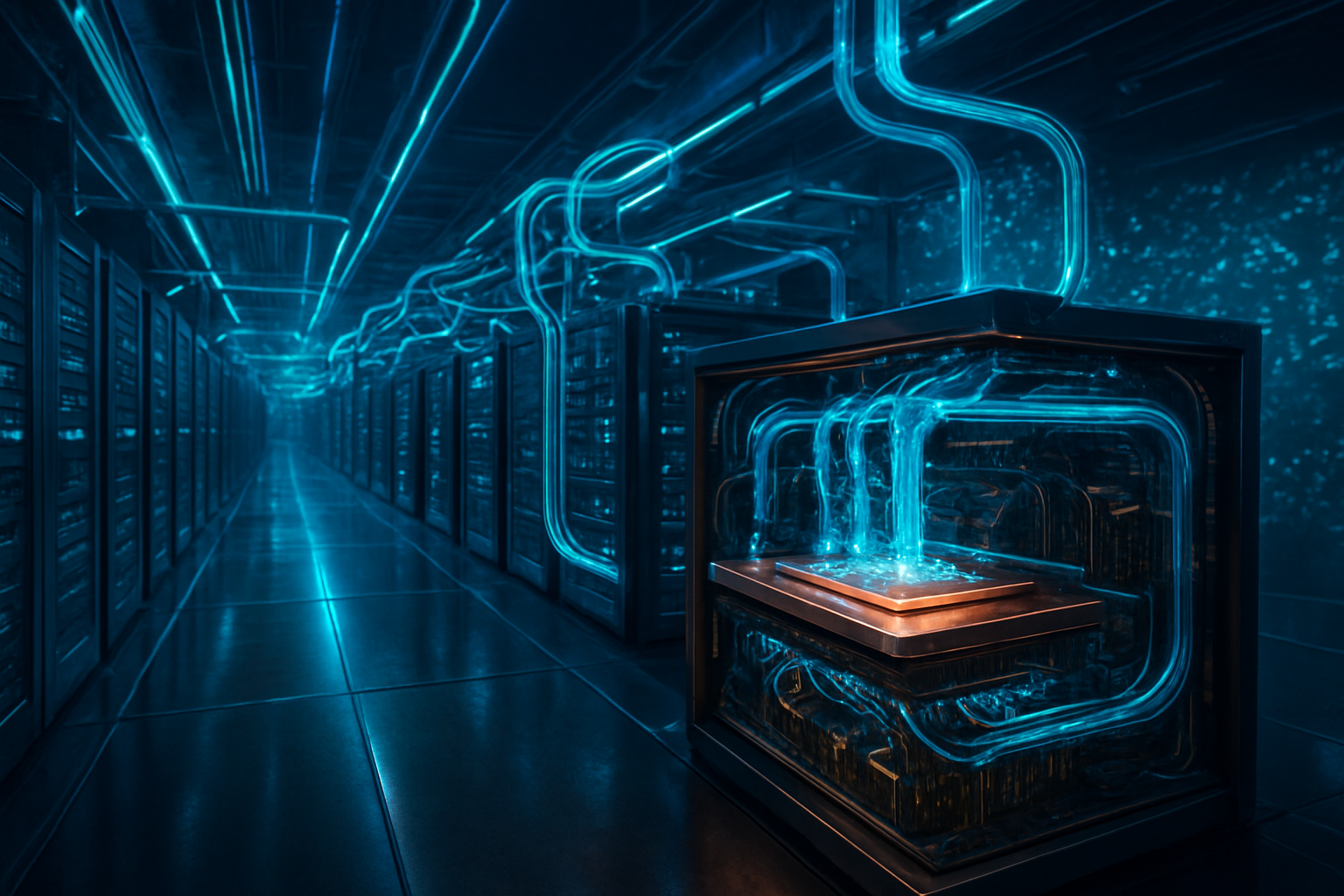

The explosive growth of generative AI has officially moved beyond the laboratory and into the heavy industrial phase. As of January 2026, the industry is shifting away from bespoke, one-off data center builds toward standardized, high-density "AI Factories." Leading this charge is a landmark partnership between Siemens AG (OTCMKTS: SIEGY) and nVent Electric plc (NYSE: NVT), who have unveiled a comprehensive 100MW blueprint designed specifically to house the massive compute clusters required by the latest generation of large language models and industrial AI systems.

This blueprint represents a critical turning point in global tech infrastructure. By providing a pre-validated, modular architecture that integrates high-density power management with advanced liquid cooling, Siemens and nVent are addressing the primary "bottleneck" of the AI era: the inability of traditional data centers to handle the extreme thermal and electrical demands of modern GPUs. The significance of this announcement lies in its ability to shorten the time-to-market for hyperscalers and enterprise operators from years to months, effectively creating a "plug-and-play" template for 100MW to 500MW AI facilities.

Scaling the Power Wall: Technical Specifications of the 100MW Blueprint

The technical core of the Siemens-nVent blueprint is its focus on the NVIDIA Corporation (NASDAQ: NVDA) Blackwell and Rubin architectures, specifically the DGX GB200 NVL72 system. While traditional data centers were built to support 10kW to 15kW per rack, the new blueprint is engineered for densities exceeding 120kW per rack. To manage this nearly ten-fold increase in heat, nVent has integrated its state-of-the-art Direct Liquid Cooling (DLC) technology. This includes high-capacity Coolant Distribution Units (CDUs) and standardized manifolds that allow for liquid-to-chip cooling, ensuring that even under peak "all-core" AI training loads, the system maintains thermal stability without the need for massive, energy-inefficient air conditioning arrays.

Siemens provides the "electrical backbone" through its Sentron and Sivacon medium and low voltage distribution systems. Unlike previous approaches that relied on static power distribution, this architecture is "grid-interactive." It features integrated software that allows the 100MW site to function as a virtual power plant, capable of adjusting its consumption in real-time based on grid stability or renewable energy availability. This is controlled via the Siemens Xcelerator platform, which uses a digital twin of the entire facility to simulate heat-load changes and electrical stress before they occur, effectively automating much of the operational oversight.

This modular approach differs significantly from previous generations of data center design, which often required fragmented engineering from multiple vendors. The Siemens and nVent partnership eliminates this fragmentation by offering a "Lego-like" scalability. Operators can deploy 20MW blocks as needed, eventually scaling to a half-gigawatt site within the same physical footprint. Initial reactions from the industry have been overwhelmingly positive, with researchers noting that this level of standardization is the only way to meet the projected demand for AI training capacity over the next decade.

A New Competitive Frontier for the AI Infrastructure Market

The strategic alliance between Siemens and nVent places them in direct competition with other infrastructure giants like Vertiv Holdings Co (NYSE: VRT) and Schneider Electric (OTCMKTS: SBGSY). For nVent, this partnership solidifies its position as the premier provider of liquid cooling hardware, a market that has seen triple-digit growth as air cooling becomes obsolete for top-tier AI training. For Siemens, the blueprint serves as a gateway to embedding its Industrial AI Operating System into the very foundation of the world’s most powerful compute sites.

Major cloud providers such as Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Alphabet Inc. (NASDAQ: GOOGL) stand to benefit the most from this development. These hyperscalers are currently in a race to build "sovereign AI" and proprietary clusters at a scale never before seen. By adopting a pre-validated blueprint, they can mitigate the risks of hardware failure and supply chain delays. Furthermore, the ability to operate at 120kW+ per rack allows these companies to pack more compute power into smaller real estate footprints, significantly lowering the total cost of ownership for AI services.

The market positioning here is clear: the infrastructure providers who can offer the most efficient "Tokens-per-Watt" will win the contracts of the future. This blueprint shifts the focus away from simple Power Usage Effectiveness (PUE) toward a more holistic measure of AI productivity. By optimizing the link between the power grid and the GPU chip, Siemens and nVent are creating a strategic advantage for companies that need to balance massive AI ambitions with increasingly strict environmental and energy-efficiency regulations.

The Broader Significance: Sustainability and the "Tokens-per-Watt" Era

In the context of the broader AI landscape, this 100MW blueprint is a direct response to the "energy crisis" narratives that have plagued the industry since late 2024. As AI models require exponentially more power, the ability to build data centers that are grid-interactive and highly efficient is no longer a luxury—it is a requirement for survival. This move mirrors previous milestones in the tech industry, such as the standardization of server racks in the early 2000s, but at a scale and complexity that is orders of magnitude higher.

However, the rapid expansion of 100MW sites has raised concerns among environmental groups and grid operators. The sheer volume of water required for liquid cooling systems and the massive electrical pull of these "AI Factories" can strain local infrastructures. The Siemens-nVent architecture attempts to address this through closed-loop liquid systems that minimize water consumption and by using AI-driven energy management to smooth out power spikes. It represents a shift toward "responsible scaling," where the growth of AI is tied to the modernization of the underlying energy grid.

Compared to previous breakthroughs, this development highlights the "physicality" of AI. While the public often focuses on the software and the neural networks, the battle for AI supremacy is increasingly being fought with copper, coolant, and silicon. The move to standardized 100MW blueprints suggests that the industry is maturing, moving away from the "wild west" of experimental builds toward a structured, industrial-scale deployment phase that can support the global economy's transition to AI-integrated operations.

The Road Ahead: From 100MW to Gigawatt Clusters

Looking toward the near-term future, experts predict that the 100MW blueprint is merely a baseline. By late 2026 and 2027, we expect to see the emergence of "Gigawatt Clusters"—facilities five to ten times the size of the current blueprint—supporting the next generation of "General Purpose" AI models. These future developments will likely incorporate more advanced forms of cooling, such as two-phase immersion, and even more integrated power solutions like on-site small modular reactors (SMRs) to ensure a steady supply of carbon-free energy.

The primary challenges remaining involve the supply chain for specialized components like CDUs and high-voltage switchgear. While Siemens and nVent have scaled their production, the global demand for these components is currently outstripping supply. Furthermore, as AI compute moves closer to the "edge," we may see scaled-down versions of this blueprint (1MW to 5MW) designed for urban environments, allowing for real-time AI processing in smart cities and autonomous transport networks.

What experts are watching for next is the integration of "infrastructure-aware" AI. This would involve the AI models themselves adjusting their training parameters based on the real-time thermal and electrical health of the data center. In this scenario, the "AI Factory" becomes a living organism, optimizing its own physical existence to maximize compute output while minimizing its environmental footprint.

Final Assessment: The Industrialization of Intelligence

The Siemens and nVent 100MW blueprint is more than just a technical document; it is a manifesto for the industrialization of artificial intelligence. By standardizing the way we power and cool the world's most powerful computers, these two companies have provided the foundation upon which the next decade of AI progress will be built. The transition to liquid-cooled, high-density, grid-interactive facilities is now the gold standard for the industry.

In the coming weeks and months, the focus will shift to the first full-scale implementations of this architecture, such as the one currently operating at Siemens' own factory in Erlangen, Germany. As more hyperscalers adopt these modular blocks, the speed of AI deployment will likely accelerate, bringing more powerful models to market faster than ever before. For the tech industry, the message is clear: the age of the bespoke data center is over; the age of the AI Factory has begun.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.