The global semiconductor landscape has undergone a transformation that few would have predicted eighteen months ago. What began as frantic rumors of a Taiwan Semiconductor Manufacturing Company (NYSE: TSM)-led consortium to rescue the struggling foundry assets of Intel Corporation (NASDAQ: INTC) has culminated in a landmark "Silicon Sovereignty" deal. This shift has effectively nationalized a portion of America’s leading chipmaker, with the U.S. government now holding a 9.9% non-voting equity stake in the company to ensure the goals of the CHIPS Act are not just met, but secured against geopolitical volatility.

The rumors, which reached a fever pitch in the spring of 2025, suggested that TSMC was being courted by a "consortium of customers"—including NVIDIA (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), and Broadcom (NASDAQ: AVGO)—to take over the operational management of Intel’s manufacturing plants. While the joint venture never materialized in its rumored form, the threat of a foreign entity managing America’s most critical industrial assets forced a radical rethink of U.S. industrial policy. Today, on December 22, 2025, Intel stands as a stabilized "National Strategic Asset," having successfully entered high-volume manufacturing (HVM) for its 18A process node, a feat that marks the first time 2nm-class chips have been mass-produced on American soil.

The Technical Turnaround: From 18A Rumors to High-Volume Reality

The technical centerpiece of this saga is Intel’s 18A (1.8nm) process node. Throughout late 2024 and early 2025, the industry was rife with skepticism regarding Intel’s ability to deliver on its "five nodes in four years" roadmap. Critics argued that the complexity of RibbonFET gate-all-around (GAA) transistors and PowerVia backside power delivery—technologies essential for the 18A node—were beyond Intel’s reach without external intervention. The rumored TSMC-led joint venture was seen as a way to inject "Taiwanese operational discipline" into Intel’s fabs to save these technologies from failure.

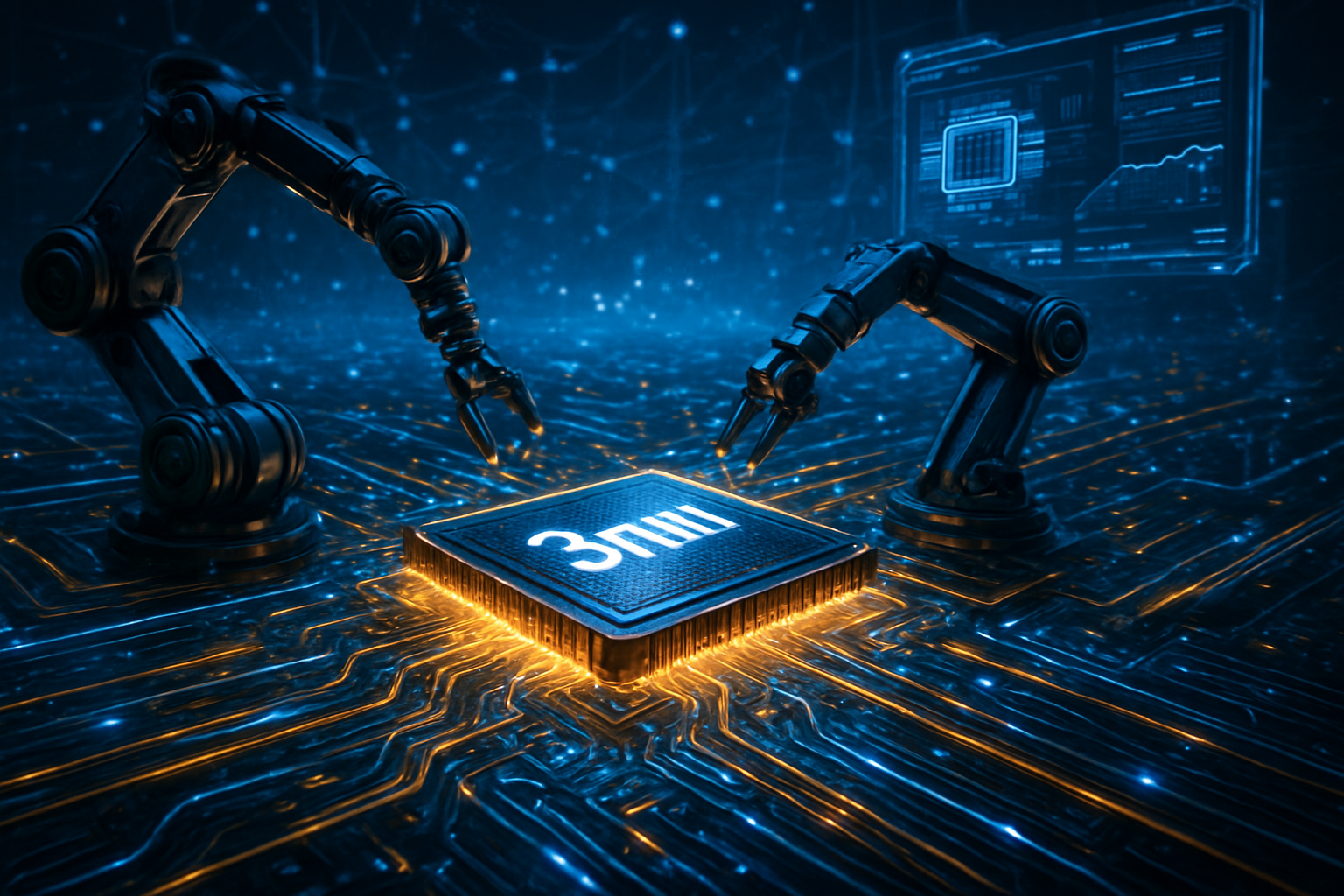

However, under the leadership of CEO Lip-Bu Tan, who took the helm in March 2025 following the ousting of Pat Gelsinger, Intel focused its depleted resources exclusively on the 18A ramp-up. The technical specifications of 18A are formidable: it offers a 10% improvement in performance-per-watt over its predecessor and introduces a level of transistor density that rivals TSMC’s N2 node. By December 19, 2025, Intel’s Arizona and Ohio fabs officially moved into HVM, supported by the first commercial installations of High-NA EUV lithography machines.

This achievement differs from previous Intel efforts by decoupling the design and manufacturing arms more aggressively. The initial reactions from the research community have been cautiously optimistic. Experts note that while Intel 18A is technically competitive, the real breakthrough was the implementation of a "copy-exactly" manufacturing philosophy—a hallmark of TSMC—which Intel finally adopted at scale in 2025. This move was facilitated by a $3.2 billion "Secure Enclave" grant from the Department of Defense, which provided the financial buffer necessary to perfect the 18A yields.

A Consortium of Necessity: Impact on Tech Giants and Competitors

The rumored involvement of NVIDIA, AMD, and Broadcom in a potential Intel Foundry takeover was driven by a desperate need for supply chain diversification. Throughout 2024, these companies were almost entirely dependent on TSMC’s facilities in Taiwan, creating a "single point of failure" for the AI revolution. While the TSMC-led joint venture was officially denied by CEO C.C. Wei in September 2025, the underlying pressure led to a different kind of alliance: the "Equity for Subsidies" model.

NVIDIA and SoftBank (OTC: SFTBY) have since emerged as major strategic investors, contributing $5 billion and $2 billion respectively to Intel’s foundry expansion. For NVIDIA, this investment serves as an insurance policy. By helping Intel succeed, NVIDIA ensures it has a secondary source for its next-generation Blackwell and Rubin GPUs, reducing its reliance on the Taiwan Strait. AMD and Broadcom, while not direct equity investors, have signed multi-year "anchor customer" agreements, committing to shift a portion of their sub-5nm production to Intel’s U.S.-based fabs by 2027.

This development has disrupted the market positioning of pure-play foundries. Samsung’s foundry division has struggled to keep pace, leaving Intel as the only viable domestic alternative to TSMC. The strategic advantage for U.S. tech giants is clear: they now have a "home court" advantage in manufacturing, which mitigates the risk of export controls or regional conflicts disrupting their hardware pipelines.

De-risking the CHIPS Act and the Rise of Silicon Sovereignty

The broader significance of the Intel rescue cannot be overstated. It represents the end of the "hands-off" era of American industrial policy. The U.S. government’s decision to convert $8.9 billion in CHIPS Act grants into a 9.9% equity stake—a move dubbed "Silicon Sovereignty"—was a direct response to the risk that Intel might be broken up or sold to foreign interests. This "Golden Share" gives the White House veto power over any future sale or spin-off of Intel’s foundry business for the next five years.

This fits into a global trend of "de-risking" where nations are treating semiconductor manufacturing with the same strategic gravity as oil reserves or nuclear energy. By taking an equity stake, the U.S. government has effectively "de-risked" the massive capital expenditure required for Intel’s $89.6 billion fab expansion. This model is being compared to the 2009 automotive bailouts, but with a futuristic twist: the government is not just saving jobs, it is securing the foundational technology of the AI era.

However, this intervention has raised concerns about market competition and the potential for political interference in corporate strategy. Critics argue that by picking a "national champion," the U.S. may stifle smaller innovators. Yet, compared to previous milestones like the invention of the transistor or the rise of the PC, the 2025 stabilization of Intel marks a shift from a globalized, borderless tech industry to one defined by regional blocs and national security imperatives.

The Horizon: 14A, High-NA EUV, and the Next Frontier

Looking ahead, the next 24 months will be defined by Intel’s transition to the 14A (1.4nm) node. Expected to enter risk production in late 2026, 14A will be the first node to fully utilize High-NA EUV at scale across multiple layers. The challenge remains daunting: Intel must prove that it can not only manufacture these chips but do so profitably. The foundry division remains loss-making as of December 2025, though the losses have stabilized significantly compared to the disastrous 2024 fiscal year.

Future applications for this domestic capacity include a new generation of "Sovereign AI" chips—hardware designed specifically for government and defense applications that never leaves U.S. soil during the fabrication process. Experts predict that if Intel can maintain its 18A yields through 2026, it will begin to win back significant market share from TSMC, particularly for high-performance computing (HPC) and automotive applications where supply chain security is paramount.

Conclusion: A New Chapter for American Silicon

The saga of the TSMC-Intel rumors and the subsequent government intervention marks a turning point in the history of technology. The key takeaway is that the "too big to fail" doctrine has officially arrived in Silicon Valley. Intel’s survival was deemed so critical to the U.S. economy and national security that the government was willing to abandon decades of neoliberal economic policy to become a shareholder.

As we move into 2026, the significance of this development will be measured by the stability of the AI supply chain. The "Silicon Sovereignty" deal has provided a roadmap for how other Western nations might protect their own critical tech sectors. For now, the industry will be watching Intel’s quarterly yield reports and the progress of its Ohio "mega-fab" with intense scrutiny. The rumors of a TSMC takeover may have faded, but the transformation they sparked has permanently altered the geography of the digital world.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.