that end-to-end neural networks have yet to achieve.

Industry Disruption: The Battle of Discrete vs. End-to-End AI

The emergence of Speech-to-Reality has set the stage for a strategic clash among tech giants and robotics startups. On one side are the "discrete assembly" proponents like MIT, who argue that building with modular parts is the fastest way to scale. On the other are companies like NVIDIA (NASDAQ: NVDA) and Figure AI, which are betting on "end-to-end" Vision-Language-Action (VLA) models. NVIDIA’s Project GR00T, for instance, focuses on teaching robots to handle any arbitrary object through massive simulation, a more flexible but computationally expensive approach.

For companies like Autodesk (NASDAQ: ADSK), the Speech-to-Reality breakthrough poses a fascinating challenge to the traditional CAD market. If a user can "speak" a design into existence, the barrier to entry for professional-grade engineering drops to near zero. Meanwhile, Tesla (NASDAQ: TSLA) is watching these developments closely as it iterates on its Optimus humanoid. Integrating a Speech-to-Reality workflow could allow Optimus units in "Giga-factories" to receive verbal instructions for custom jig assembly or emergency repairs, drastically reducing downtime.

The market positioning of this technology is clear: it is the "LLM for the physical world." Startups are already emerging to license the MIT voxelization algorithms, aiming to create "automated micro-factories" that can be deployed in remote areas or disaster zones. The competitive advantage here is not just speed, but the ability to bypass the specialized labor typically required to operate robotic manufacturing lines.

Wider Significance: Sustainability and the Circular Economy

Beyond the technical "cool factor," the Speech-to-Reality breakthrough has profound implications for the global sustainability movement. Because the system uses modular, interlocking voxels rather than solid plastic or metal, the objects it creates are inherently "circular." A stool built for a temporary event can be disassembled by the same robot five minutes later, and the blocks can be reused to build a shelf or a desk. This "reversible manufacturing" stands in stark contrast to the waste-heavy models of current consumerism.

This development also marks a milestone in the broader AI landscape, representing the successful integration of "World Models"—AI that understands the physical laws of gravity, friction, and stability. While previous AI milestones like AlphaGo or DALL-E 3 conquered the domains of logic and art, Speech-to-Reality is one of the first systems to master the "physics of making." It addresses the "Moravec’s Paradox" of AI: the realization that high-level reasoning is easy for computers, but low-level physical interaction is incredibly difficult.

However, the technology is not without its concerns. Critics have pointed out potential safety risks if the system is used to create unverified structural components for critical use. There are also questions regarding the intellectual property of "spoken" designs—if a user describes a chair that looks remarkably like a patented Herman Miller design, the legal framework for "voice-to-object" infringement remains entirely unwritten.

The Horizon: Mobile Robots and Room-Scale Construction

Looking forward, the MIT team and industry experts predict that the next logical step is the transition from stationary robotic arms to swarms of mobile robots. In the near term, we can expect to see "collaborative assembly" demonstrations where multiple small robots work together to build room-scale furniture or temporary architectural structures based on a single verbal prompt.

One of the most anticipated applications lies in space exploration. NASA and private space firms are reportedly interested in discrete assembly for lunar bases. Transporting raw materials is prohibitively expensive, but a "Speech-to-Reality" system equipped with a large supply of universal modular blocks could allow astronauts to "speak" their base infrastructure into existence, reconfiguring their environment as mission needs change. The primary challenge remaining is the miniaturization of the connectors and the expansion of the "voxel library" to include functional blocks like sensors, batteries, and light sources.

A New Chapter in Human-Machine Collaboration

The MIT Speech-to-Reality system is more than just a faster way to build a chair; it is a foundational shift in human agency. It marks the moment when the "digital-to-physical" barrier became porous, allowing the speed of human thought to be matched by the speed of robotic execution. In the history of AI, this will likely be remembered as the point where generative models finally "grew hands."

As we look toward the coming months, the focus will shift from the laboratory to the field. Watch for the first pilot programs in "on-demand retail," where customers might walk into a store, describe a product, and walk out with a physically assembled version of their imagination. The era of "Conversational Fabrication" has arrived, and the physical world may never be the same.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.