The semiconductor industry has officially entered the era of Gate-All-Around (GAA) transistor technology, marking the most significant architectural shift in chip manufacturing in over a decade. As of January 2, 2026, the race for 2-nanometer (2nm) supremacy has reached a fever pitch, with Taiwan Semiconductor Manufacturing Company (NYSE:TSM), Samsung Electronics (KRX:005930), and Intel (NASDAQ:INTC) all deploying their most advanced nodes to satisfy the insatiable demand for high-performance AI compute. This transition represents more than just a reduction in size; it is a fundamental redesign of the transistor that promises to unlock unprecedented levels of energy efficiency and processing power for the next generation of artificial intelligence.

While the technical hurdles have been immense, the stakes could not be higher. The winner of this race will dictate the pace of AI innovation for years to come, providing the underlying hardware for everything from autonomous vehicles and generative AI models to the next wave of ultra-powerful consumer electronics. TSMC currently leads the pack in high-volume manufacturing, but the aggressive strategies of Samsung and Intel are creating a fragmented market where performance, yield, and geopolitical security are becoming as important as the nanometer designation itself.

The Technical Leap: Nanosheets, RibbonFETs, and the End of FinFET

The move to the 2nm node marks the retirement of the FinFET (Fin Field-Effect Transistor) architecture, which has dominated the industry since the 22nm era. At the heart of the 2nm revolution is Gate-All-Around (GAA) technology. Unlike FinFETs, where the gate contacts the channel on three sides, GAA transistors feature a gate that completely surrounds the channel on all four sides. This design provides superior electrostatic control, drastically reducing current leakage and allowing for further voltage scaling. TSMC’s N2 process utilizes a "Nanosheet" architecture, while Samsung has dubbed its version Multi-Bridge Channel FET (MBCFET), and Intel has introduced "RibbonFET."

Intel’s 18A node, which has become its primary "comeback" vehicle in 2026, pairs RibbonFET with another breakthrough: PowerVia. This backside power delivery system moves the power routing to the back of the wafer, separating it from the signal lines on the front. This reduces voltage drop and allows for higher clock speeds, giving Intel a distinct performance-per-watt advantage in high-performance computing (HPC) tasks. Benchmarks from late 2025 suggest that while Intel's 18A trails TSMC in pure transistor density—238 million transistors per square millimeter (MTr/mm²) compared to TSMC’s 313 MTr/mm²—it excels in raw compute performance, making it a formidable contender for the AI data center market.

Samsung, which was the first to implement GAA at the 3nm stage, has utilized its early experience to launch the SF2 node. Although Samsung has faced well-documented yield struggles in the past, its SF2 process is now in mass production, powering the latest Exynos 2600 processors. The SF2 node offers an 8% increase in power efficiency over its predecessor, though it remains under pressure to improve its 40–50% yield rates to compete with TSMC’s mature 70% yields. The industry’s initial reaction has been a mix of cautious optimism for Samsung’s persistence and awe at TSMC’s ability to maintain high yields even at such extreme technical complexities.

Market Positioning and the New Foundry Hierarchy

The 2nm race has reshaped the strategic landscape for tech giants and AI startups alike. TSMC remains the primary choice for external chip design firms, having secured over 50% of its initial N2 capacity for Apple (NASDAQ:AAPL). The upcoming A20 Pro and M6 chips are expected to set new benchmarks for mobile and desktop efficiency, further cementing Apple’s lead in consumer hardware. However, TSMC’s near-monopoly on high-volume 2nm production has led to capacity constraints, forcing other major players like Qualcomm (NASDAQ:QCOM) and Nvidia (NASDAQ:NVDA) to explore multi-sourcing strategies.

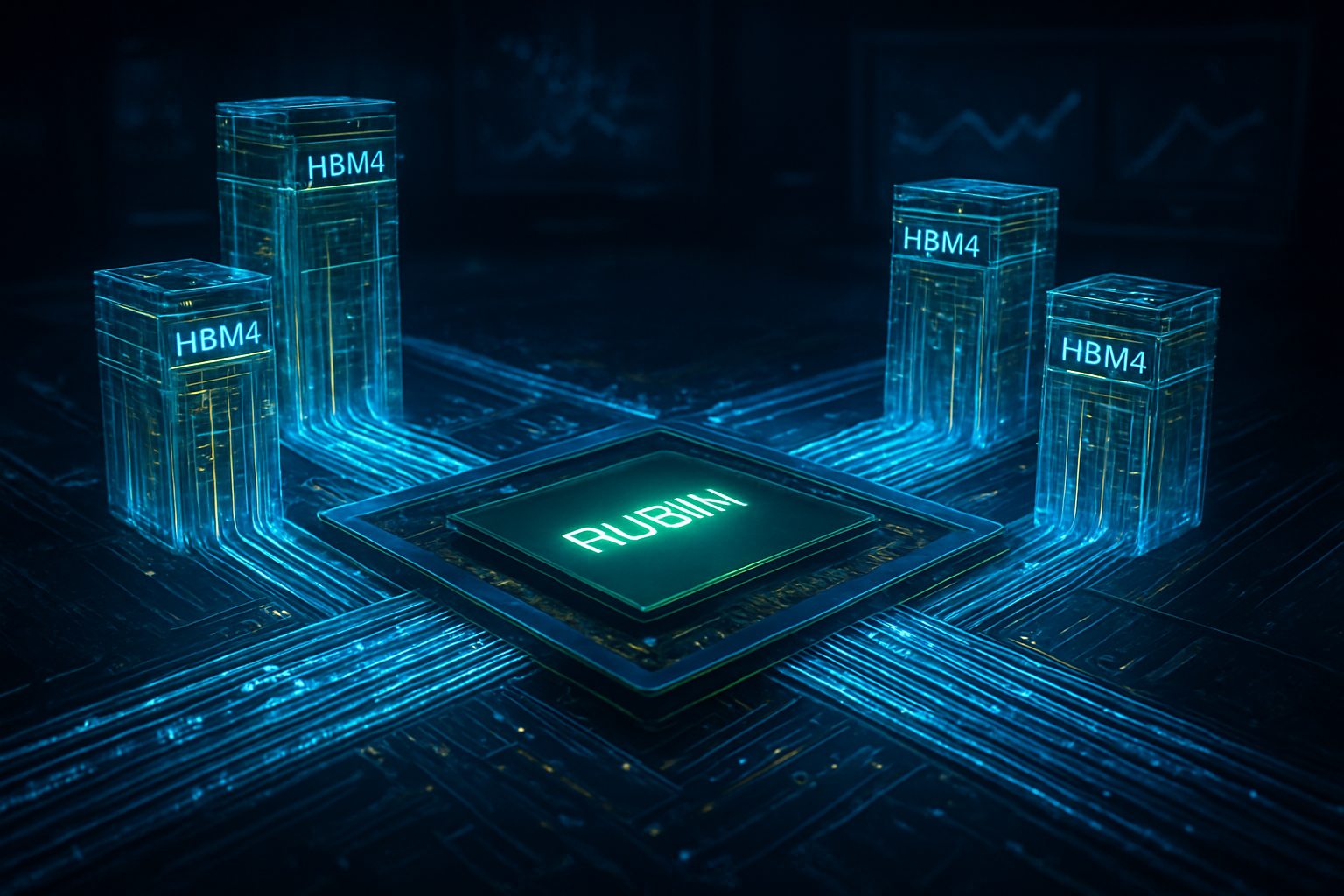

Nvidia, in a landmark move in late 2025, finalized a $5 billion investment in Intel’s foundry services. While Nvidia continues to rely on TSMC for its flagship "Rubin Ultra" AI GPUs, the investment in Intel provides a strategic hedge and access to U.S.-based manufacturing and advanced packaging. This move significantly benefits Intel, providing the capital and credibility needed to establish its "IDM 2.0" vision. Meanwhile, Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) have begun leveraging Intel’s 18A node for their custom AI accelerators, seeking to reduce their total cost of ownership by moving away from off-the-shelf components.

Samsung has found its niche as a "relief valve" for the industry. While it may not match TSMC’s density, its lower wafer costs—estimated at $22,000 to $25,000 compared to TSMC’s $30,000—have attracted cost-sensitive or capacity-constrained customers. Tesla (NASDAQ:TSLA) has reportedly secured SF2 capacity for its next-generation AI5 autonomous driving chips, and Meta (NASDAQ:META) is utilizing Samsung for its MTIA ASICs. This diversification of the foundry market is disrupting the previous winner-take-all dynamic, allowing for a more resilient global supply chain.

Geopolitics, Energy, and the Broader AI Landscape

The 2nm transition is not occurring in a vacuum; it is deeply intertwined with the global push for "silicon sovereignty." The ability to manufacture 2nm chips domestically has become a matter of national security for the United States and the European Union. Intel’s progress with 18A is a cornerstone of the U.S. CHIPS Act goals, providing a domestic alternative to the Taiwan-centric supply chain. This geopolitical dimension adds a layer of complexity to the 2nm race, as government subsidies and export controls on advanced lithography equipment from ASML (NASDAQ:ASML) influence where and how these chips are built.

From an environmental perspective, the shift to GAA is a critical milestone. As AI data centers consume an ever-increasing share of the world’s electricity, the 25–30% power reduction offered by nodes like TSMC’s N2 is essential for sustainable growth. The industry is reaching a point where traditional scaling is no longer enough; architectural innovations like backside power delivery and advanced 3D packaging are now the primary drivers of efficiency. This mirrors previous milestones like the introduction of High-K Metal Gate (HKMG) or EUV lithography, but at a scale that impacts the global energy grid.

However, concerns remain regarding the "yield gap" between TSMC and its rivals. If Samsung and Intel cannot stabilize their production lines, the industry risks a bottleneck where only a handful of companies—those with the deepest pockets—can afford the most advanced silicon. This could lead to a two-tier AI landscape, where the most capable models are restricted to the few firms that can secure TSMC’s premium capacity, potentially stifling innovation among smaller startups and research labs.

The Horizon: 1.4nm and the High-NA EUV Era

Looking ahead, the 2nm node is merely a stepping stone toward the "Angstrom Era." TSMC has already announced its A16 (1.6nm) node, scheduled for mass production in late 2026, which will incorporate its own version of backside power delivery. Intel is similarly preparing its 18AP node, which promises further refinements to the RibbonFET architecture. These near-term developments suggest that the pace of innovation is actually accelerating, rather than slowing down, as the industry tackles the limits of physics.

The next major hurdle will be the widespread adoption of High-NA (Numerical Aperture) EUV lithography. Intel has taken an early lead in this area, installing the world’s first High-NA machines to prepare for the 1.4nm (Intel 14A) node. Experts predict that the integration of High-NA EUV will be the defining challenge of 2027 and 2028, requiring entirely new photoresists and mask technologies. Challenges such as thermal management in 3D-stacked chips and the rising cost of design—now exceeding $1 billion for a complex 2nm SoC—will need to be addressed by the broader ecosystem.

A New Chapter in Semiconductor History

The 2nm GAA race of 2026 represents a pivotal moment in semiconductor history. It is the point where the industry successfully navigated the transition away from FinFETs, ensuring that Moore’s Law—or at least the spirit of it—continues to drive the AI revolution. TSMC’s operational excellence has kept it at the forefront, but the emergence of a viable three-way competition with Intel and Samsung is a healthy development for a world that is increasingly dependent on advanced silicon.

In the coming months, the industry will be watching the first consumer reviews of 2nm-powered devices and the performance of Intel’s 18A in enterprise data centers. The key takeaways from this era are clear: architecture matters as much as size, and the ability to manufacture at scale remains the ultimate competitive advantage. As we look toward the end of 2026, the focus will inevitably shift toward the 1.4nm horizon, but the lessons learned during the 2nm GAA transition will provide the blueprint for the next decade of compute.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.