The intricate world of semiconductor manufacturing, the bedrock of our digital age, is currently grappling with unprecedented challenges. As the industry relentlessly pursues smaller, more powerful, and more energy-efficient chips, the complexities of fabrication processes, the astronomical costs of development, and the critical need for higher yields have become formidable hurdles. However, a new wave of innovation, largely spearheaded by artificial intelligence (AI), is emerging to transform these processes, promising to unlock new levels of efficiency, precision, and cost-effectiveness. The future of computing hinges on the ability to overcome these manufacturing bottlenecks, and AI is proving to be the most potent tool in this ongoing technological arms race.

The continuous miniaturization of transistors, a cornerstone of Moore's Law, has pushed traditional manufacturing techniques to their limits. Achieving high yields—the percentage of functional chips from a single wafer—is a constant battle against microscopic defects, process variability, and equipment downtime. These issues not only inflate production costs but also constrain the supply of the advanced chips essential for everything from smartphones to supercomputers and, crucially, the rapidly expanding field of artificial intelligence itself. The industry's ability to innovate in manufacturing directly impacts the pace of technological progress across all sectors, making these advancements critical for global economic and technological leadership.

The Microscopic Battleground: AI-Driven Precision and Efficiency

The core of semiconductor manufacturing's technical challenges lies in the extreme precision required at the atomic scale. Creating features just a few nanometers wide demands unparalleled control over materials, environments, and machinery. Traditional methods often rely on statistical process control and human oversight, which, while effective to a degree, struggle with the sheer volume of data and the subtle interdependencies that characterize advanced nodes. This is where AI-driven solutions are making a profound impact, offering a level of analytical capability and real-time optimization previously unattainable.

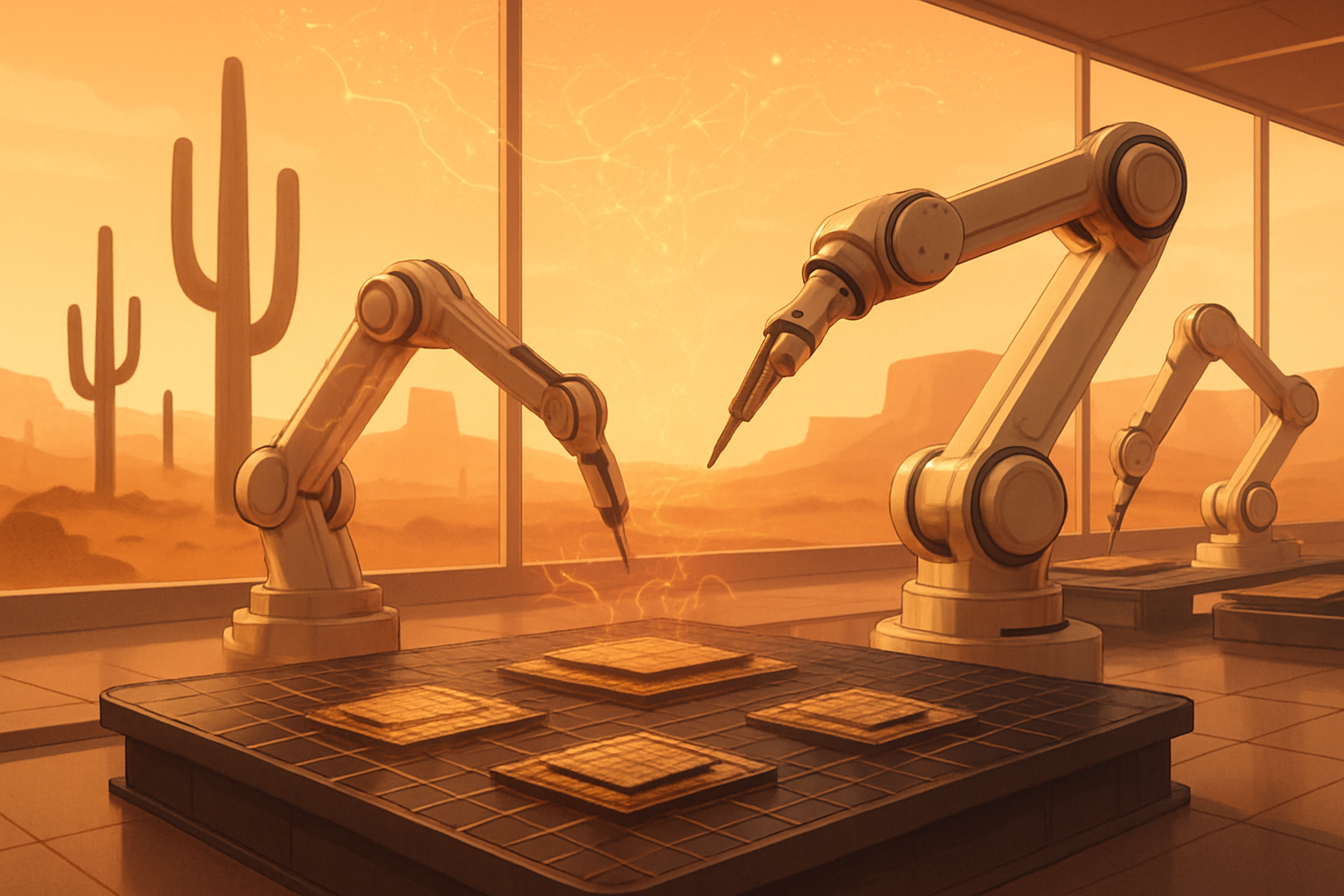

One of the most significant AI advancements is in automated defect detection. Leveraging computer vision and deep learning, AI systems can now inspect wafers and chips with greater speed and accuracy than human inspectors, often exceeding 99% accuracy. These systems can identify microscopic flaws and even previously unknown defect patterns, drastically improving yield rates and reducing material waste. This differs from older methods that might rely on sampling or less sophisticated image processing, providing a comprehensive, real-time understanding of defect landscapes. Furthermore, AI excels in process parameter optimization. By analyzing vast datasets from historical and real-time production, AI algorithms identify subtle correlations affecting yield. They can then recommend and dynamically adjust manufacturing parameters—such as temperature, pressure, and chemical concentrations—to optimize production, potentially reducing yield detraction by up to 30%. This proactive, data-driven adjustment is a significant leap beyond static process recipes or manual fine-tuning, ensuring processes operate at peak performance and predicting potential defects before they occur.

Another critical application is predictive maintenance. Complex fabrication equipment, costing hundreds of millions of dollars, can cause massive losses with unexpected downtime. AI analyzes sensor data from these machines to predict potential failures or maintenance needs, allowing proactive interventions that prevent costly unplanned outages. This shifts maintenance from a reactive to a predictive model, significantly improving overall equipment effectiveness and reliability. Lastly, AI-driven Electronic Design Automation (EDA) tools are revolutionizing the design phase itself. Machine learning and generative AI automate complex tasks like layout generation, logic synthesis, and verification, accelerating development cycles. These tools can evaluate countless architectural choices and optimize designs for performance, power, and area, streamlining workflows and reducing time-to-market compared to purely human-driven design processes. The initial reactions from the AI research community and industry experts are overwhelmingly positive, recognizing these advancements as essential for sustaining the pace of innovation in chip technology.

Reshaping the Chip Landscape: Implications for Tech Giants and Startups

The integration of AI into semiconductor manufacturing processes carries profound implications for the competitive landscape, poised to reshape the fortunes of established tech giants and emerging startups alike. Companies that successfully implement these AI-driven innovations stand to gain significant strategic advantages, influencing market positioning and potentially disrupting existing product and service offerings.

Leading semiconductor manufacturers like Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM), Intel (NASDAQ: INTC), and Samsung Electronics (KRX: 005930) are at the forefront of adopting these advanced AI solutions. Their immense R&D budgets and existing data infrastructure provide a fertile ground for developing and deploying sophisticated AI models for yield optimization, predictive maintenance, and process control. Companies that can achieve higher yields and faster turnaround times for advanced nodes will be better positioned to meet the insatiable global demand for cutting-edge chips, solidifying their market dominance. This competitive edge translates directly into greater profitability and the ability to invest further in next-generation technologies.

The impact extends to chip designers and AI hardware companies such as NVIDIA (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), and Qualcomm (NASDAQ: QCOM). With more efficient and higher-yielding manufacturing processes, these companies can bring their innovative AI accelerators, GPUs, and specialized processors to market faster and at a lower cost. This enables them to push the boundaries of AI performance, offering more powerful and accessible solutions for everything from data centers to edge devices. For startups, while the capital expenditure for advanced fabs remains prohibitive, AI-driven EDA tools and improved access to foundry services (due to higher yields) could lower the barrier to entry for innovative chip designs, fostering a new wave of specialized AI hardware. Conversely, companies that lag in adopting AI for their manufacturing processes risk falling behind, facing higher production costs, lower yields, and an inability to compete effectively in the rapidly evolving semiconductor market. The potential disruption to existing products is significant; superior manufacturing capabilities can enable entirely new chip architectures and performance levels, rendering older designs less competitive.

Broader Significance: Fueling the AI Revolution and Beyond

The advancements in semiconductor manufacturing, particularly those powered by AI, are not merely incremental improvements; they represent a fundamental shift that will reverberate across the entire technological landscape and beyond. This evolution is critical for sustaining the broader AI revolution, which relies heavily on the continuous availability of more powerful and efficient processing units. Without these manufacturing breakthroughs, the ambitious goals of advanced machine learning, large language models, and autonomous systems would remain largely aspirational.

These innovations fit perfectly into the broader trend of AI enabling its own acceleration. As AI models become more complex and data-hungry, they demand ever-increasing computational power. More efficient semiconductor manufacturing means more powerful chips can be produced at scale, in turn fueling the development of even more sophisticated AI. This creates a virtuous cycle, pushing the boundaries of what AI can achieve. The impacts are far-reaching: from enabling more realistic simulations and digital twins in various industries to accelerating drug discovery, climate modeling, and space exploration. However, potential concerns also arise, particularly regarding the increasing concentration of advanced manufacturing capabilities in a few geographical regions, exacerbating geopolitical tensions and supply chain vulnerabilities. The energy consumption of these advanced fabs also remains a significant environmental consideration, although AI is also being deployed to optimize energy usage.

Comparing this to previous AI milestones, such as the rise of deep learning or the advent of transformer architectures, these manufacturing advancements are foundational. While those milestones focused on algorithmic breakthroughs, the current developments ensure the physical infrastructure can keep pace. Without the underlying hardware, even the most brilliant algorithms would be theoretical constructs. This period marks a critical juncture where the physical limitations of silicon are being challenged and overcome, setting the stage for the next decade of AI innovation. The ability to reliably produce chips at 2nm and beyond will unlock capabilities that are currently unimaginable, pushing us closer to truly intelligent machines and profoundly impacting societal structures, economies, and even national security.

The Horizon: Future Developments and Uncharted Territory

Looking ahead, the trajectory of semiconductor manufacturing, heavily influenced by AI, promises even more groundbreaking developments. In the near term, we can expect to see further integration of AI across the entire manufacturing lifecycle, moving beyond individual optimizations to holistic, AI-orchestrated fabrication plants. This will involve more sophisticated AI models capable of predictive control across multiple process steps, dynamically adapting to real-time conditions to maximize yield and throughput. The synergy between advanced lithography techniques, such as High-NA EUV, and AI-driven process optimization will be crucial for pushing towards sub-2nm nodes.

Longer-term, the focus will likely shift towards entirely new materials and architectures, with AI playing a pivotal role in their discovery and development. Expect continued exploration of novel materials like 2D materials (e.g., graphene), carbon nanotubes, and advanced compounds for specialized applications, alongside the widespread adoption of advanced packaging technologies like 3D ICs and chiplets, which AI will help optimize for interconnectivity and thermal management. Potential applications on the horizon include ultra-low-power AI chips for ubiquitous edge computing, highly resilient and adaptive chips for quantum computing interfaces, and specialized hardware designed from the ground up to accelerate specific AI workloads, moving beyond general-purpose architectures.

However, significant challenges remain. Scaling down further will introduce new physics-based hurdles, such as quantum tunneling effects and atomic-level variations, requiring even more precise control and novel solutions. The sheer volume of data generated by advanced fabs will necessitate more powerful AI infrastructure and sophisticated data management strategies. Experts predict that the next decade will see a greater emphasis on co-optimization of design and manufacturing (DTCO), with AI bridging the gap between chip designers and fab engineers to create designs that are inherently more manufacturable and performant. What experts predict will happen next is a convergence of AI in design, manufacturing, and even material science, creating a fully integrated, intelligent ecosystem for chip development that will continuously push the boundaries of what is technologically possible.

A New Era for Silicon: AI's Enduring Legacy

The current wave of innovation in semiconductor manufacturing, driven primarily by artificial intelligence, marks a pivotal moment in the history of technology. The challenges of miniaturization, escalating costs, and the relentless pursuit of higher yields are being met with transformative AI-driven solutions, fundamentally reshaping how the world's most critical components are made. Key takeaways include the indispensable role of AI in automated defect detection, real-time process optimization, predictive maintenance, and accelerating chip design through advanced EDA tools. These advancements are not merely incremental; they represent a paradigm shift that is essential for sustaining the rapid progress of the AI revolution itself.

This development's significance in AI history cannot be overstated. Just as breakthroughs in algorithms and data have propelled AI forward, the ability to manufacture the hardware required to run these increasingly complex models is equally crucial. AI is now enabling its own acceleration by making the production of its foundational hardware more efficient and powerful. The long-term impact will be a world where computing power is more abundant, more specialized, and more energy-efficient, unlocking applications and capabilities across every sector imaginable.

As we look to the coming weeks and months, the key things to watch for include further announcements from major foundries regarding their yield improvements on advanced nodes, the commercialization of new AI-powered manufacturing tools, and the emergence of innovative chip designs that leverage these enhanced manufacturing capabilities. The symbiotic relationship between AI and semiconductor manufacturing is set to define the next chapter of technological progress, promising a future where the physical limitations of silicon are continuously pushed back by the ingenuity of artificial intelligence.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.