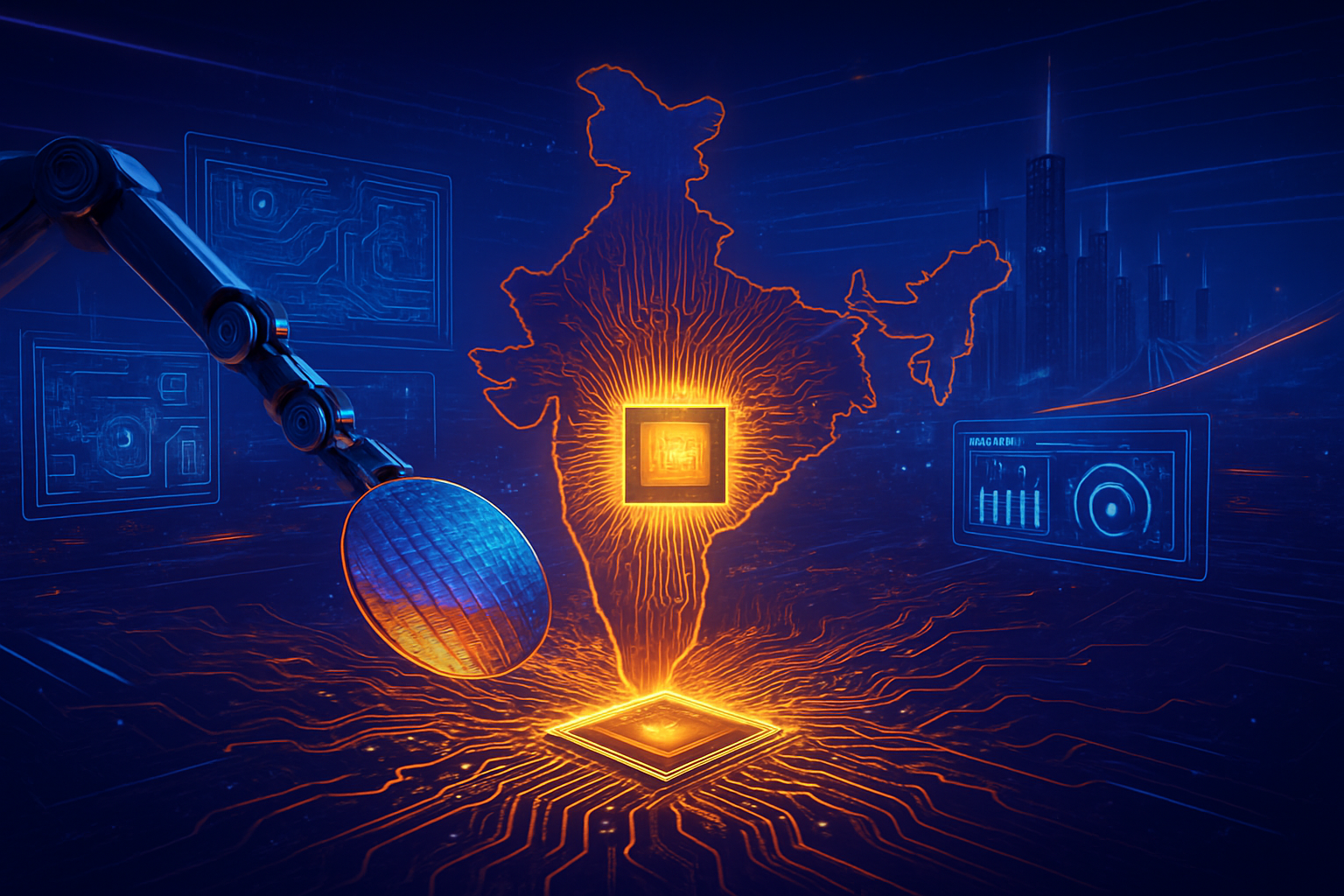

As of January 26, 2026, the global semiconductor landscape has undergone a tectonic shift. What was once a policy-driven ambition for the Indian subcontinent has transformed into a tangible, high-output reality. At the center of this transformation is a pivotal partnership between Tata Electronics and ROHM Co., Ltd. (TYO: 6963), a Japanese pioneer in power and analog semiconductors. This alliance, focusing on the production of automotive-grade power MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors), marks a critical milestone in India’s bid to offer a robust, democratic alternative to China’s long-standing dominance in mature-node manufacturing.

The significance of this development extends far beyond simple hardware assembly. By localizing the production of high-current power management components, India is securing the physical backbone required for the next generation of AI-driven mobility and industrial automation. As the "China+1" strategy matures into a standard operating procedure for Western tech giants, the Tata-ROHM partnership stands as the first major proof of concept for India’s Semiconductor Mission (ISM) 2.0, successfully bridging the gap between design expertise and high-volume fabrication.

Technical Prowess: Powering the Edge AI Revolution

The technical centerpiece of the Tata-ROHM collaboration is the commercial rollout of an automotive-grade N-channel silicon MOSFET, specifically engineered for the rigorous demands of electric vehicles (EVs) and smart energy systems. Boasting a voltage rating of 100V and a current capacity of 300A, these chips utilize a TOLL (Transistor Outline Leadless) package. This modern surface-mount design is critical for high power density, offering superior thermal efficiency and lower parasitic inductance compared to traditional packaging. In the context of early 2026, where "Edge AI" in vehicles requires massive real-time processing, these power chips ensure that the high-current demands of onboard Neural Processing Units (NPUs) are met without compromising vehicle range or safety.

This development is inextricably linked to the progress of India’s first mega-fab in Dholera, Gujarat—a $11 billion joint venture between Tata and Powerchip Semiconductor Manufacturing Corp (PSMC). As of this month, the Dholera facility has successfully completed high-volume trial runs using 300mm (12-inch) wafers. While the industry’s "bleeding edge" focuses on sub-5nm nodes, Tata’s strategic focus on the 28nm, 40nm, and 90nm "workhorse" nodes is a calculated move. These nodes are the essential foundations for Power Management ICs (PMICs), display drivers, and microcontrollers. Initial reactions from the industry have been overwhelmingly positive, with experts noting that India has bypassed the "learning curve" typically associated with greenfield fabs by integrating ROHM's established design IP directly into Tata’s manufacturing workflow.

Market Impact: Navigating the 'China+1' Paradigm

The market implications of this partnership are profound, particularly for the automotive and AI hardware sectors. Tata Motors (NSE: TATAMOTORS) and other global OEMs stand to benefit immensely from a shortened, more resilient supply chain that bypasses the geopolitical volatility associated with East Asian hubs. By establishing a reliable source of AEC-Q101 qualified semiconductors on Indian soil, the partnership offers a strategic hedge against potential sanctions or trade disruptions involving Chinese manufacturers like BYD (HKG: 1211).

Furthermore, the involvement of Micron Technology (NASDAQ: MU)—whose Sanand facility reached full-scale commercial production in February 2026—and CG Power & Industrial Solutions (NSE: CGPOWER) creates a synergistic cluster. This ecosystem allows for "full-stack" manufacturing, where memory modules from Micron can be paired with power management chips from Tata-ROHM and logic chips from the Dholera fab. This vertical integration provides India with a unique competitive edge in the mid-range semiconductor market, which currently accounts for roughly 75% of global chip volume. Tech giants looking to diversify their hardware sourcing now view India not just as a consumer market, but as a critical export hub for the global AI and EV supply chains.

The Geopolitical and AI Landscape: Beyond the Silicon

The rise of the Tata-ROHM alliance must be viewed through the lens of the U.S.-India TRUST (Transforming the Relationship Utilizing Strategic Technology) initiative. This framework has paved the way for India to join the "Pax Silica" alliance, a group of nations committed to securing "trusted" silicon supply chains. For the global AI community, this means that the hardware required for "Sovereign AI"—data centers and AI-enabled infrastructure built within national borders—now has a secondary, reliable point of origin.

In the data center space, the demand for Silicon Carbide (SiC) and Gallium Nitride (GaN) is exploding. These "Wide-Bandgap" materials are essential for the high-efficiency power units required by massive AI server racks featuring NVIDIA (NASDAQ: NVDA) Blackwell-architecture chips. The Tata-ROHM roadmap already signals a transition to SiC wafer production by 2027. By addressing the thermal and power density challenges of AI infrastructure, India is positioning itself as an indispensable partner in the global race for AI supremacy, ensuring that the energy-hungry demands of large language models (LLMs) are met by more efficient, locally-produced hardware.

Future Horizons: From 28nm to the Bleeding Edge

Looking ahead, the next 24 to 36 months will be decisive. Near-term expectations include the first commercial shipment of "Made in India" silicon from the Dholera fab by December 2026. However, the roadmap doesn't end at 28nm. Plans are already in motion for "Fab 2," which aims to target 14nm and eventually 7nm nodes to cater to the smartphone and high-performance computing (HPC) markets. The integration of advanced lithography systems from ASML (NASDAQ: ASML) into Indian facilities suggests that the technological ceiling is rapidly rising.

The challenges remain significant: maintaining a consistent power supply, managing the high water-usage requirements of fabs, and scaling the specialized workforce. However, the Gujarat government's rapid infrastructure build-out—including thousands of residential units for semiconductor staff—demonstrates a level of political will rarely seen in industrial history. Analysts predict that by 2030, India could command a 10% share of the global semiconductor market, effectively neutralizing the risk of a single-point failure in the global electronics supply chain.

A New Era for Global Manufacturing

In summary, the partnership between Tata Electronics and ROHM is more than a corporate agreement; it is the cornerstone of a new global order in technology manufacturing. It signifies India's successful transition from a software-led economy to a hardware powerhouse capable of producing the most complex components of the modern age. The key takeaway for investors and industry leaders is clear: the semiconductor center of gravity is shifting.

As we move deeper into 2026, the success of the Tata-ROHM venture will serve as a bellwether for India’s long-term semiconductor goals. The convergence of AI infrastructure needs, automotive electrification, and geopolitical realignments has created a "perfect storm" that India is now uniquely positioned to navigate. For the global tech industry, the emergence of this Indian silicon shield provides a much-needed layer of resilience in an increasingly uncertain world.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.