As of January 5, 2026, the global semiconductor landscape has shifted on its axis. Intel (NASDAQ: INTC) has officially announced that its 18A (1.8nm-class) process node has reached high-volume manufacturing (HVM) at the newly inaugurated Fab 52 in Chandler, Arizona. This milestone marks the completion of CEO Pat Gelsinger’s ambitious "five nodes in four years" roadmap, a feat many industry skeptics deemed impossible when it was first unveiled. The transition to 18A is not merely a technical upgrade; it represents the dawn of the "Silicon Renaissance," a period defined by the return of leading-edge semiconductor manufacturing to American soil and the reclamation of the process leadership crown by the Santa Clara giant.

The immediate significance of this development cannot be overstated. By successfully ramping 18A, Intel has effectively leapfrogged its primary competitors in the "Angstrom Era," delivering a level of transistor density and power efficiency that was previously the sole domain of theoretical physics. With Fab 52 now churning out thousands of wafers per week, Intel is providing the foundational hardware necessary to power the next generation of generative AI, autonomous systems, and hyperscale cloud computing. This moment serves as a definitive validation of the U.S. CHIPS Act, proving that with strategic investment and engineering discipline, the domestic semiconductor industry can once again lead the world.

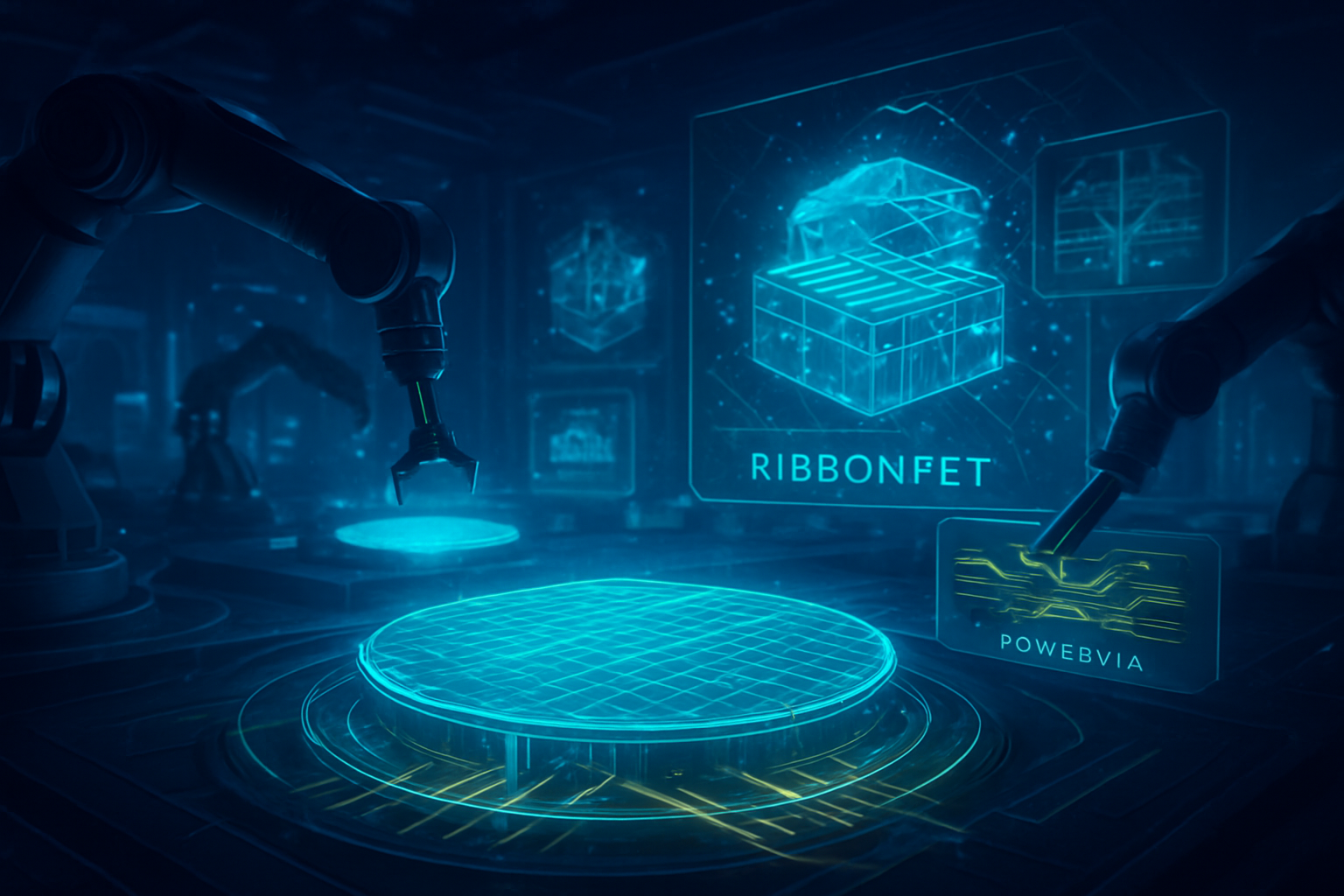

The Architecture of Leadership: RibbonFET and PowerVia

The 18A node is built upon two revolutionary architectural pillars that distinguish it from any previous semiconductor technology: RibbonFET and PowerVia. RibbonFET is Intel’s implementation of Gate-All-Around (GAA) transistor architecture, which replaces the industry-standard FinFET design that has dominated the last decade. By surrounding the conducting channel on all four sides with the gate, RibbonFET allows for precise control over electrical current, drastically reducing power leakage—a critical hurdle as transistors shrink toward the atomic scale. This breakthrough enables higher performance at lower voltages, providing a massive boost to the energy-conscious AI sector.

Complementing RibbonFET is PowerVia, a pioneering "backside power delivery" system that separates power distribution from signal routing. In traditional chip designs, power and data lines are intricately woven together on the top side of the wafer, leading to "routing congestion" and electrical interference. PowerVia moves the power delivery network to the back of the silicon, a move that early manufacturing data suggests reduces voltage droop by 10% and yields frequency gains of up to 10% at the same power levels. The combination of these technologies, facilitated by the latest High-NA EUV lithography systems from ASML (NASDAQ: ASML), places Intel’s 18A at the absolute cutting edge of material science.

The first major products to emerge from this process are already making waves. Unveiled today at CES 2026, the Panther Lake processor (marketed as Core Ultra Series 3) is designed to redefine the AI PC. Featuring the new Xe3 "Celestial" integrated graphics and a 5th-generation NPU, Panther Lake promises a staggering 180 TOPS of AI performance and a 50% improvement in performance-per-watt over its predecessors. Simultaneously, for the data center, Intel has begun shipping Clearwater Forest (Xeon 6+). This E-core-only beast features up to 288 "Darkmont" cores, offering cloud providers unprecedented density and a 17% gain in instructions per cycle (IPC) for scale-out workloads.

Initial reactions from the semiconductor research community have been overwhelmingly positive. Analysts note that while initial yields at Fab 52 are currently hovering in the 55% to 65% range—typical for a brand-new node—the improvement curve is aggressive. Intel expects to reach "golden yields" of over 75% by early 2027. Experts from the IEEE and various industry think tanks have highlighted that Intel’s successful integration of backside power delivery ahead of its rivals gives the company a unique competitive advantage in the race for high-performance, low-power AI silicon.

Reshaping the Competitive Landscape: Intel Foundry 2.0

The successful ramp of 18A is the cornerstone of the "Intel Foundry 2.0" strategy. Under this pivot, Intel Foundry has been legally and financially decoupled from the company’s product divisions, operating as a distinct entity to build trust with external customers. This separation has already begun to pay dividends. Major tech giants like Microsoft (NASDAQ: MSFT) and Amazon (NASDAQ: AMZN) have reportedly secured capacity on the 18A node for their custom AI accelerators, seeking to diversify their supply chains away from a total reliance on TSMC (NYSE: TSM).

The competitive implications are profound. For years, TSMC held an undisputed lead, but as Intel hits HVM on 18A, the gap has closed—and in some metrics, Intel has pulled ahead. This development forces a strategic re-evaluation for companies like NVIDIA (NASDAQ: NVDA), which has traditionally relied on TSMC but recently signaled a $5 billion commitment to explore Intel’s manufacturing capabilities. For AI startups, the availability of a second world-class foundry option in the United States reduces geopolitical risk and provides more leverage in price negotiations, potentially lowering the barrier to entry for custom silicon development.

Furthermore, the involvement of SoftBank (TYO: 9984) through a $2 billion stake in Intel Foundry operations suggests that the investment community sees Intel as the primary beneficiary of the ongoing AI hardware boom. By positioning itself as the "Silicon Shield" for Western interests, Intel is capturing a market segment that values domestic security as much as raw performance. This strategic positioning, backed by billions in CHIPS Act subsidies, creates a formidable moat against competitors who remain concentrated in geographically sensitive regions.

Market positioning for Intel has shifted from a struggling incumbent to a resurgent leader. The ability to offer both leading-edge manufacturing and a robust portfolio of AI-optimized CPUs and GPUs allows Intel to capture a larger share of the total addressable market (TAM). As 18A enters the market, the company is not just selling chips; it is selling the infrastructure of the future, positioning itself as the indispensable partner for any company serious about the AI-driven economy.

The Global Significance: A New Era of Manufacturing

Beyond the corporate balance sheets, the success of 18A at Fab 52 represents a pivot point in the broader AI landscape. We are moving from the era of "AI experimentation" to "AI industrialization," where the sheer volume of compute required necessitates radical improvements in manufacturing efficiency. The 18A node is the first to be designed from the ground up for this high-density, high-efficiency requirement. It fits into a trend where hardware is no longer a commodity but a strategic asset that determines the speed and scale of AI model training and deployment.

The impacts of this "Silicon Renaissance" extend to national security and global economics. For the first time in over a decade, the most advanced logic chips in the world are being mass-produced in the United States. This reduces the fragility of the global tech supply chain, which was severely tested during the early 2020s. However, this transition also brings concerns, particularly regarding the environmental impact of such massive industrial operations and the intense water requirements of semiconductor fabrication in the Arizona desert—challenges that Intel has pledged to mitigate through advanced recycling and "net-positive" water initiatives.

Comparisons to previous milestones, such as the introduction of the first 64-bit processors or the shift to multi-core architectures, feel almost inadequate. The 18A transition is more akin to the invention of the integrated circuit itself—a fundamental shift in how we build the tools of human progress. By mastering the angstrom scale, Intel has unlocked a new dimension of Moore’s Law, ensuring that the exponential growth of computing power can continue well into the 2030s.

The Road Ahead: 14A and the Sub-Angstrom Frontier

Looking toward the future, the HVM status of 18A is just the beginning. Intel’s roadmap already points toward the 14A node, which is expected to enter risk production by 2027. This next step will further refine High-NA EUV techniques and introduce even more exotic materials into the transistor stack. In the near term, we can expect the 18A node to be the workhorse for a variety of "AI-first" devices, from sophisticated edge sensors to the world’s most powerful supercomputers.

The potential applications on the horizon are staggering. With the power efficiency gains of 18A, we may see the first truly viable "all-day" AR glasses and autonomous drones with the onboard intelligence to navigate complex environments without cloud connectivity. However, challenges remain. As transistors shrink toward the sub-angstrom level, quantum tunneling and thermal management become increasingly difficult to control. Addressing these will require continued breakthroughs in 2.5D and 3D packaging technologies, such as Foveros and EMIB, which Intel is also scaling at its Arizona facilities.

Experts predict that the next two years will see a "land grab" for 18A capacity. As more companies realize the performance benefits of backside power delivery and GAA transistors, the demand for Fab 52’s output is likely to far exceed supply. This will drive further investment in Intel’s Ohio and European "mega-fabs," creating a global network of advanced manufacturing that could sustain the AI revolution for decades to face.

Conclusion: A Historic Pivot Confirmed

The successful high-volume manufacturing of the 18A node at Fab 52 is a watershed moment for Intel and the tech industry at large. It marks the successful execution of one of the most difficult corporate turnarounds in history, transforming Intel from a lagging manufacturer into a vanguard of the "Silicon Renaissance." The key takeaways are clear: Intel has reclaimed the lead in process technology, secured a vital domestic supply chain for the U.S., and provided the hardware foundation for the next decade of AI innovation.

In the history of AI, the launch of 18A will likely be remembered as the moment when the physical limits of hardware caught up with the limitless ambitions of software. The long-term impact will be felt in every sector of the economy, as more efficient and powerful chips drive down the cost of intelligence. As we look ahead, the industry will be watching the yield rates and the first third-party chips coming off the 18A line with intense interest. For now, the message from Chandler, Arizona, is unmistakable: the leader is back, and the angstrom era has officially begun.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.