The transition to glass substrates is driven by the failure of organic materials (like ABF and BT resins) to cope with the extreme heat and structural demands of massive AI "superchips." Glass offers a Coefficient of Thermal Expansion (CTE) that closely matches that of silicon (3–7 ppm/°C), which drastically reduces the risk of warpage during the high-temperature manufacturing processes required for advanced 2nm and 1.4nm nodes. Furthermore, glass is an exceptional electrical insulator with significantly lower dielectric loss (Df) and a lower dielectric constant (Dk) than silicon-based interposers. This allows for signal speeds to double while cutting insertion loss in half—a critical requirement for the high-frequency data transfers essential for 5G, 6G, and ultra-fast AI training.

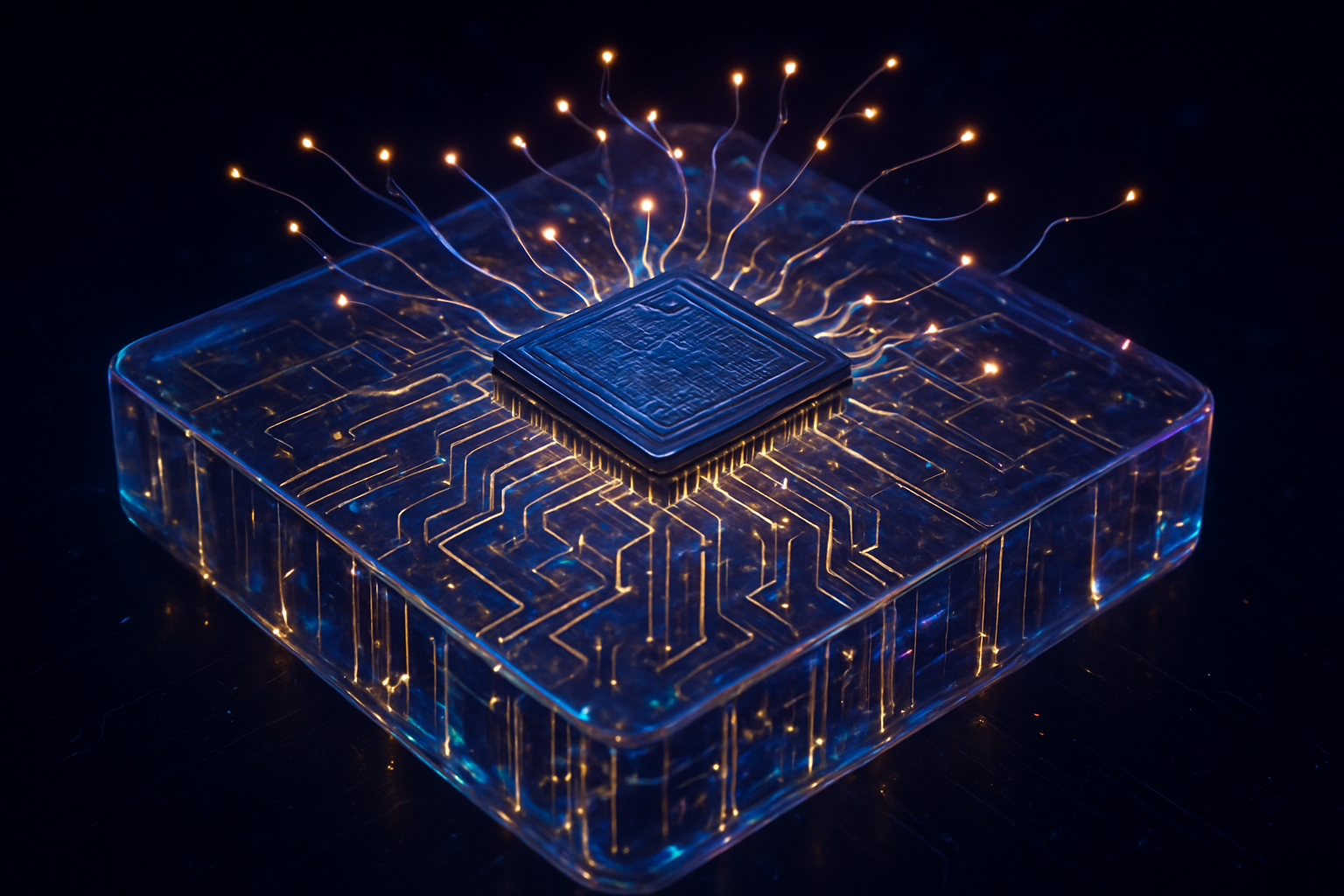

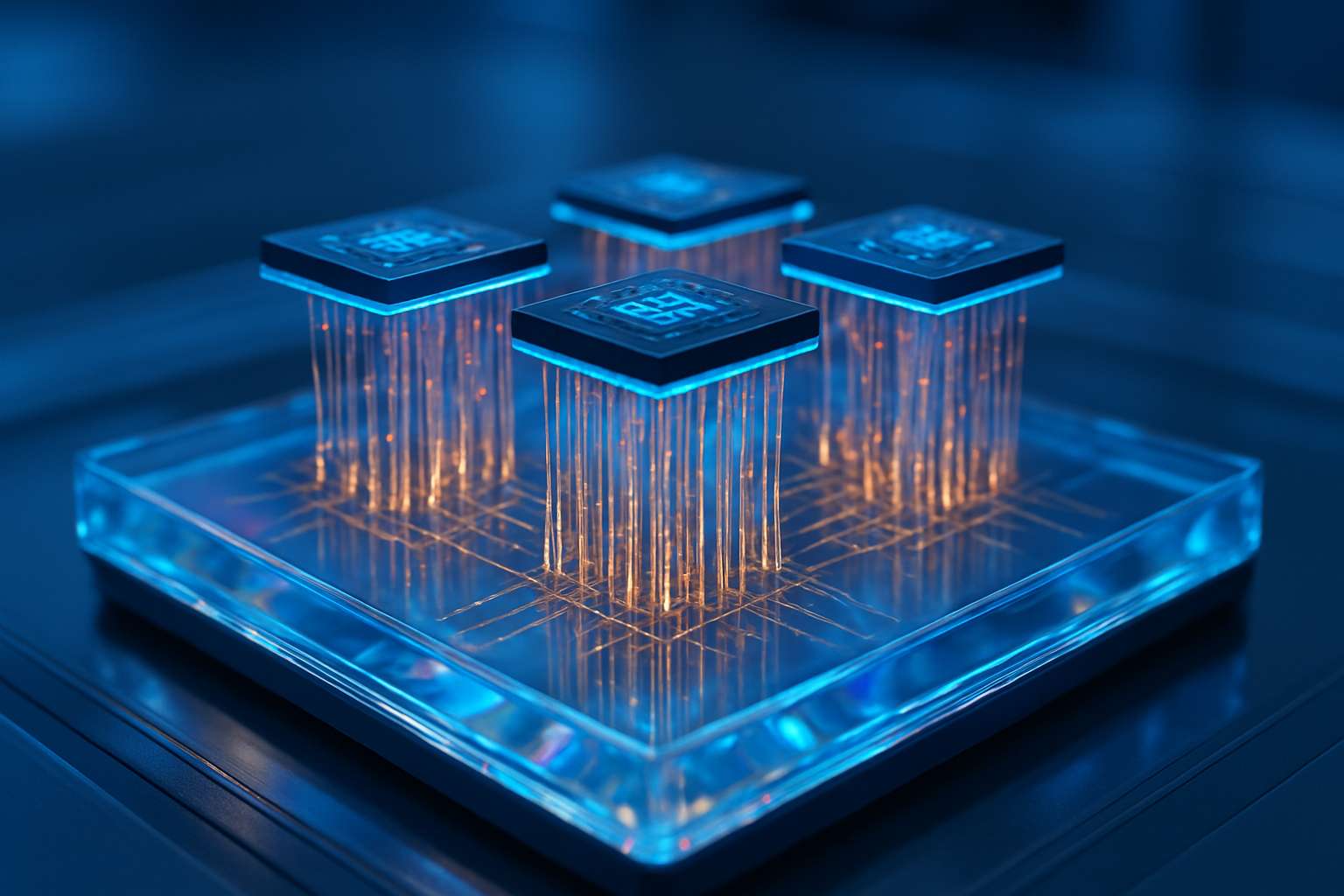

Technically, the "magic" of glass lies in Through-Glass Vias (TGVs). These microscopic vertical interconnects allow for a 10-fold increase in interconnect density compared to traditional organic substrates. This density enables thousands of Input/Output (I/O) bumps, allowing multiple chiplets—CPUs, GPUs, and High Bandwidth Memory (HBM)—to be packed closer together with minimal latency. At SEMICON Japan in December 2025, Rapidus demonstrated the sheer scale of this potential by unveiling a 600mm x 600mm glass panel-level packaging (PLP) prototype. Unlike traditional 300mm round silicon wafers, these massive square panels can yield up to 10 times more interposers, significantly reducing material waste and enabling the creation of "monster" packages that can house up to 24 HBM4 dies alongside a multi-tile GPU.

Market Dynamics: A High-Stakes Race for Dominance

Intel is currently the undisputed leader in the "Glass War," having invested over a decade of R&D into the technology. The company's Arizona-based pilot line is already operational, and Intel is on track to integrate glass substrates into its high-volume manufacturing (HVM) roadmap by late 2026. This head start provides Intel with a significant strategic advantage, potentially allowing them to reclaim the lead in the foundry business by offering packaging capabilities that Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) is not expected to match at scale until 2028 or 2029 with its "CoPoS" (Chip-on-Panel-on-Substrate) initiative.

However, the competition is intensifying rapidly. Samsung Electronics (KRX: 005930) has fast-tracked its glass substrate development, leveraging its existing expertise in large-scale glass manufacturing from its display division. Samsung is currently building a pilot line at its Sejong facility and aims for a 2026-2027 rollout, potentially positioning itself as a primary alternative for AI giants like NVIDIA and Advanced Micro Devices (NASDAQ: AMD) who are desperate to diversify their supply chains away from a single source. Meanwhile, the emergence of Rapidus as a serious contender with its panel-level prototype suggests that the Japanese semiconductor ecosystem is successfully leveraging its legacy in LCD technology to leapfrog current packaging constraints.

Redefining the AI Landscape and Moore’s Law

The wider significance of glass substrates lies in their role as the "enabling platform" for the post-Moore's Law era. As it becomes increasingly difficult to shrink transistors further, the industry has turned to heterogeneous integration—stacking and stitching different chips together. Glass substrates provide the structural integrity needed to build these massive 3D structures. Intel’s stated goal of reaching 1 trillion transistors on a single package by 2030 is virtually impossible without the flatness and thermal stability provided by glass.

This development also addresses the critical "power wall" in AI data centers. The extreme flatness of glass allows for more reliable implementation of Backside Power Delivery (such as Intel’s PowerVia technology) at the package level. This reduces power noise and improves overall energy efficiency by an estimated 15% to 20%. In an era where AI power consumption is a primary concern for hyperscalers and environmental regulators alike, the efficiency gains from glass substrates could be just as important as the performance gains.

The Road to 2026 and Beyond

Looking ahead, the next 12 to 18 months will be focused on solving the remaining engineering hurdles of glass: namely, fragility and handling. While glass is structurally superior once assembled, it is notoriously difficult to handle in a high-speed factory environment without cracking. Companies like Rapidus are working closely with equipment manufacturers to develop specialized "glass-safe" robotic handling systems and laser-drilling techniques for TGVs. If these challenges are met, the shift to 600mm square panels could drop the cost of manufacturing massive AI interposers by as much as 40% by 2027.

In the near term, expect to see the first commercial glass-packaged chips appearing in high-end server environments. These will likely be specialized AI accelerators or high-end Xeon processors designed for the most demanding scientific computing tasks. As the ecosystem matures, we can anticipate the technology trickling down to consumer-grade high-end gaming GPUs and workstations, where thermal management is a constant struggle. The ultimate goal is a fully standardized glass-based ecosystem that allows for "plug-and-play" chiplet integration from various vendors.

Conclusion: A New Foundation for Computing

The move to glass substrates marks the beginning of a new chapter in semiconductor history. It is a transition that validates the industry's shift from "system-on-chip" to "system-in-package." By solving the thermal and density bottlenecks that have plagued organic substrates, Intel and Rapidus are paving the way for a new generation of AI hardware that was previously thought to be physically impossible.

As we move into 2026, the industry will be watching closely to see if Intel can successfully execute its high-volume rollout and if Rapidus can translate its impressive prototype into a viable manufacturing reality. The stakes are immense; the winner of the glass substrate race will likely hold the keys to the world's most powerful AI systems for the next decade. For now, the "Glass War" is just beginning, and it promises to be the most consequential battle in the tech industry's ongoing evolution.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.