As of January 26, 2026, the semiconductor landscape has reached a historic inflection point that many industry veterans once thought impossible. Intel Corp (NASDAQ:INTC) has officially entered high-volume manufacturing (HVM) for its 18A (1.8nm) process node, successfully completing its ambitious "five nodes in four years" roadmap. This milestone marks the first time in over a decade that the American chipmaker has successfully wrested the technical innovation lead away from its rivals, positioning itself as a dominant force in the high-stakes world of AI silicon and foundry services.

The significance of 18A extends far beyond a simple increase in transistor density. It represents a fundamental architectural shift in how microchips are built, introducing two "holy grail" technologies: RibbonFET and PowerVia. By being the first to bring these advancements to the mass market, Intel has secured multi-billion dollar manufacturing contracts from tech giants like Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN), signaling a major shift in the global supply chain. For the first time in the 2020s, the "Intel Foundry" vision is not just a strategic plan—it is a tangible reality that is forcing competitors to rethink their multi-year strategies.

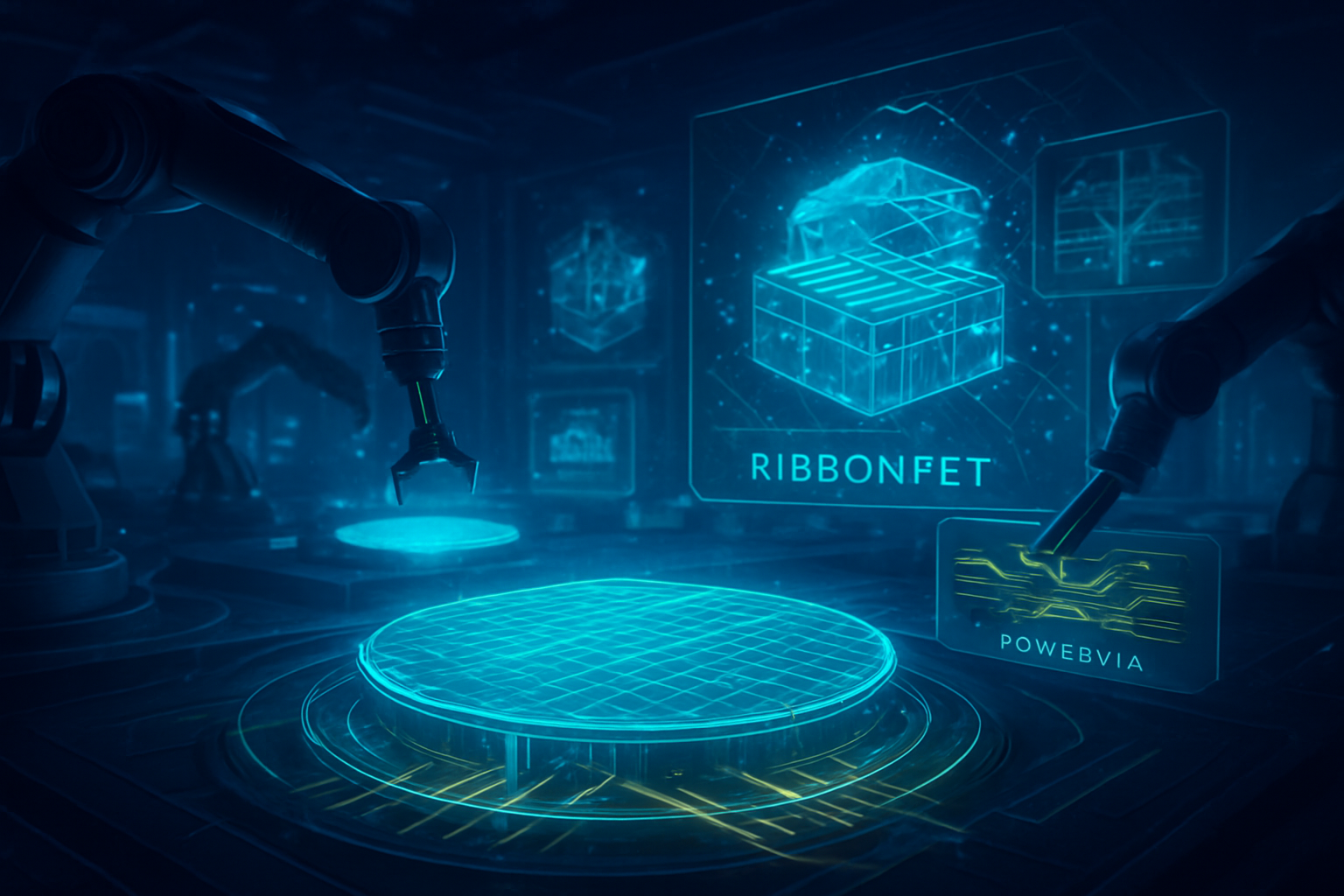

The Technical Edge: RibbonFET and the PowerVia Revolution

At the heart of the 18A node are two breakthrough technologies that redefine chip performance. The first is RibbonFET, Intel’s implementation of a Gate-All-Around (GAA) transistor. Unlike the older FinFET architecture, which dominated the industry for years, RibbonFET surrounds the transistor channel on all four sides. This allows for significantly higher drive currents and vastly improved leakage control, which is essential as transistors approach the atomic scale. While Samsung Electronics (KRX:005930) was technically first to GAA at 3nm, Intel’s 18A implementation in early 2026 is being praised by the research community for its superior scalability and yield stability, currently estimated between 60% and 75%.

However, the true "secret sauce" of 18A is PowerVia, Intel’s proprietary version of backside power delivery. Traditionally, power and data signals have shared the same "front" side of a wafer, leading to a crowded "wiring forest" that causes electrical interference and voltage droop. PowerVia moves the power delivery network to the back of the wafer, using "Nano-TSVs" (Through-Silicon Vias) to tunnel power directly to the transistors. This decoupling of power and data lines has led to a documented 30% reduction in voltage droop and a 6% boost in clock frequencies at the same power level. Initial reactions from industry experts at TechInsights suggest that this architectural shift gives Intel a definitive "performance-per-watt" advantage over current 2nm offerings from competitors.

This technical lead is particularly evident when comparing 18A to the current offerings from Taiwan Semiconductor Manufacturing Company (NYSE:TSM). While TSMC’s N2 (2nm) node is currently in high-volume production and holds a slight lead in raw transistor density (roughly 313 million transistors per square millimeter compared to Intel’s 238 million), it lacks backside power delivery. TSMC’s equivalent technology, "Super PowerRail," is not slated for volume production until the second half of 2026 with its A16 node. This window of exclusivity allows Intel to market itself as the most efficient option for the power-hungry demands of generative AI and hyperscale data centers for the duration of early 2026.

A New Era for Intel Foundry Services

The success of the 18A node has fundamentally altered the competitive dynamics of the foundry market. Intel Foundry Services (IFS) has secured a massive $15 billion contract from Microsoft to produce custom AI accelerators, a move that would have been unthinkable five years ago. Furthermore, Amazon’s AWS has deepened its partnership with Intel, utilizing 18A for its next-generation Xeon 6 fabric silicon. Even Apple (NASDAQ:AAPL), which has long been the crown jewel of TSMC’s client list, has reportedly signed on for the performance-enhanced 18A-P variant to manufacture entry-level M-series chips for its 2027 device lineup.

The strategic advantage for these tech giants is twofold: performance and geopolitical resilience. By utilizing Intel’s domestic manufacturing sites, such as Fab 52 in Arizona and the modernized facilities in Oregon, US-based companies are mitigating the risks associated with the concentrated supply chain in East Asia. This has been bolstered by the U.S. government’s $3 billion "Secure Enclave" contract, which tasks Intel with producing the next generation of sensitive defense and intelligence chips. The availability of 18A has transformed Intel from a struggling integrated device manufacturer into a critical national asset and a viable alternative to the TSMC monopoly.

The competitive pressure is also being felt by NVIDIA (NASDAQ:NVDA). While the AI GPU leader continues to rely on TSMC for its flagship H-series and B-series chips, it has invested $5 billion into Intel’s advanced packaging ecosystem, specifically Foveros and EMIB. Experts believe this is a precursor to NVIDIA moving some of its mid-range production to Intel 18A by late 2026 to ensure supply chain diversity. This market positioning has allowed Intel to maintain a premium pricing strategy for 18A wafers, even as it works to improve the "golden yield" threshold toward 80%.

Wider Significance: The Geopolitics of Silicon

The 18A milestone is a significant chapter in the broader history of computing, marking the end of the "efficiency plateau" that plagued the industry in the early 2020s. As AI models grow exponentially in complexity, the demand for energy-efficient silicon has become the primary constraint on global AI progress. By successfully implementing backside power delivery before its peers, Intel has effectively moved the goalposts for what is possible in data center density. This achievement fits into a broader trend of "Angstrom-era" computing, where breakthroughs are no longer just about smaller transistors, but about smarter ways to power and cool them.

From a global perspective, the success of 18A represents a major victory for the U.S. CHIPS Act and Western efforts to re-shore semiconductor manufacturing. For the first time in two decades, a leading-edge process node is being ramped in the United States concurrently with, or ahead of, its Asian counterparts. This has significant implications for global stability, reducing the world's reliance on the Taiwan Strait for the highest-performance silicon. However, this shift has also sparked concerns regarding the immense energy and water requirements of these new "Angstrom-scale" fabs, prompting calls for more sustainable manufacturing practices in the desert regions of the American Southwest.

Comparatively, the 18A breakthrough is being viewed as similar in impact to the introduction of High-K Metal Gate in 2007 or the transition to FinFET in 2011. It is a fundamental change in the "physics of the chip" that will dictate the design rules for the next decade. While TSMC remains the yield and volume king, Intel’s 18A has shattered the aura of invincibility that surrounded the Taiwanese firm, proving that a legacy giant can indeed pivot and innovate under the right leadership—currently led by CEO Lip-Bu Tan.

Future Horizons: Toward 14A and High-NA EUV

Looking ahead, the road doesn't end at 18A. Intel is already aggressively pivoting its R&D teams toward the 14A (1.4nm) node, which is scheduled for risk production in late 2027. This next step will be the first to fully utilize "High-NA" (High Numerical Aperture) Extreme Ultraviolet (EUV) lithography. These massive, $380 million machines from ASML are already being calibrated in Intel’s Oregon facilities. The 14A node is expected to offer a further 15% performance-per-watt improvement and will likely see the first implementation of stacked transistors (CFETs) toward the end of the decade.

The immediate next step for 18A is the retail launch of "Panther Lake," the Core Ultra Series 3 processors, which hit global shelves tomorrow, January 27, 2026. These chips will be the first 18A products available to consumers, featuring a dedicated NPU (Neural Processing Unit) capable of 100+ TOPS (Trillions of Operations Per Second), setting a new bar for AI PCs. Challenges remain, however, particularly in the scaling of advanced packaging. As chips become more complex, the "bottleneck" is shifting from the transistor to the way these tiny tiles are bonded together. Intel will need to significantly expand its packaging capacity in New Mexico and Malaysia to meet the projected 18A demand.

A Comprehensive Wrap-Up: The New Leader?

The arrival of Intel 18A in high-volume manufacturing is a watershed moment for the technology industry. By successfully delivering PowerVia and RibbonFET ahead of the competition, Intel has reclaimed its seat at the table of technical leadership. While the company still faces financial volatility—highlighted by recent stock fluctuations following conservative Q1 2026 guidance—the underlying engineering success of 18A provides a solid foundation that was missing for nearly a decade.

The key takeaway for 2026 is that the semiconductor race is no longer a one-horse race. The rivalry between Intel, TSMC, and Samsung has entered its most competitive phase yet, with each player holding a different piece of the puzzle: TSMC with its unmatched yields and density, Samsung with its GAA experience, and Intel with its first-mover advantage in backside power. In the coming months, all eyes will be on the retail performance of Panther Lake and the first benchmarks of the 18A-based Xeon "Clearwater Forest" server chips. If these products meet their ambitious performance targets, the "Process Leadership Crown" may stay in Santa Clara for a very long time.

This content is intended for informational purposes only and represents analysis of current AI and semiconductor developments as of January 26, 2026.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.