As we enter the first weeks of 2026, the global semiconductor industry has officially crossed the threshold into the "Angstrom Era." While 2nm production (N2) is currently ramping up in Taiwan and the United States, the strategic focus of the world's most powerful foundries has already shifted toward the 1.4nm node. This milestone, designated as A14 by TSMC and 14A by Intel, represents a final frontier for traditional silicon-based computing, where the laws of classical physics begin to collapse and are replaced by the complex realities of quantum mechanics.

The immediate significance of the 1.4nm roadmap cannot be overstated. As artificial intelligence models scale toward quadrillions of parameters, the hardware required to train and run them is hitting a "thermal and power wall." The 1.4nm node is being engineered as the antidote to this crisis, promising to deliver a 20-30% reduction in power consumption and a nearly 1.3x increase in transistor density compared to the 2nm nodes currently entering the market. For the giants of the AI industry, this roadmap is not just a technical benchmark—it is the lifeline that will allow the next generation of generative AI to exist.

The Physics of the Sub-2nm Frontier: High-NA EUV and BSPDN

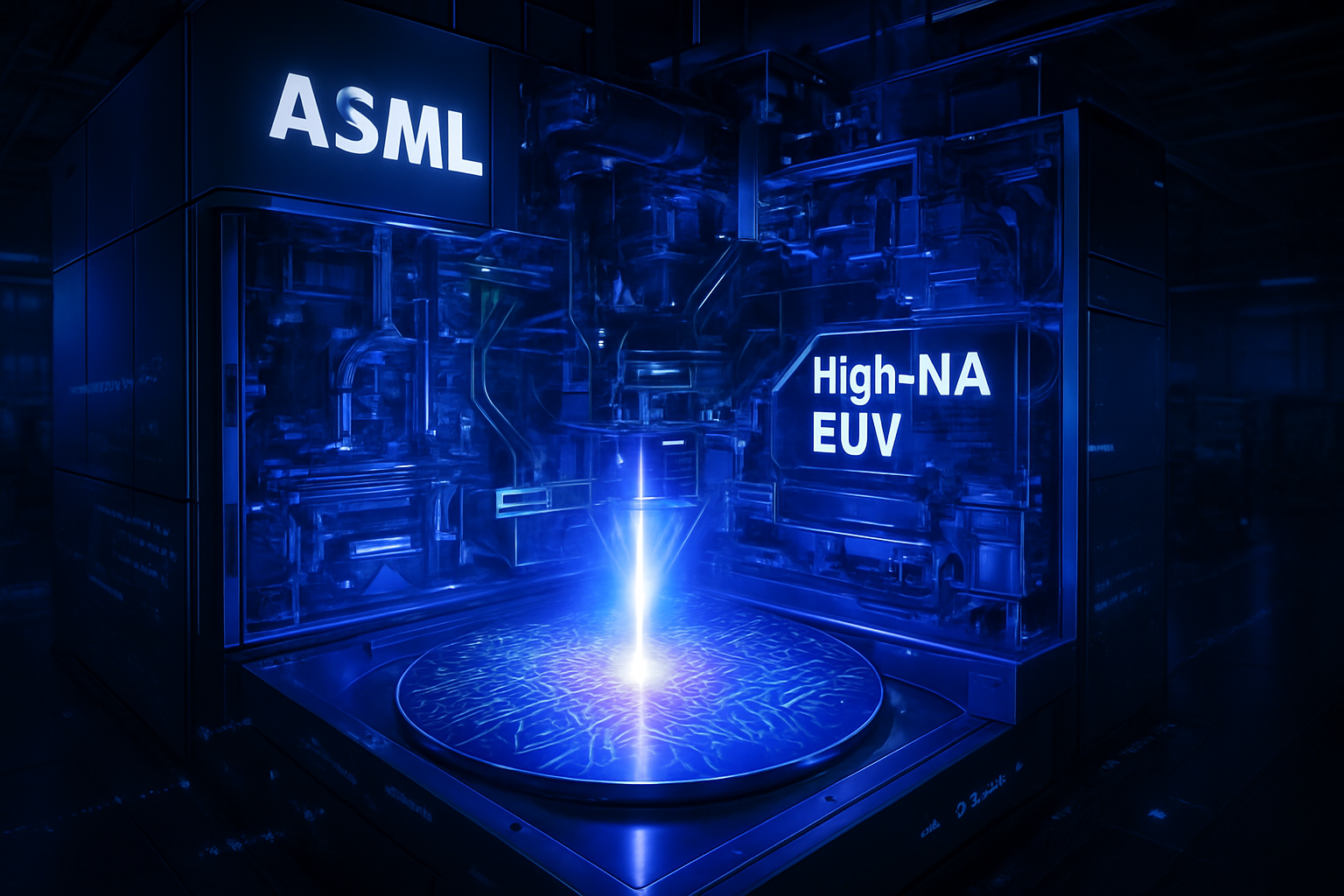

At the heart of the 1.4nm breakthrough are three transformative technologies: High-NA Extreme Ultraviolet (EUV) lithography, Backside Power Delivery (BSPDN), and second-generation Gate-All-Around (GAA) transistors. Intel (NASDAQ: INTC) has taken an aggressive lead in the adoption of High-NA EUV, having already installed the industry’s first ASML (NASDAQ: ASML) TWINSCAN EXE:5200 scanners. These $380 million machines use a higher numerical aperture (0.55 NA) to print features with 1.7x more precision than previous generations, potentially allowing Intel to print 1.4nm features in a single pass rather than through complex, yield-killing multi-patterning steps.

While Intel is betting on expensive hardware, TSMC (NYSE: TSM) has taken a more conservative "cost-first" approach for its initial A14 node. TSMC’s engineers plan to push existing Low-NA (0.33 NA) EUV machines to their absolute limits using advanced multi-patterning before transitioning to High-NA for their enhanced A14P node in 2028. This divergence in strategy has sparked a fierce debate among industry experts: Intel is prioritizing technical supremacy and process simplification, while TSMC is betting that its refined manufacturing recipes can deliver 1.4nm performance at a lower cost-per-wafer, which is currently estimated to exceed $45,000 for these advanced nodes.

Perhaps the most radical shift in the 1.4nm era is the implementation of Backside Power Delivery. For decades, power and signal wires were crammed onto the front of the chip, leading to "IR drop" (voltage sag) and signal interference. Intel’s "PowerDirect" and TSMC’s "Super Power Rail" move the power delivery network to the bottom of the silicon wafer. This decoupling allows for nearly 90% cell utilization, solving the wiring congestion that has haunted chip designers for a decade. However, this comes with extreme thermal challenges; by stacking power and logic so closely, the "Self-Heating Effect" (SHE) can cause transistors to degrade prematurely if not mitigated by groundbreaking liquid-to-chip cooling solutions.

Geopolitical Maneuvering and the Foundry Supremacy War

The 1.4nm race is also a battle for the soul of the foundry market. Intel’s "Five Nodes in Four Years" strategy has culminated in the 18A node, and the company is now positioning 14A as its "comeback node" to reclaim the crown it lost a decade ago. Intel is opening its 14A Process Design Kits (PDKs) to external customers earlier than ever, specifically targeting major AI lab spinoffs and hyperscalers. By leveraging the U.S. CHIPS Act to build "Giga-fabs" in Ohio and Arizona, Intel is marketing 14A as the only secure, Western-based supply chain for Angstrom-level AI silicon.

TSMC, however, remains the undisputed king of capacity and ecosystem. Most major AI players, including NVIDIA (NASDAQ: NVDA) and AMD (NASDAQ: AMD), have already aligned their long-term roadmaps with TSMC’s A14. NVIDIA’s rumored "Feynman" architecture, the successor to the upcoming Rubin series, is expected to be the anchor tenant for TSMC’s A14 production in late 2027. For NVIDIA, the 1.4nm node is critical for maintaining its dominance, as it will allow for GPUs that can handle 1,000W of power while maintaining the efficiency needed for massive data centers.

Samsung (KRX: 005930) is the "wild card" in this race. Having been the first to move to GAA transistors with its 3nm node, Samsung is aiming to leapfrog both Intel and TSMC by moving directly to its SF1.4 (1.4nm) node by late 2027. Samsung’s strategic advantage lies in its vertical integration; it is the only company capable of producing 1.4nm logic and the HBM5 (High Bandwidth Memory) that must be paired with it under one roof. This could lead to a disruption in the market if Samsung can solve the yield issues that have plagued its previous 3nm and 4nm nodes.

The Scaling Laws and the Ghost of Quantum Tunneling

The broader significance of the 1.4nm roadmap lies in its impact on the "Scaling Laws" of AI. Currently, AI performance is roughly proportional to the amount of compute and data used for training. However, we are reaching a point where scaling compute requires more electricity than many regional grids can provide. The 1.4nm node represents the industry’s most potent weapon against this energy crisis. By delivering significantly more "FLOPS per watt," the Angstrom era will determine whether we can reach the next milestones of Artificial General Intelligence (AGI) or if progress will stall due to infrastructure limits.

However, the move to 1.4nm brings us face-to-face with the "Ghost of Quantum Tunneling." At this scale, the insulating layers of a transistor are only about 3 to 5 atoms thick. At such extreme dimensions, electrons can simply "leak" through the barriers, turning binary 1s into 0s and causing massive static power loss. To combat this, foundries are exploring "high-k" dielectrics and 2D materials like molybdenum disulfide. This is a far cry from the silicon breakthroughs of the 1990s; we are now effectively building machines that must account for the probabilistic nature of subatomic particles to perform a simple addition.

Comparatively, the jump to 1.4nm is more significant than the transition from FinFET to GAA. It marks the first time that the entire "system" of the chip—power, memory, and logic—must be redesigned in 3D. While previous milestones focused on shrinking the transistor, the Angstrom Era is about rebuilding the chip's architecture to survive a world where silicon is no longer a perfect insulator.

Future Horizons: Beyond 1.4nm and the Rise of CFET

Looking ahead toward 2028 and 2029, the industry is already preparing for the successor to GAA: the Complementary FET (CFET). While current 1.4nm designs stack nanosheets of the same type, CFET will stack n-type and p-type transistors vertically on top of each other. This will effectively double the transistor density once again, potentially leading us to the A10 (1nm) node by the turn of the decade. The 1.4nm node is the bridge to this vertical future, serving as the proving ground for the backside power and 3D stacking techniques that CFET will require.

In the near term, we should expect a surge in "domain-specific" 1.4nm chips. Rather than general-purpose CPUs, we will likely see silicon specifically optimized for transformer architectures or neural-symbolic reasoning. The challenge remains yield; at 1.4nm, even a single stray atom or a microscopic thermal hotspot can ruin an entire wafer. Experts predict that while risk production will begin in 2027, "golden yields" (over 60%) may not be achieved until late 2028, leading to a period of high prices and limited supply for the most advanced AI hardware.

A New Chapter in Computing History

The transition to 1.4nm is a watershed moment for the technology industry. It represents the successful navigation of the "Angstrom Era," a period many predicted would never arrive due to the insurmountable walls of physics. By the end of 2027, the first 14A and A14 chips will likely be powering the most advanced autonomous systems, real-time global translation devices, and scientific simulations that were previously impossible.

The key takeaways from this roadmap are clear: Intel is back in the fight for leadership, TSMC is prioritizing industrial-scale reliability, and the cost of staying at the leading edge is skyrocketing. As we move closer to the production dates of 2027-2028, the industry will be watching for the first "tape-outs" of 1.4nm AI chips. In the coming months, keep a close eye on ASML’s shipping manifests and the quarterly capital expenditure reports from the big three foundries—those figures will tell the true story of who is winning the race to the bottom of the atomic scale.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.